Why isn’t the cost of mining Bitcoin more or less equal to the current price of Bitcoin?

A comment on Is inflation already at 15-30 percent if we hold delivery time constant?:

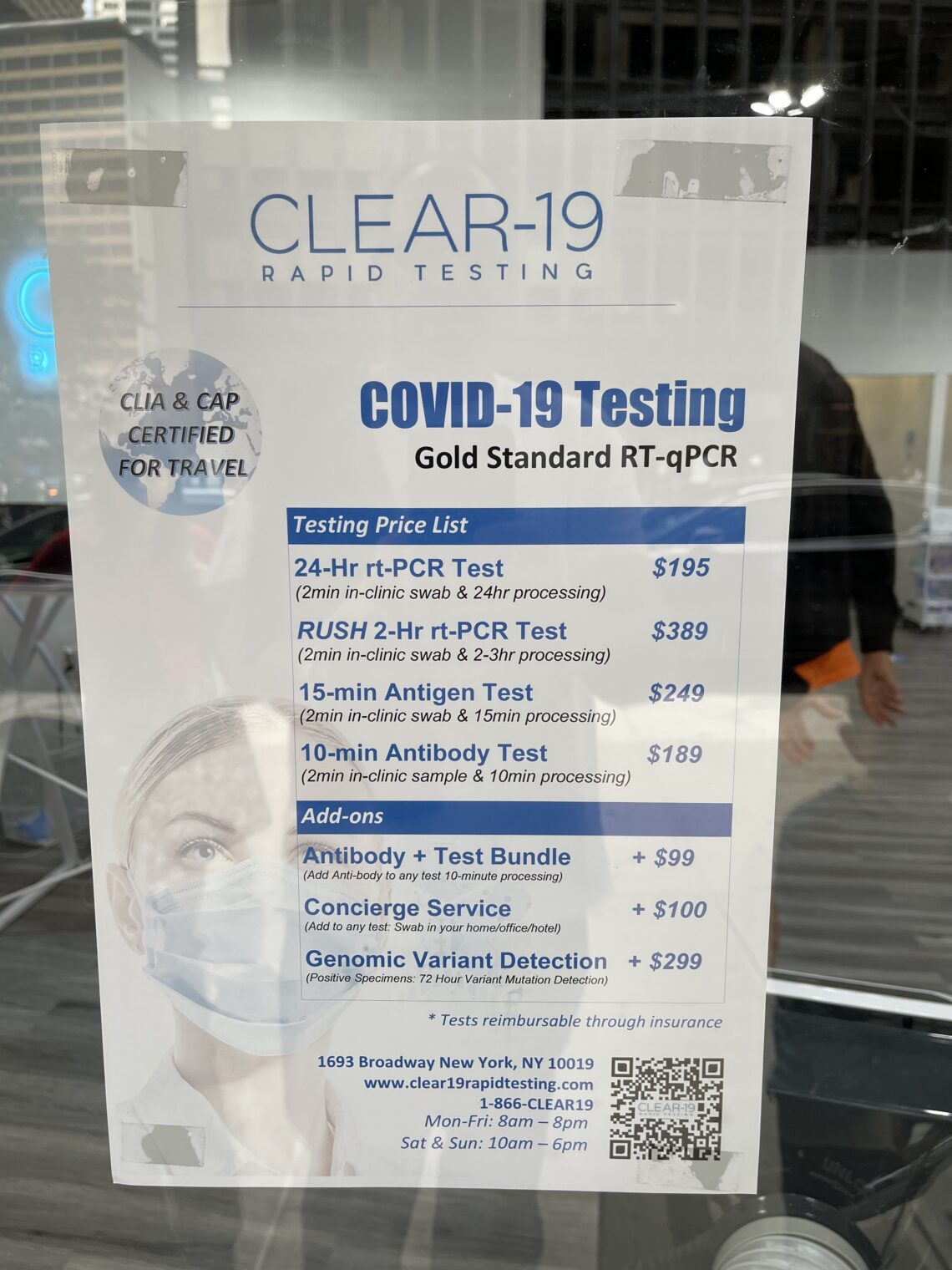

GPU scarcity is entirely due to the growth of digital currency mining and the corresponding increase in demand for the chips that do the mining most efficiently. A top-end GPU can recoup the list price from digital currency mining in two months.

Why is the return on investment quick/high for Bitcoin mining? If the price of Bitcoin goes up, shouldn’t there be an almost immediate flood of people into the mining business such that the cost of mining rises to just below the selling price of Bitcoin?

An explanation of the mining process:

Once miners have verified 1 MB (megabyte) worth of Bitcoin transactions, known as a “block,” those miners are eligible to be rewarded with a quantity of bitcoin (more about the bitcoin reward below as well). The 1 MB limit was set by Satoshi Nakamoto, and is a matter of controversy, as some miners believe the block size should be increased to accommodate more data, which would effectively mean that the bitcoin network could process and verify transactions more quickly.

Note that verifying 1 MB worth of transactions makes a coin miner eligible to earn bitcoin—not everyone who verifies transactions will get paid out.

To earn bitcoins, you need to meet two conditions. One is a matter of effort; one is a matter of luck.

2) You have to be the first miner to arrive at the right answer, or closest answer, to a numeric problem. This process is also known as proof of work.

If mining is lucrative, e.g., because mining costs $5,000 in carbon-spewing electricity while Bitcoin is selling for $40,000, shouldn’t so many new miners flood in that it would be less probable to “be the first miner to arrive at the right answer”? This would effectively raise the cost of mining and the process should continue until mining costs $39,000+.

I suspect that I’m missing something. “Why The Actual Cost Of Mining Bitcoin Can Leave It Vulnerable To A Deep Correction” (mid-2020):

In early 2020, researchers predicted the cost to mine Bitcoin will be at around $12,000 to $15,000 after the block reward halving in May. But, it is now much cheaper to mine BTC than the initial estimates. The low breakeven price to mine Bitcoin may leave it vulnerable to a correction.

Bitcoin has become more affordable to mine in recent weeks due to two main factors: difficulty adjustments and cheaper electricity in Sichuan, China due to the rainy season.

A low breakeven price of Bitcoin can raise the probability of a price pullback because miners have more incentive to sell BTC, which may increase selling pressure in the short-term.

“To be completely accurate: Given current difficulty, 0.04$/kWh and S9 running custom firmware bringing it down to 71W per TH efficiency. The cost to mine 1 BTC is 8206.64$. Meaning its still profitable,” one miner said.

Maybe my theory isn’t contradicted by this article. At the time it was written, the market price of Bitcoin was $9,626. But what is the cost of mining today relative to the market price of existing Bitcoin?

Full post, including comments