Finally a use case for cryptocurrency? (currency conversion fees)

I did a lot more research after Portuguese stocks or Lisbon real estate for the next five years? (May) and, as part of an EU citizenship project, decided to purchase stocks over in Portugal rather than take on more real estate ownership hassles (one of the big joys of our Florida move has been saying goodbye to homeownership).

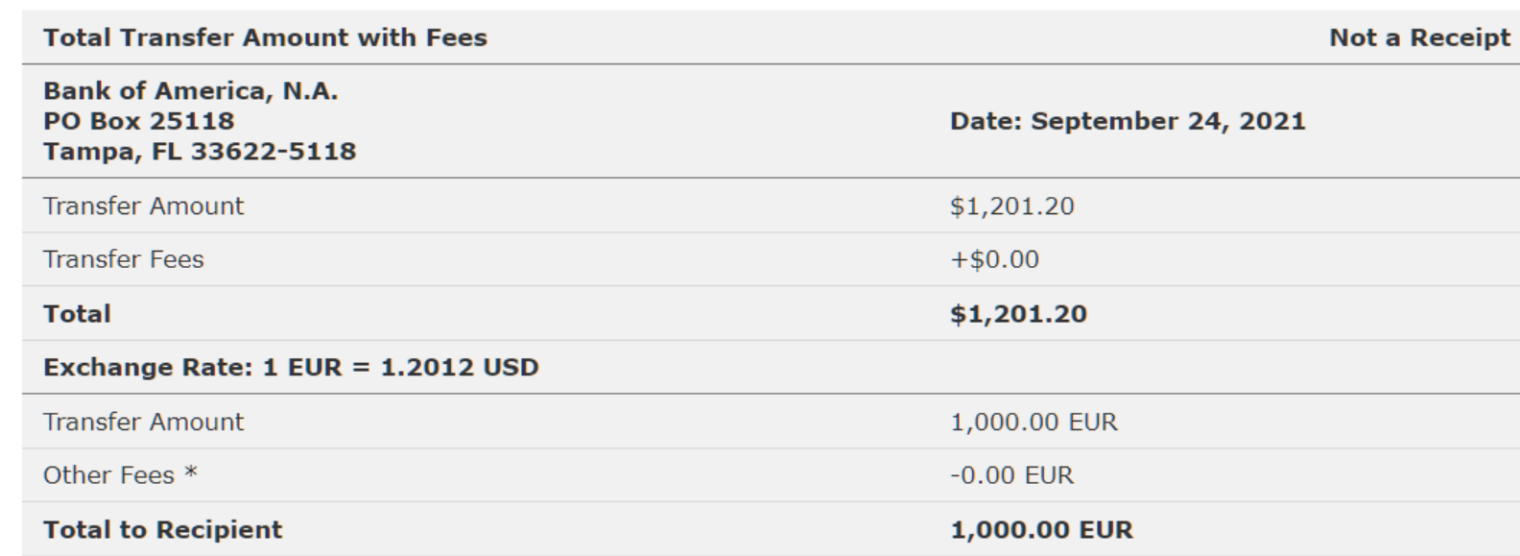

Moving money from Bank of America to Bankinter led to some discoveries about international wire transfer costs. If you move a small amount in euros, Bank of America says that they won’t charge you any fees:

But the exchange rate was actually 1.17 on 9/24. So this is a 2.65 percent fee (still only about $31, plus whatever Bankinter will charge to receive the wire (0.05 percent, minimum €5, maximum €30)).

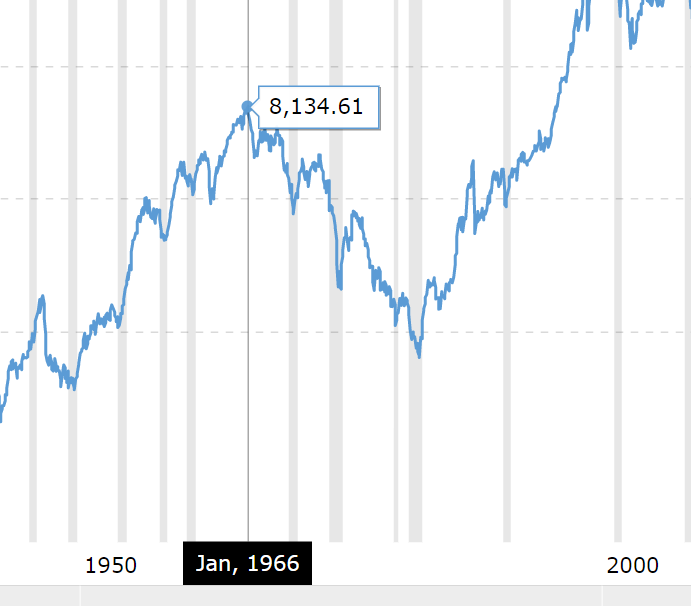

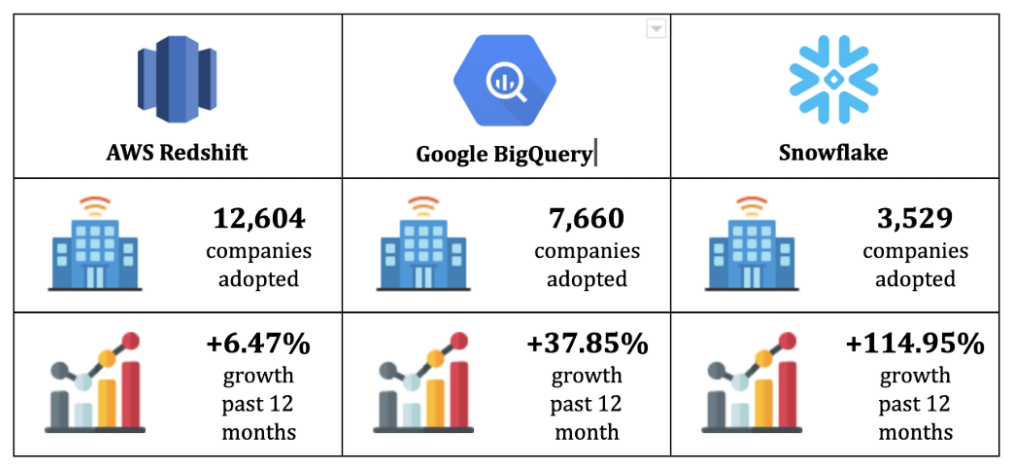

What about for the million euro transfer that is necessary to get the golden visa/passport process kicked off? Compared to the quoted market, the hidden fees within Bank of America were about 0.75 percent (e.g., about $7,500 on $1 million). If sent in USD, however, and converted by Bankinter, the non-hidden cost is 0.5 percent, a little cheaper than BofA, but still about 80X more than the cost of a Bitcoin transaction on the blockchain, right? (right now roughly $60 to the miners?). Given that we supposedly live in a seamless global economy, I’m kind of surprised at how much it costs to change a couple of database records at two banks that are already tightly coupled.

Could this be an argument for cryptocurrency, assuming that just one of the Ponzicoins prevails and becomes a worldwide currency?

(Why is it fair to call these Ponzicoins? Whoever creates a cryptocurrency can mint the first few million or whatever at almost no cost and then they gain value when he/she/ze/they convinces others to buy in.)

Separately, let’s look at the motivational factors from May:

At least to judge by our media, the U.S. is embroiled in white v. Black, white v. Asian, white v. Latinx, and hetero cisgender v. LGBTQIA+ fights. We’re also adding $trillions in debt, welcoming millions of new welfare-dependent citizens, and instituting dramatic changes in government (every day we hear a new and exciting idea for a bigger more powerful central government!). It seems like a good time to ensure that children have the option to study, work, and live in Europe. The Europeans bumped up against the limits of how much government could be responsible for and don’t seem anxious to go back to the 1970s.

There is no way to predict whether Portugal, Italy, Germany, France, or Sweden will be a better place to live than the U.S. in 2030, but keeping only a U.S. passport is essentially a bet that the U.S. will be a better place to live than anywhere in the E.U. Would we want to make that bet?

Now that we’ve had a full summer of rule by Joe Biden and the Democrats, do the above factors still apply to the U.S. as reconceived from Washington, D.C.? Let’s take them one at a time.

embroiled in white v. Black, white v. Asian, white v. Latinx, and hetero cisgender v. LGBTQIA+ fights

The conflicts described in May don’t seem to have been resolved. To these we’ve added roughly half of Americans who now hate Texas and Texans (see “Boycott Texas,” for example, from The Nation, 9/14: “With SB 8 following a crazy new gun law and mandatory mask ban, the Lone Star State has more than earned the cold shoulder”). We also have the hatred of the vaccinated for the unvaccinated, a new-since-May phenomenon.

adding $trillions in debt

“America’s Need to Pay Its Bills Has Spawned a Political Game” (NYT, 9/26): “The Covid-19 pandemic continues to ravage the United States in waves, frequently disrupting economic activity and the taxes the government collects, complicating Treasury’s ability to gauge its cash flow.”

In other words, the U.S. will continue to bury itself more deeply in debt so long as coronapanic continues. And, absent an enormous advance in treatment, we know that coronapanic will continue so long as the virus has the capability of evolving.

(Of course the U.S. also buried itself more deeply in debt before COVID-19 emerged, but at a somewhat slower pace (St. Louis Fed))

welcoming millions of new welfare-dependent citizens

This one might have changed. In order to hit our goal numbers for Americans dependent on government-provided housing, health care, food, and smartphone, we’re no longer relying on immigrants (the “welcoming” part of the headline). We’ve got the new $3,600 per year per child handout, which started in July. Going forward, the NYT tells us that what we used to call “welfare” is our common destiny: “From Cradle to Grave, Democrats Move to Expand Social Safety Net” (9/6, regarding $3.5 trillion in new spending, “a cradle-to-grave reweaving of a social safety net frayed by decades of expanding income inequality, stagnating wealth and depleted governmental resources, capped by the worst public health crisis in a century.”). Tens of millions of additional residents of the U.S. will be dependent on government support (no longer called “welfare”) going forward, but, due to the massive expansion of the welfare state, most of them will be native-born.

On the third hand, once chain migration (wives, cousins, kids, parents, etc.) is mostly complete, we’ll have at least 1 million new citizens from Afghanistan as a result of our spectacular defeat in August and decision to evacuate mostly men mostly at random rather than simply pay the Taliban not to bother people on a list. If these folks are like previous immigrants from Afghanistan to the U.S., they and their descendants will be among the poorest of the poor here, eligible for every form of government assistance for at least three generations. (See “Challenges to the economic integration of Afghan refugees in the U.S.”: “Afghan refugees’ earned incomes are the lowest of seven refugee/immigrant comparison groups”)

instituting dramatic changes in government (every day we hear a new and exciting idea for a bigger more powerful central government!)

Other than the welfare state expansion that the NYT describes above, I can’t think of anything new since May from the Biden administration or Congress.

If an EU passport was a good idea in May 2021, therefore, it seems like it might be an even better idea today. If you want to buy yourself and your children the option to study, work, or live in Europe (or simply travel back and forth during lockdowns), I would recommend acting ASAP. The Portuguese love hardcopy, notarization, etc. and it will take a two months to jump over the bureaucratic hurdles, even with two-day FedEx delivery of signed hardcopies. Email if you need recommendations for a lawyer and bank over there.

Related:

- “Former Google CEO Eric Schmidt applies to become Cyprus citizen, along with his wife and daughter, in $2.5m passport-for-sale program that will allow him unrestricted access to the EU – and tax breaks” (Daily Mail, 11/10/2020)