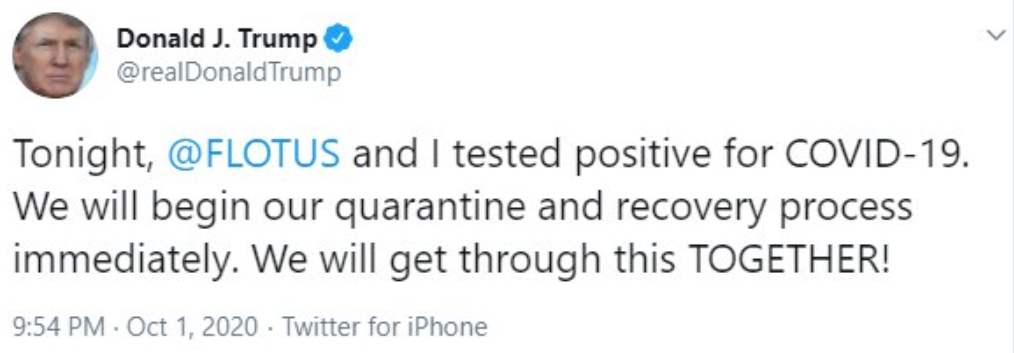

“LONG-CONCEALED RECORDS SHOW TRUMP’S CHRONIC LOSSES AND YEARS OF TAX AVOIDANCE” (NYT):

The Times obtained Donald Trump’s tax information extending over more than two decades, revealing struggling properties, vast write-offs, an audit battle and hundreds of millions in debt coming due.

Finally all of the Trump-haters’ questions will be answered? Sadly, no. Much additional forensic accounting remains to be done.

By their very nature, the filings will leave many questions unanswered, many questioners unfulfilled. They comprise information that Mr. Trump has disclosed to the I.R.S., not the findings of an independent financial examination. They report that Mr. Trump owns hundreds of millions of dollars in valuable assets, but they do not reveal his true wealth. Nor do they reveal any previously unreported connections to Russia.

If the tax returns don’t reveal Trump’s true wealth “by their very nature,” why was it so important to obtain and review them?

I’ve read through this article once and can’t find anything interesting. Trump seems to have had some winners and losers among his properties and took all of the deductions that good tax lawyers (such as RBG’s husband, a specialist in limiting payments to the government that RBG sought to expand) could find.

Actually, a close reading of the article reveals that Trump should actually be rich, as you might expect with someone who uses a Boeing 757 as a personal/family aircraft:

The newer tax returns show that Mr. Trump burned through the last of the tax-reducing power of that $1 billion in 2005, just as a torrent of entertainment riches began coming his way following the debut of “The Apprentice” the year before.

For 2005 through 2007, cash from licensing deals and endorsements filled Mr. Trump’s bank accounts with $120 million in pure profit. With no prior-year losses left to reduce his taxable income, he paid substantial federal income taxes for the first time in his life: a total of $70.1 million.

According to some previous articles that I’ve read, due to some crazy favorable contract terms and tax laws it seems that Trump was able to deduct losses on real estate that were actually incurred by partners (i.e., the $1 billion in losses for him might have been taken after only a $50 million personal loss). So if he chewed through this $1 billion with profits, that likely means that he actually earned $1 billion in profit circa 1995-2005 and didn’t have to pay income tax on that profit (due to the losses carried forward from the previous ventures in which he had not actually lost $1 billion of his own money).

Is it fair to say that the NYT’s long hunt for Trump’s tax returns has merely revealed that Trump was making roughly $100 million per year in a volatile industry and that his tax lawyers have been aggressive with the deductions? Who was a primary enabler of Trump being able to keep most of this $100 million/year?

Business losses can work like a tax-avoidance coupon: A dollar lost on one business reduces a dollar of taxable income from elsewhere. The types and amounts of income that can be used in a given year vary, depending on an owner’s tax status. But some losses can be saved for later use, or even used to request a refund on taxes paid in a prior year.

Until 2009, those coupons could be used to wipe away taxes going back only two years. But that November, the window was more than doubled by a little-noticed provision in a bill Mr. Obama signed as part of the Great Recession recovery effort. Now business owners could request full refunds of taxes paid in the prior four years, and 50 percent of those from the year before that.

What about the New York Times’s passion for learning more about how American women make money with their, um, natural assets?

The data contains no new revelations about the $130,000 payment to Stephanie Clifford, the actress who performs as Stormy Daniels — a focus of the Manhattan district attorney’s subpoena for Mr. Trump’s tax returns and other financial information.

How about the proven (by the NYT) fact that everything Trump has done has been bankrolled by Russia?

No subject has provoked more intense speculation about Mr. Trump’s finances than his connection to Russia. While the tax records revealed no previously unknown financial connection — and, for the most part, lack the specificity required to do so — they did shed new light on the money behind the 2013 Miss Universe pageant in Moscow, a subject of enduring intrigue because of subsequent investigations into Russia’s interference in the 2016 election.

The records show that the pageant was the most profitable Miss Universe during Mr. Trump’s time as co-owner, and that it generated a personal payday of $2.3 million…

So the guy who was earning $100 million per year from 1995-2005 added $2.3 million to his fortune via an event that occurred in Moscow?

Here’s the most shocking section to me:

Likewise the cost of haircuts, including the more than $70,000 paid to style his hair during “The Apprentice.” Together, nine Trump entities have written off at least $95,464 paid to a favorite hair and makeup artist of Ivanka Trump.

That’s a lot of hair-related expense!

Readers: What new and important information did you take away from this article?

Full post, including comments