Increase Federal border staff in the south by moving some from the north?

The situation on the U.S. southern border is now considered by our media to be a “crisis.” The crisis is not so severe, of course, that Congress has been motivated to change any of the laws that encourage people to migrate here (birthright citizenship, lifetime taxpayer-funded housing, health care, food, and smartphone, etc.) [Just as the treatment of migrants who say that they’re under 18 is horrific, but not so bad that anyone complaining about it offers to open his or her own home to a migrant!]

Since we don’t have substantially more money or new laws to deal with the situation on the southern border, would it make sense to move resources that we’re already paying for?

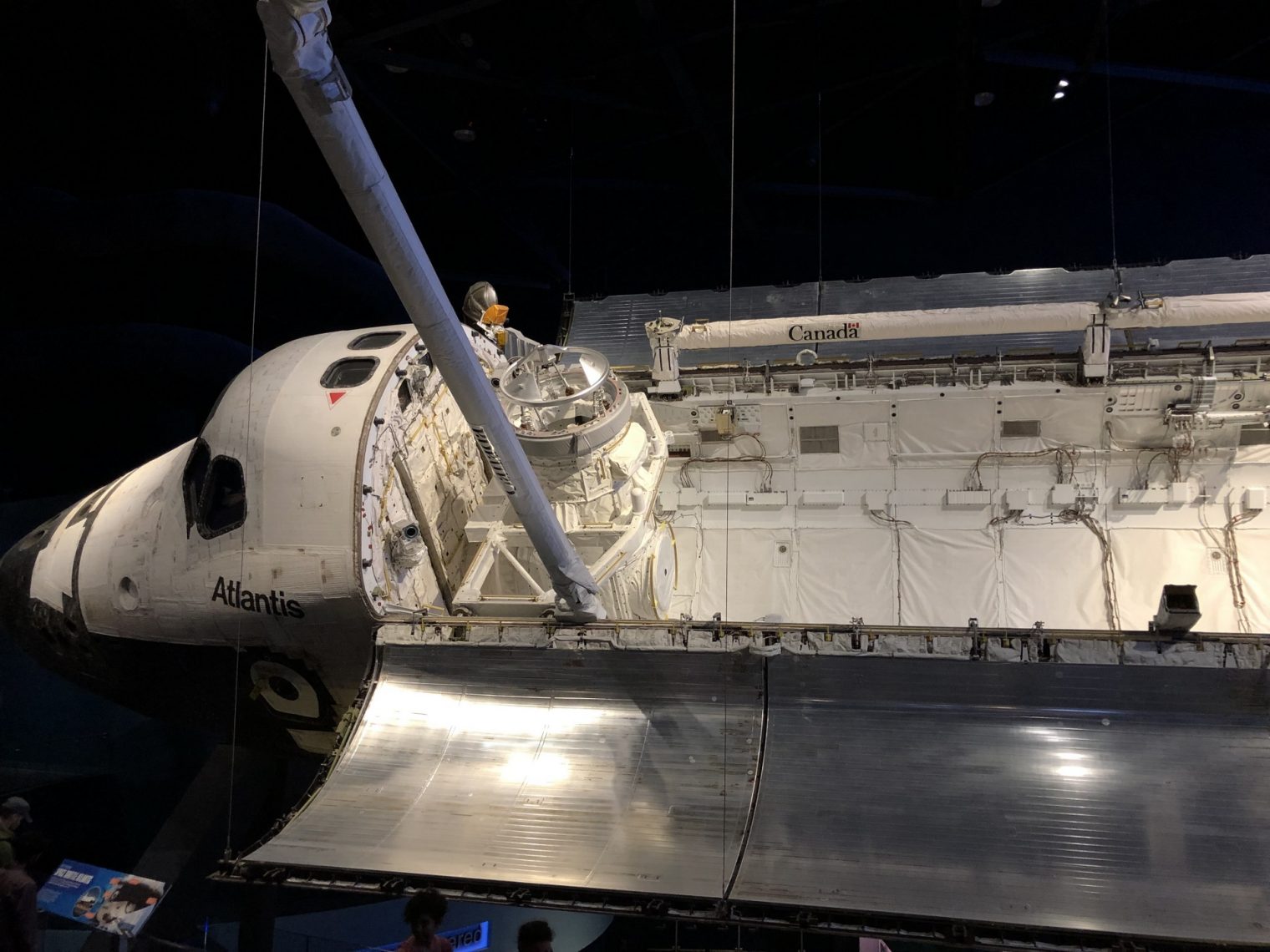

When you fly a private airplane into Canada, for example, you let the Canadians know who is on the plane and where you expect to land. On landing, if you don’t see any officials (the usual case) you call up the authorities and they give you a “report number” to write down (unclear what this could ever be used for!), thus freeing the Canadian government to deal with more pressing issues.

When you fly a private airplane into the U.S., on the other hand, you have to provide complete information on all occupants of the aircraft via a web site (eAPIS) and also make a phone call as you would with Canada. The Feds will send out an armed agent ($1000 per working hour if we factor in pension, overtime for evenings/weekends, periodic weapons training, government SUV, and other benefits?) to do a cursory inspection of the plane and the people.

If the U.S. went to the “random sampling” approach that the Canadians use, there would be a lot of resources freed up to deal with the tide of migrants washing over the southern border. Aircraft operators are fairly diligent about customs and immigration. None of them want the government to take away their airplanes if an unauthorized person is found on board.

The same approach could be used for commercial airline flights. Why have 100 people at Logan Airport to deal with flights coming from London? The government already was advised via eAPIS of the passenger manifest. The passports were already checked in London by the airline. Why not move 90 of the 100 people to where they are most needed and have the remaining 10 randomly sample passengers from London?

If we had a country in which 100 percent of the residents were documented, maybe it would make sense to screen 100 percent of inbound travelers. But if we already have between 10 million and 22 million undocumented people living in the U.S., why does it make sense to screen the inbound family Cessna, the inbound Fortune 500 company’s Gulfstream, or the inbound British Airways flight whose passengers were carefully sifted through by the carrier?

Full post, including comments