Corvette driving school report (Ron Fellows near Las Vegas)

This is a report of a minivan driver’s experience at the Ron Fellows Performance Driving School in Pahrump, Nevada. A friend and I took the two-day intro class for complete novices. The school operates a fleet of nearly 200 C8 Corvettes, a fleet of 670 hp Cadillac Blackwing sedans, and a fleet of open-cockpit Radical pure race cars. We were in the Corvette.

Everyone asks “Was it fun?” The answer is that it is like flight training. You’re learning a lot and it is interesting, but you’re always frustrated because you aren’t doing as well as you want to.

The location is the nation’s most extensive race track, Spring Mountain Motor Resort and Country Club in Pahrump, Nevada, about one hour from Las Vegas. There are currently 360 members who bought in at prices ranging from $4,000 (originally) to $75,000 (today) and then pay $7,500 per year for the right to use the track for up to 16 days per month. The members will typically rent some garage space at the track or build a house somewhere on the 1,000 acres. Plans are in the works for a 7,000′ straight section of track on which a jet can be landed, which will be helpful because most of the members are coming from other parts of the U.S., e.g., Florida(!).

The structure of the school was to alternate between 30-60 minutes of classroom and 30 minutes in the car. The in-car session might be on the track, skidpad, dragstrip, or autocross course. Each day starts promptly at 8 am and concludes at 4 pm with a one-hour lunch break. We were exhausted at the end of each day from the mental and, to some extent, the physical effort. Here’s your fearful author in the morning intro (no helmet) and the afternoon track session (helmet):

The instructors, all of whom are former and/or current racers, are usually in front of you in their own car or somewhere on the sidelines. Either way, they’re communicating with you via CB radio that has been piped into the car’s AUX input.

Who takes this class? Primarily new owners of the C8 Corvette because Chevrolet pays for most of the class, resulting in a price of just over $1,000, which includes a night of lodging at the track. A Ferrari-owning friend was recently invited to a similar class in the Ferrari 296… for $18,000.

What did we learn that can be translated to street driving? First, that the C8 Corvette does not have a tendency to oversteer and, therefore, if you’re in a corner that feels too tight it never helps to add power. You’re always better off braking lightly, which will transfer weight onto the front wheels and help them steer. Also, with the stability control computers and anti-lock brakes, it is nearly always better to slow down with brakes before departing the paved surface. Accelerating transfers weight to the rear tires and makes the car understeer (move out toward the outside of the turn).

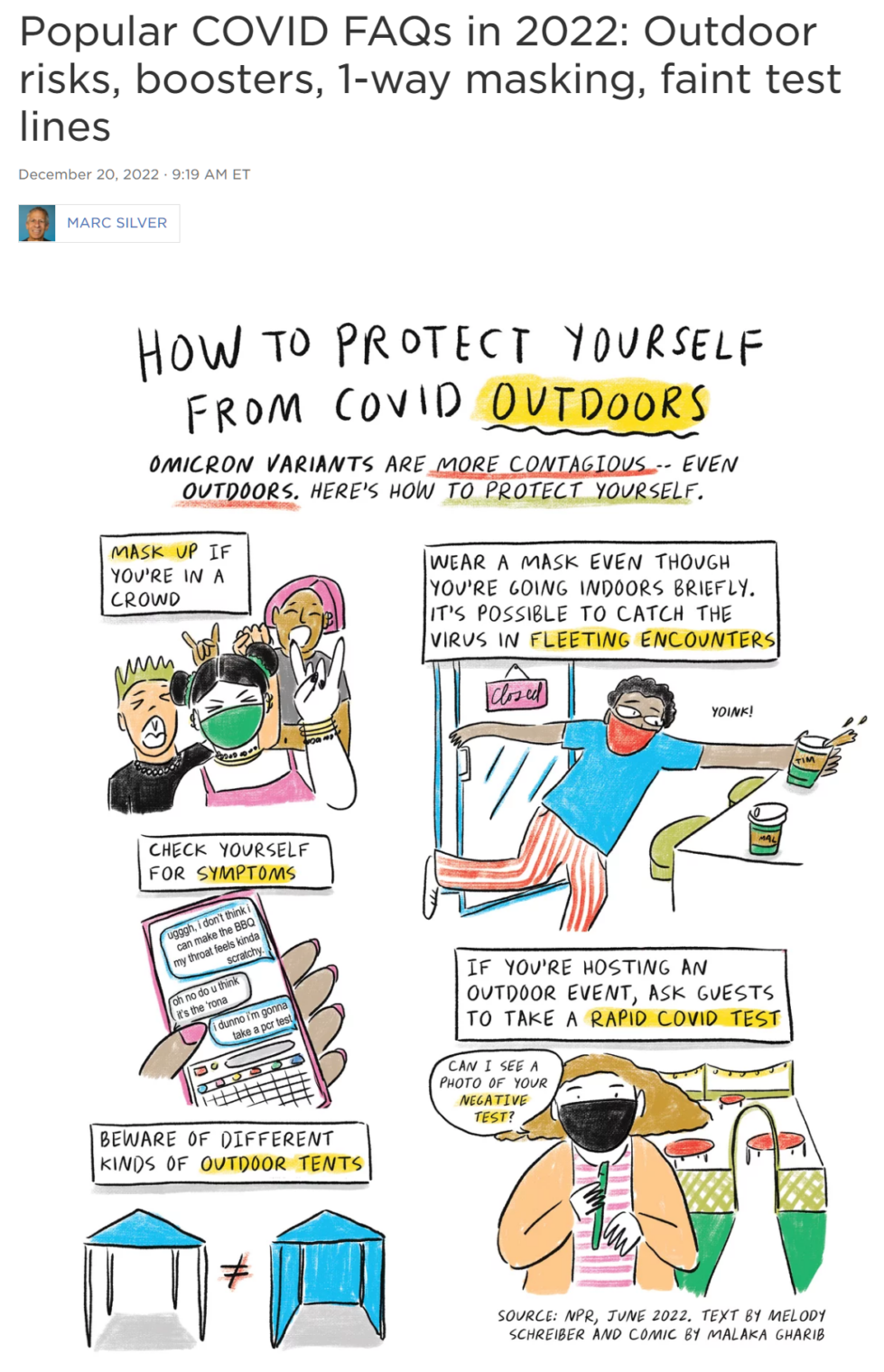

After spinning out on the skidpad a bunch of times, with the fancy computer systems disabled (press and hold the stability control switch for about 8 seconds), we learned about the magic of the Weather mode, in which the computer systems become hyper-vigilant. “It doesn’t limit the car as much as teen driver mode,” an instructor explained, “but it can be very useless even on dry pavement for novice drivers.” See the follow video starting at 5:00.

The class may not be for those who think that Twitter is now unsafe. During the explanation of the glow-in-the-dark emergency release lever inside the frunk, it was pointed out that “You can’t kidnap hookers anymore.” For everyone else, the instructors point out that this is the safest driving any of us will ever do. “There are no other cars nearby, no pedestrians, and no concrete walls near the road.” The realistic hazard is motion sickness, which snares several students in every class. Even a pilot with aerobatic experience in our class reported feeling “dizzy”. The school keeps a package of Dramamine up front. If you thought that you couldn’t make yourself sick when at the wheel of a car, you haven’t subjected yourself to constant 0.5-1g corners and speed changes.

The organization, pace, and instructor enthusiasm and skill was superior to the $50,000+ jet type rating classes offered at Flight Safety.

Speaking of aviation, you couldn’t spit in this class without hitting a fellow pilot. A handful of the attendees were airline pilots and one was an airline-track hours-building pilot. about half of the rest of the folks seemed to have at least a Private certificate and current airplane ownership was common. Here’s our merry and diverse band of brothers, sisters, and binary-resisters in Corvette appreciation:

Breakfast and lunch are included both days and there is a social evening after the first day. The clubhouse includes a Connelly pool table!

The night before class we dined at Symphony’s, a restaurant run by a local winery. They had a literal white privilege license:

If you want to meet up with Hunter Biden, note that Pahrump is the first county over from Las Vegas in which prostitution is legal. Sheri’s Ranch has its own restaurant and the $14 cheesesteak was excellent (plainly freshly grilled from sliced-up steak):

Does this mean Pahrump is not a family-friendly town? By no means, according to a bumper sticker parked in the local gourmet supermarket (Walmart) where we stopped for 70 cent/lb. bananas (I noted that these used to be 30 cents/lb. and an older lady mournfully agreed with me):

Speaking of family, quite a few students brought wives along and they seemed to have a good time in the lounge outside the classroom, in an observation tower 4 stories above the track, and at meals.

Aside from the regular street cars, the track is home to a Radical race car showroom and we also saw some fun ATVs:

Once you’re in Pahrump, Death Valley is only one more hour away. So it makes sense to combine the class with hiking in Death Valley (and/or family members can explore Death Valley National Park while a car nut is at the school).

Full post, including comments