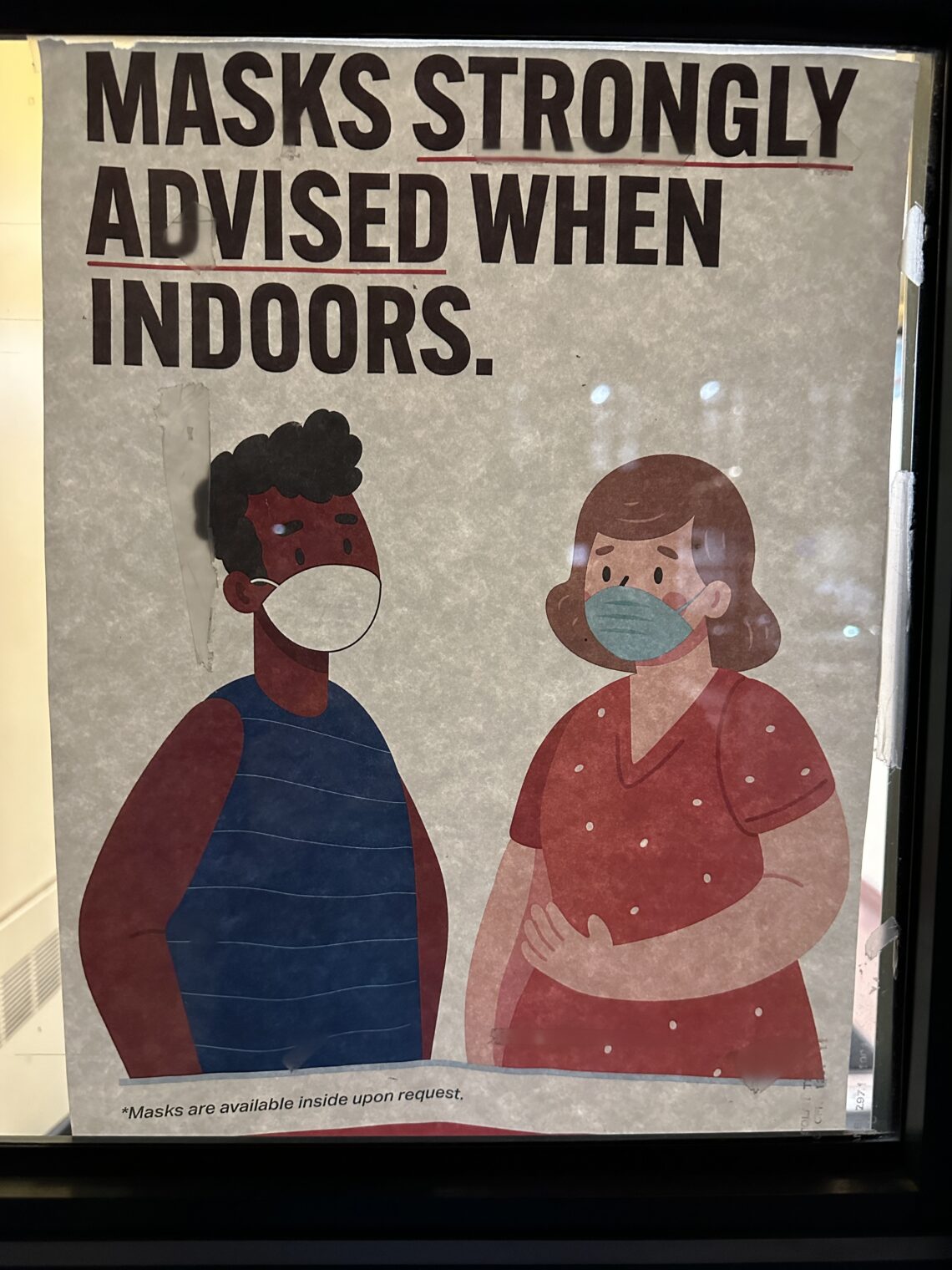

Have you noticed a dramatic reduction in mask-wearing now that Science is back to 2019?

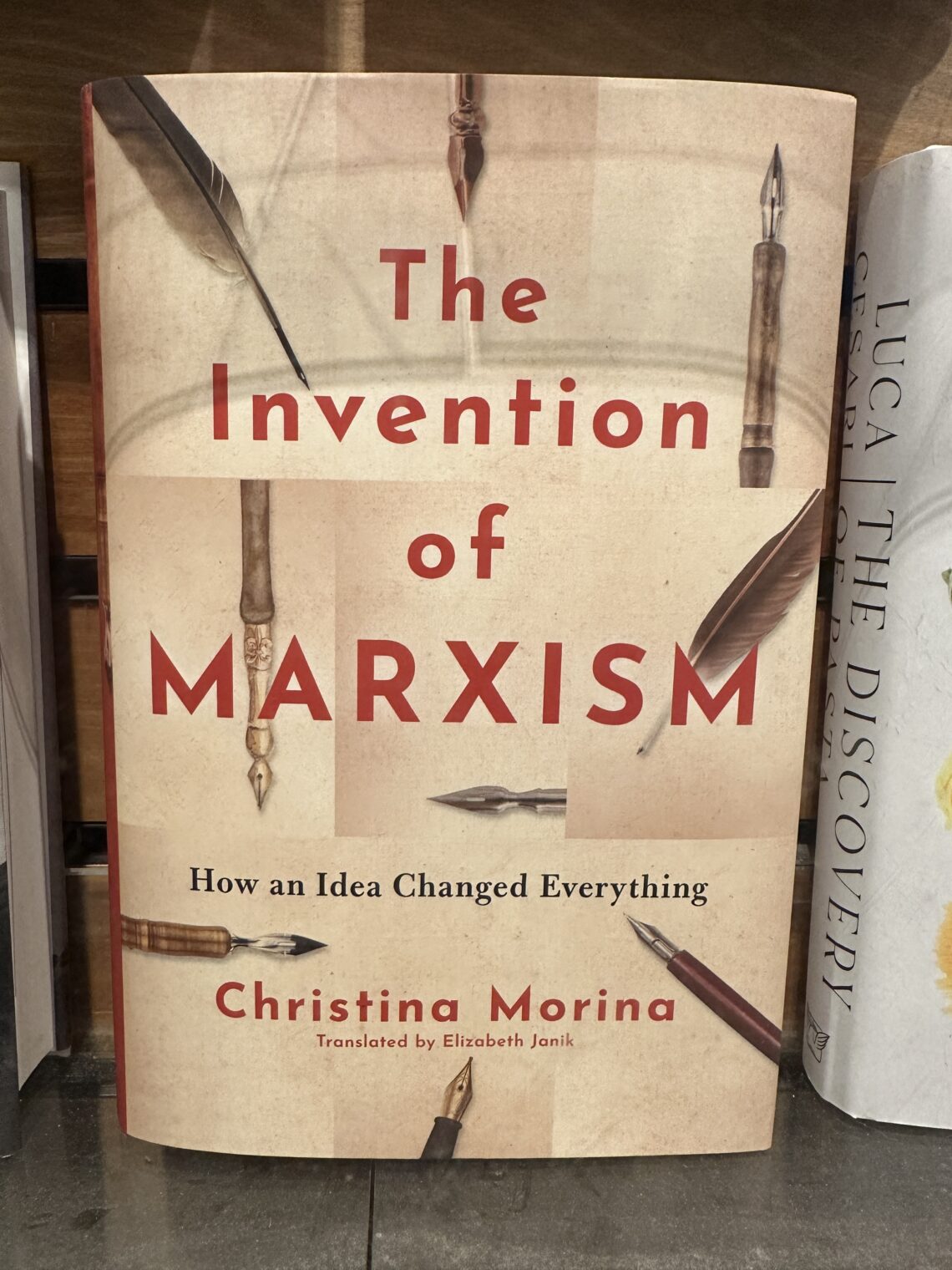

It’s been three weeks since the publication of “Do physical measures such as hand-washing or wearing masks stop or slow down the spread of respiratory viruses?” (Cochrane):

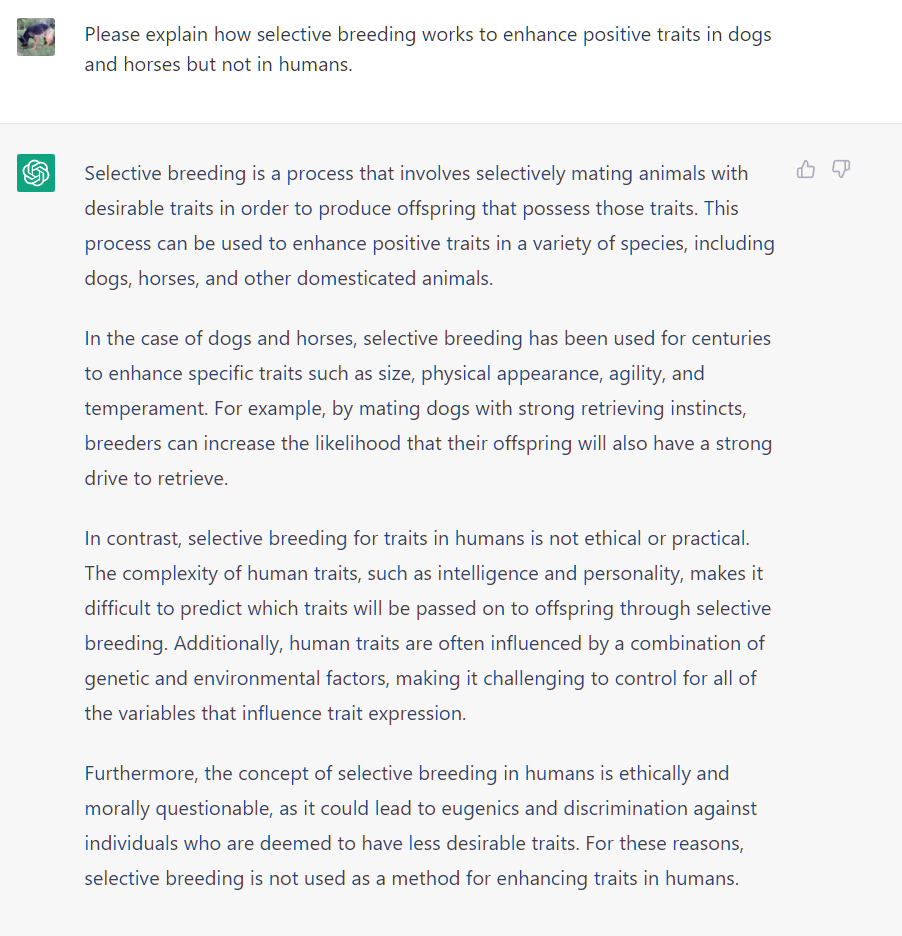

We identified 78 relevant studies. They took place in low-, middle-, and high-income countries worldwide: in hospitals, schools, homes, offices, childcare centres, and communities during non-epidemic influenza periods, the global H1N1 influenza pandemic in 2009, epidemic influenza seasons up to 2016, and during the COVID-19 pandemic. We identified five ongoing, unpublished studies; two of them evaluate masks in COVID-19.

Compared with wearing no mask in the community studies only, wearing a mask may make little to no difference in how many people caught a flu-like illness/COVID-like illness (9 studies; 276,917 people); and probably makes little or no difference in how many people have flu/COVID confirmed by a laboratory test (6 studies; 13,919 people).

Compared with wearing medical or surgical masks, wearing N95/P2 respirators probably makes little to no difference in how many people have confirmed flu (5 studies; 8407 people); and may make little to no difference in how many people catch a flu-like illness (5 studies; 8407 people), or respiratory illness (3 studies; 7799 people).

In other words, we’re back to Science v2019: the only way to avoid infection is to stay home, not to go into a theme park during Christmas vacation wearing a cloth mask (Faucism), a surgical mask, or an N95 mask (True Science).

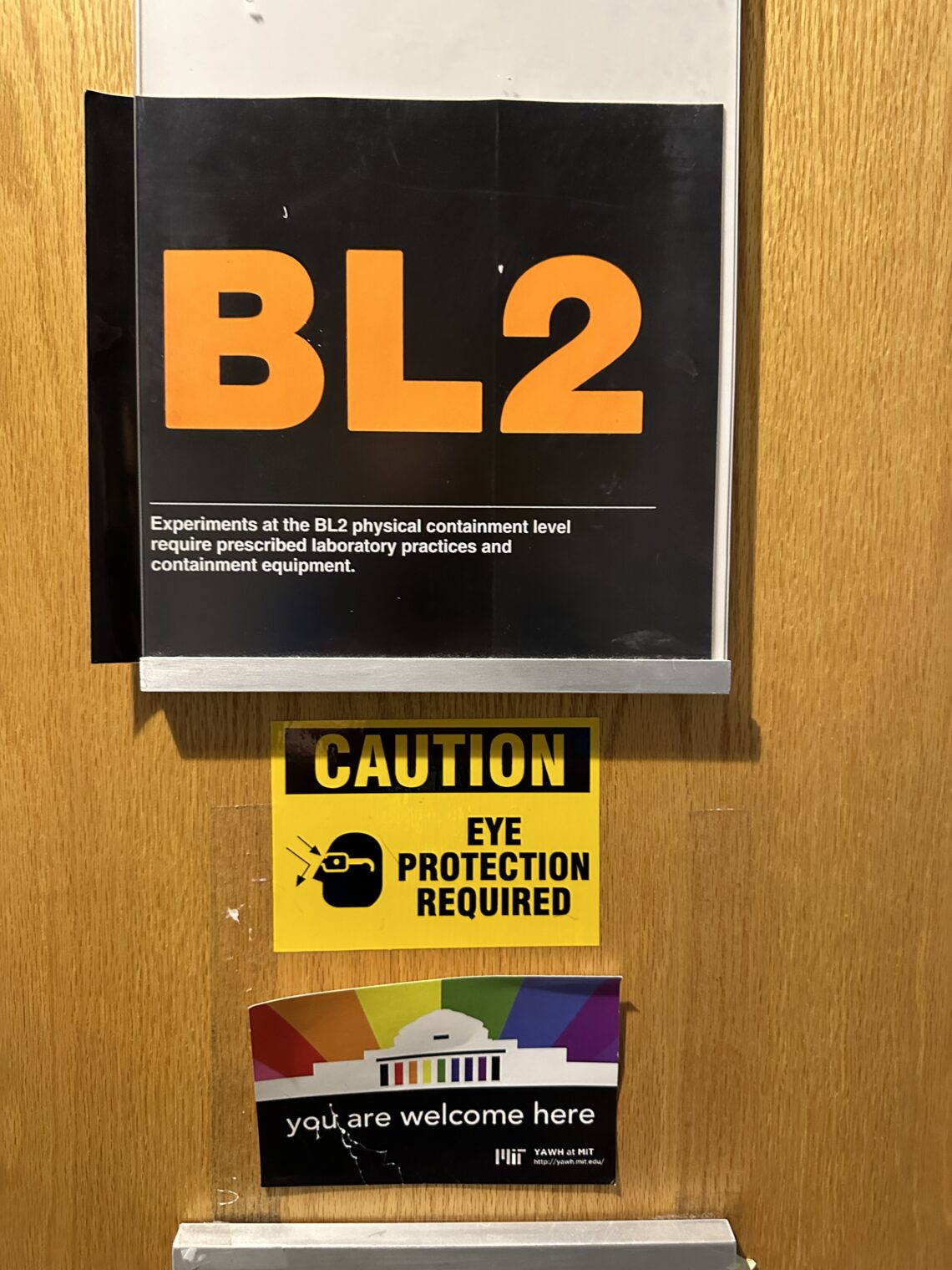

The masked faithful who’ve continued with their rituals after the Covidcrats rescinded their orders requiring masks (illegal in Florida!) say that they’re Following the Science. So we might expect a dramatic change to the slope of the de-masking curve now that this utterly reliable organization has come down with its verdict.

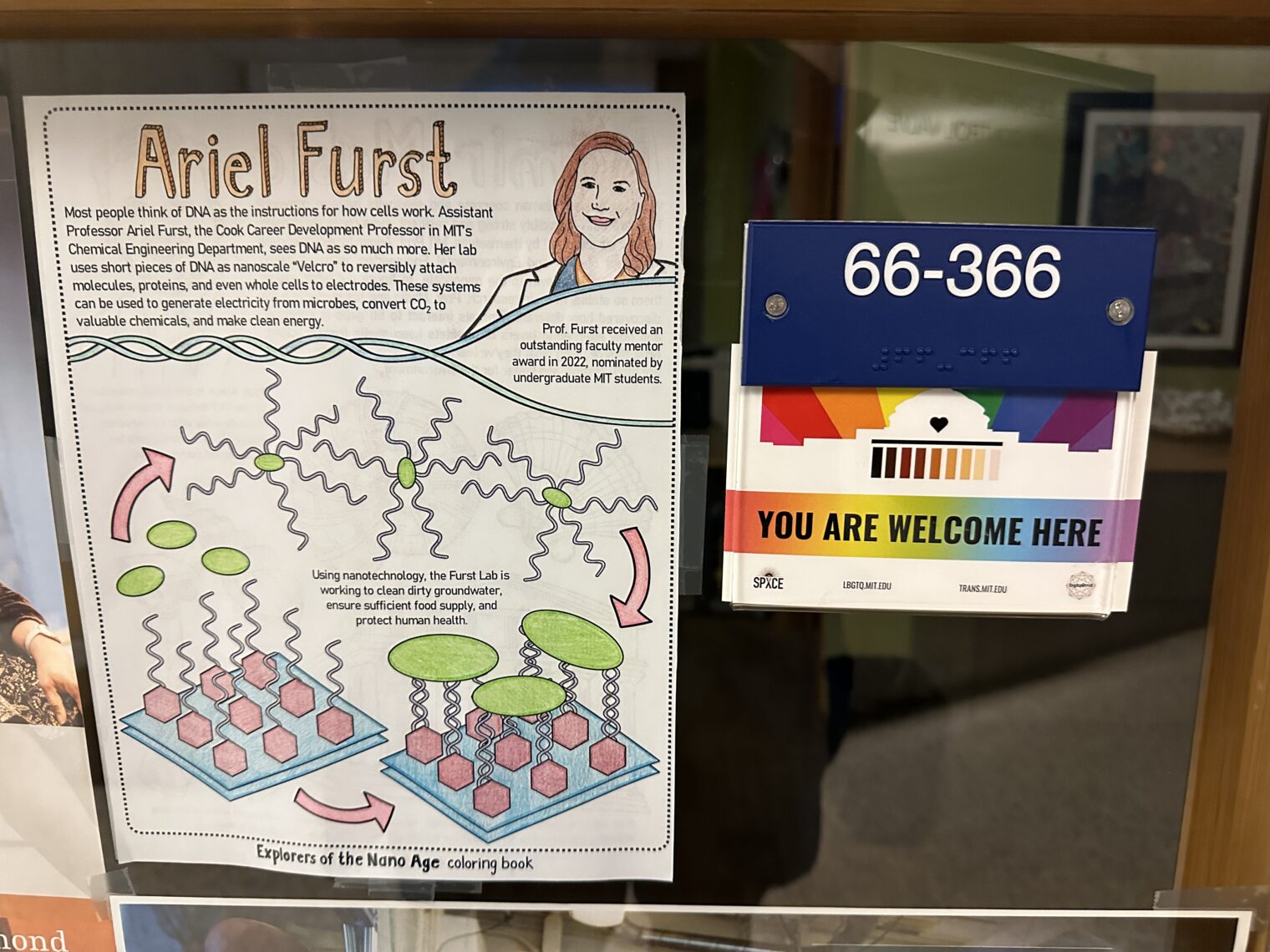

What have you seen out there in the wild? It’s tough for me to observe any changes here in Florida due to the small sample size (a handful of old/sick-looking people are sometimes observed in masks). I have queried mask believers in Massachusetts and California and they say that they are not going to change their behavior in response to the Cochrane article. Part of their justification is that they believe themselves to be vastly superior to the average person, including the health care workers in some of the studies underneath the Cochrane analysis, in competence, diligence, and consistency. Masks will fail for the incompetent rabble, but not for them.

Some excerpts from a Maskachusetts mask-believer:

Stupid people will do stupid things. Incompetent people will muddy the signals for otherwise potentially beneficial countermeasures. And your governor is still a douchebag, even if it is true that the Black History AP course [sic; the correct title is “AP African American STUDIES” (not “history”)] was politically motivated. Also, plain water and hand rubbing was shown by the CDC to be effective in getting virus particles off your hands.

(Hatred of Ron DeSantis is “Carthago delenda est!” for Democrats? I never mentioned Ron D when asking him how the Cochrane study would affect his behavior.)

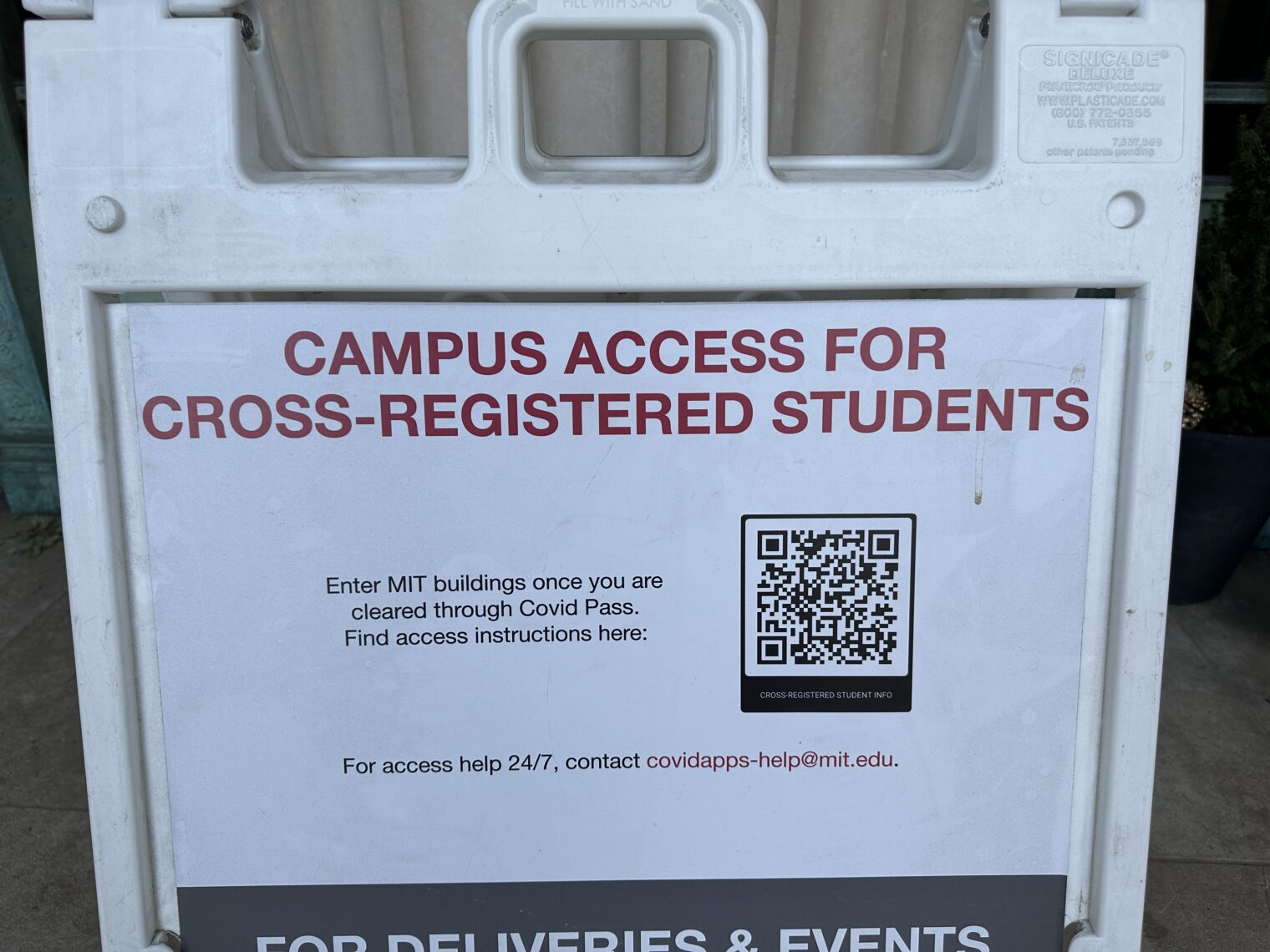

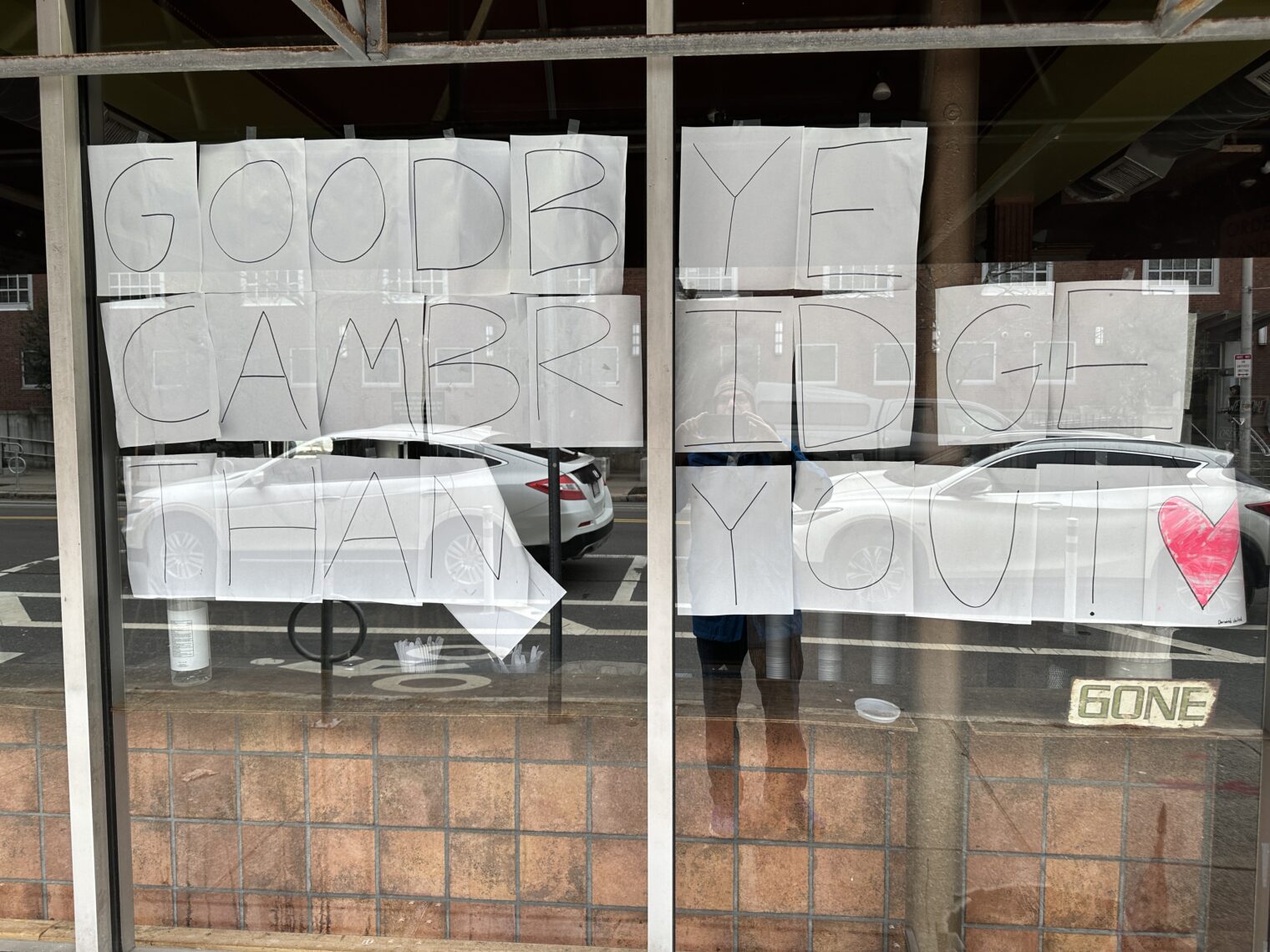

From my Boston/DCA flight in January:

Full post, including comments