Money Illusion 101: Ricky Gervais’s New York apartment that fell 45 percent from its 2008 value

Some news from the Mamdani Caliphate… “Ricky Gervais has just sold a NYC apartment for $1.4M — a slight loss from its 2008 purchase price” (NY Post):

The English comedian and actor Ricky Gervais has just sold an apartment on East 63rd Street for $1.4 million, according to city property records filed on Monday.

Gervais, whose many credits include the across-the-pond version of “The Office,” and his longtime partner Jane Fallon, both appear on the deed in the property transfer to a limited liability company — whose identity could not immediately be identified.

The pair still own a larger unit on the 12th floor, which they bought in 2011 for $3.74 million, records show. They purchased this ninth-floor residence — with one bedroom and 799 square feet — for $1.66 million in 2008, property records also show. This means a slight loss for the couple.

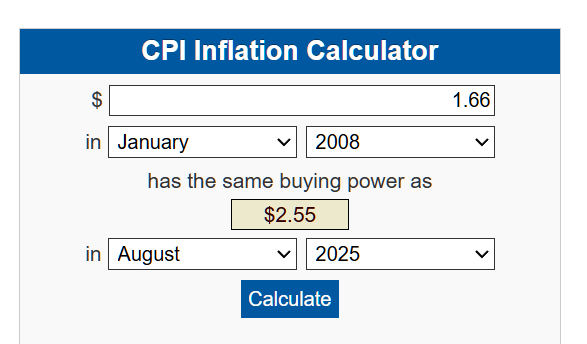

A “slight loss”? If we adjust for inflation at official CPI, the purchase price is equivalent to $2.55 million in today’s mini-dollars:

Gervais took a 45% hit on the value of this apartment in real terms, in other words, but via Money Illusion it is only “a slight loss”.

(My hedge fund manager friend, if anyone talks up real estate as a surefire investment: “Prices can only go up because they’re not making any more condos.”)

What if we consider the loss in terms of gold? My question to ChatGPT:

In terms of ounces of gold, what percentage loss was it to buy something for $1.66 million in June 2008 and sell it for $1.4 million in June 2025?

Answer (not in quote style):

Here’s one way to think about it:

- In June 2008, the price of gold was about $925.10 per ounce (on June 30, 2008). StatMuse

- In June 2025, gold was around $3,264.03 per ounce (on June 30, 2025). Gold Price

Step 1: Convert the transaction amounts into ounces of gold (at those dates)

- $1.66 million in June 2008 in terms of gold ounces = 1,660,000925.10≈1,794.8 ounces\frac{1,660,000}{925.10} \approx 1,794.8 \text{ ounces}925.101,660,000≈1,794.8 ounces

- $1.4 million in June 2025 in terms of gold ounces = 1,400,0003,264.03≈429.1 ounces\frac{1,400,000}{3,264.03} \approx 429.1 \text{ ounces}3,264.031,400,000≈429.1 ounces

Step 2: Compute the percentage loss in gold ounces

- Loss in ounces = 1,794.8 − 429.1 = 1,365.7 ounces

- Percentage loss relative to original (in ounces) = 1,365.71,794.8×100%≈76.1%\frac{1,365.7}{1,794.8} \times 100\% \approx 76.1\%1,794.81,365.7×100%≈76.1%

So, in terms of ounces of gold, the transaction represents about a 76 % loss.

Who are the two journalists and at least one editor who failed to notice the massive loss? “Zachary Kussin is the real estate editor at the New York Post. … He holds degrees from Bard College and the CUNY Graduate School of Journalism. … Mary K. Jacob is a reporter at the New York Post. … A graduate of New York University with a degree in politics and journalism…”

In other words, the two reporters who worked on this story are among the American elite when it comes to educational credentials.

Full post, including comments