CBS yesterday:

New Mexico Gov. Michelle Lujan Grisham on Friday issued an emergency public health order that suspends the open and permitted concealed carry of firearms in Albuquerque for 30 days in the midst of a spate of gun violence.

Gun enthusiasts are saying that this is unconstitutional, but that’s irrelevant if there’s an emergency. KOAT:

“I can invoke additional powers,” Lujan Grisham said. “No constitutional right, in my view, including my oath, is intended to be absolute.”

It’s only for 30 days and it is intended to address what the governor has characterized as an “emergency”, so it is unclear why anyone could make a good faith objection to this order. The governor herself summarizes the situation succinctly (nytimes):

“I have emergency powers,” she said. “Gun violence is an epidemic. Therefore, it’s an emergency.”

Let’s look at some history and consider what might be a more effective approach to ending the gun violence emergency…

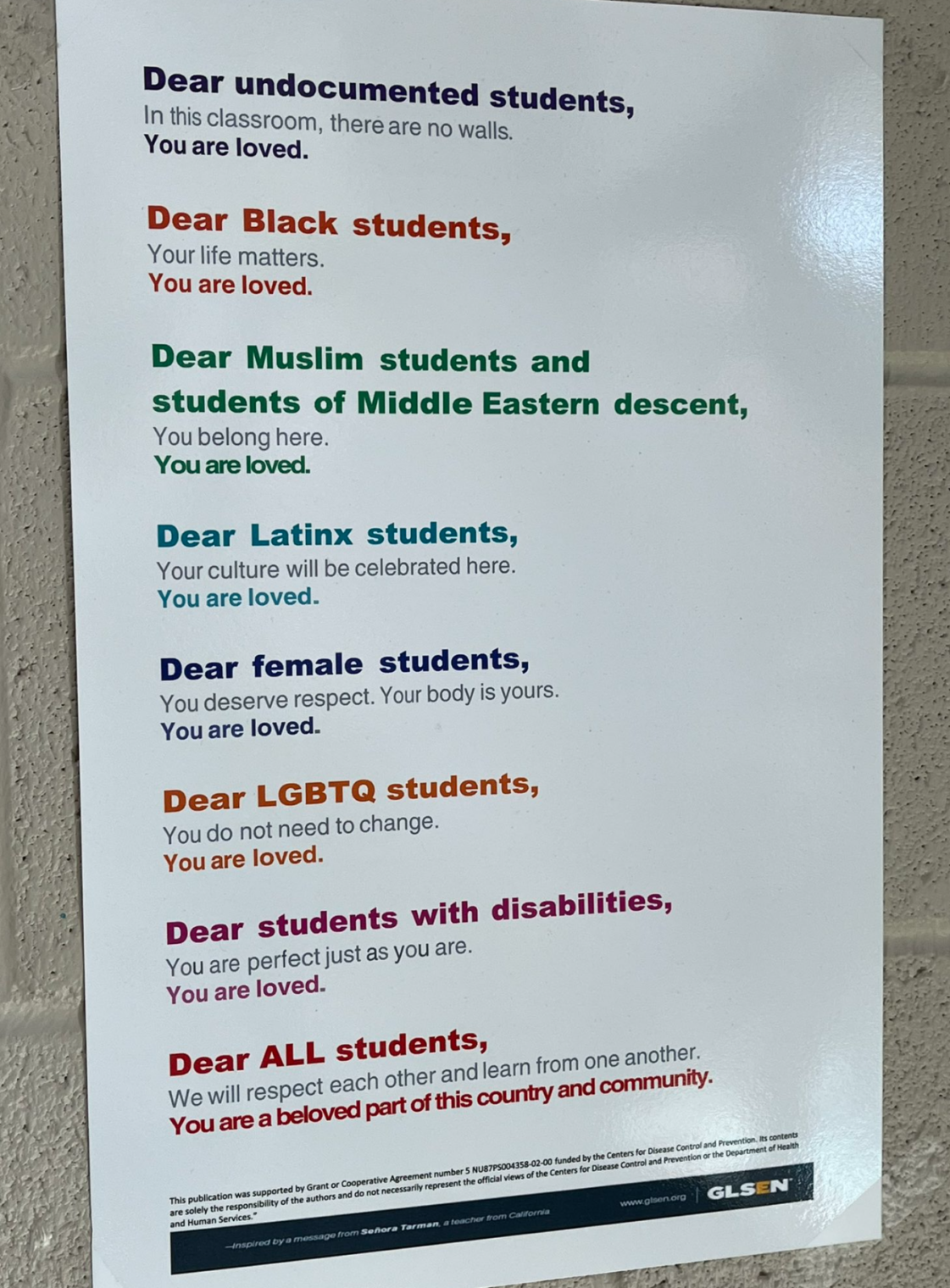

Prior to 2020, Americans believed that the U.S. Constitution guaranteed each of us the right to leave his/her/zir/their home to assemble, e.g., at work or school. However, it turned out that the Constitution did not prevent lockdowns of young healthy Americans on the grounds that there was a statistical chance that the lockdown could save the life of an old person somewhere.

That the societies with lockdowns had as-high or higher overall excess death rates compared to lockdown-free and mask-free Sweden isn’t relevant to this post. Even if no lives were saved, the idea was that lives might be saved and therefore the Constitution could be set aside. #BecauseEmergency

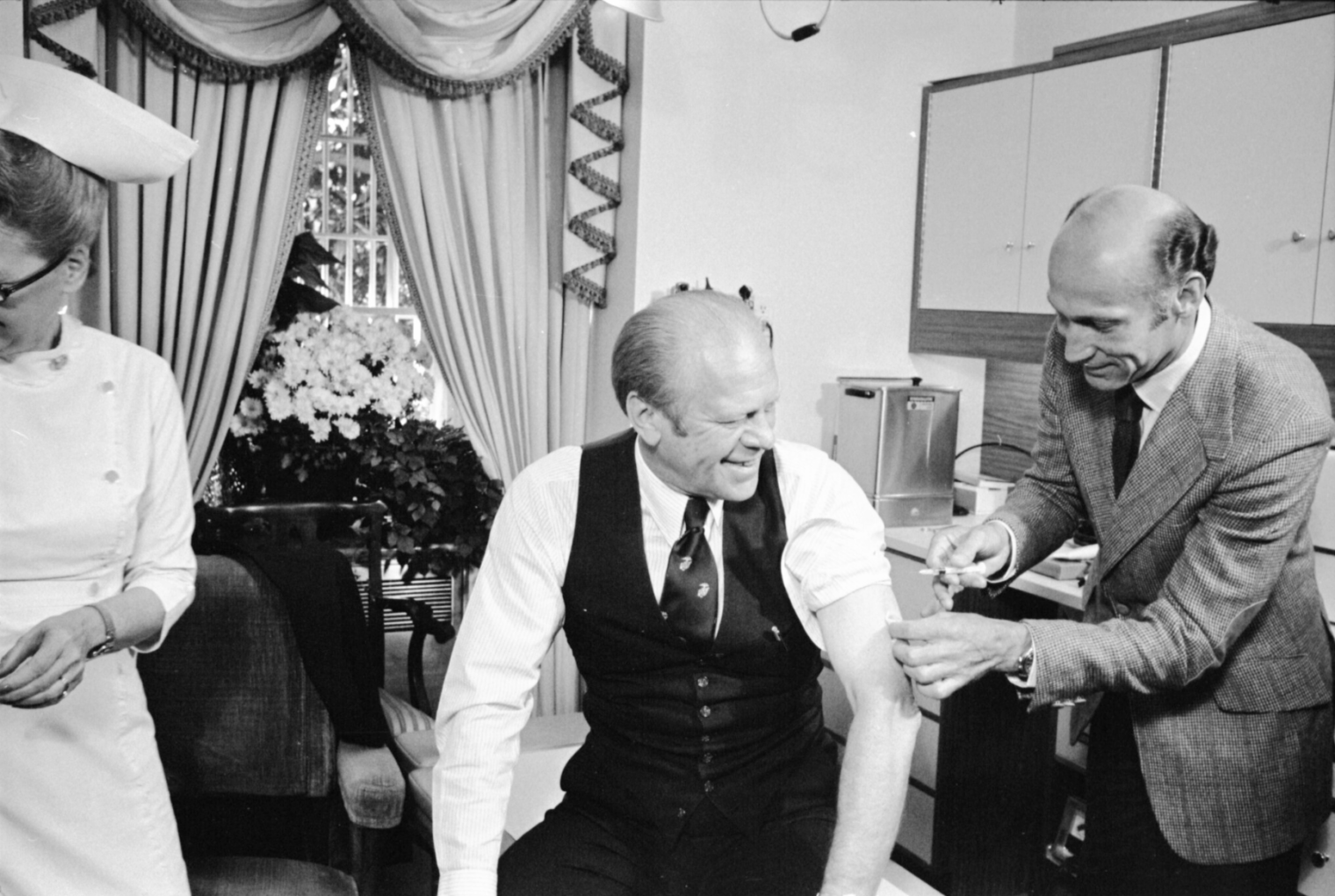

The majority of Americans, among the world’s meekest and most compliant humans, seem to be happy to have traded what had been their rights for the promise of safety. (Dutch friend at the time: “All of the rights that Americans fought and died in multiple wars to defend, they gave up in one governor’s press conference.”) Here’s part of a recent comment on Twitter, in response to a freedom-lover who complained about lockdowns, forced vaccinations, mask orders, etc. and asserted that they were unconstitutional:

Coercion is not the same as force and weakens your argument when you conflate the two. A majority of society agreed protect public health, that’s democracy.

Nobody was forced to get vaccinated. It is just that a person could have a job or be in a public place only if he/she/ze/they accepted the experimental injection. The lockdowns were okay because they were a product of democratic processes. My response:

Democracy undiluted by the Constitution sounds good. Freedom from crime is an important element of public health. What if a majority of Americans voted to seal the borders of any neighborhood in which the residents had committed more than a certain number of violent crimes? See below for how it could work in practice. https://en.wikipedia.org/wiki/District_13

Our democratically elected federal and state governments took away various freedoms based on statistical hopes and using an “emergency” as a justification. Do we have what we need to justify locking down neighborhoods from which we can expect criminal activity? From CNN:

Dr. Anthony Fauci, President Joe Biden’s chief medical adviser, acknowledged Sunday that gun violence in the US is a public health emergency.

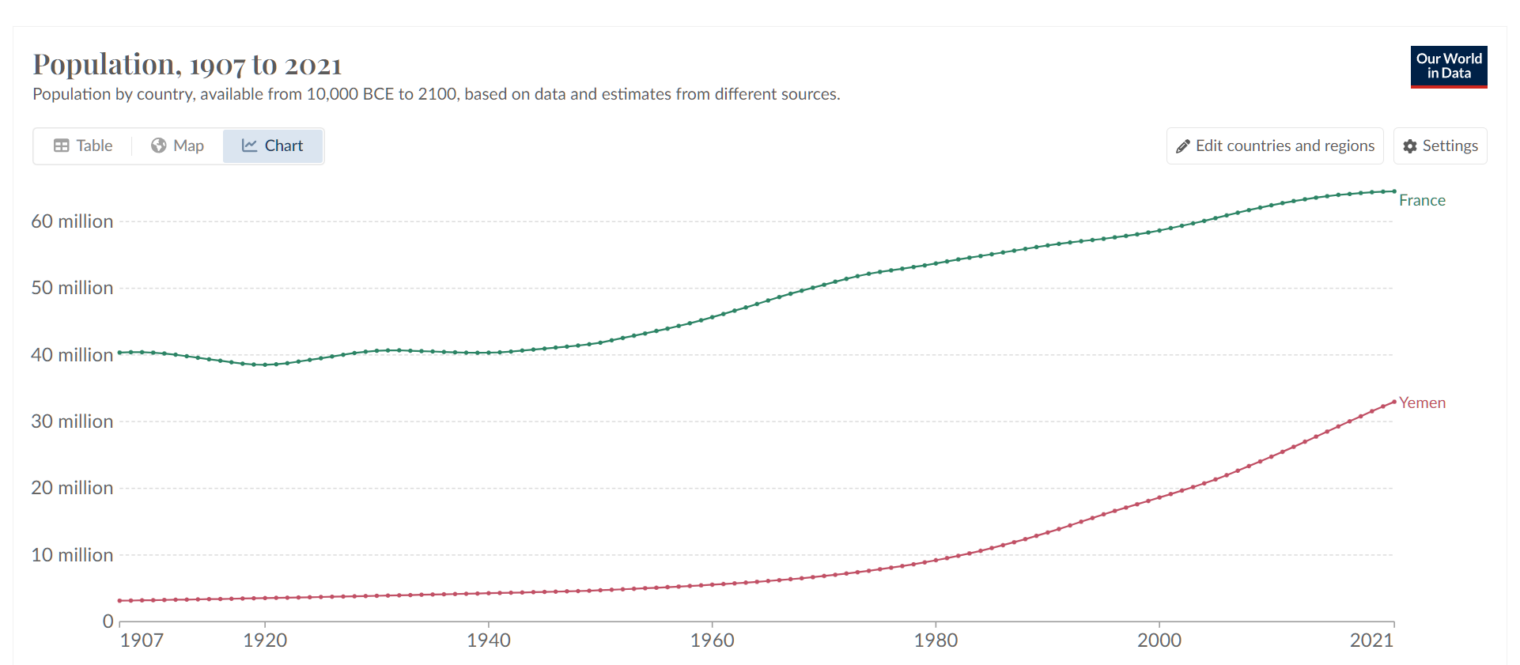

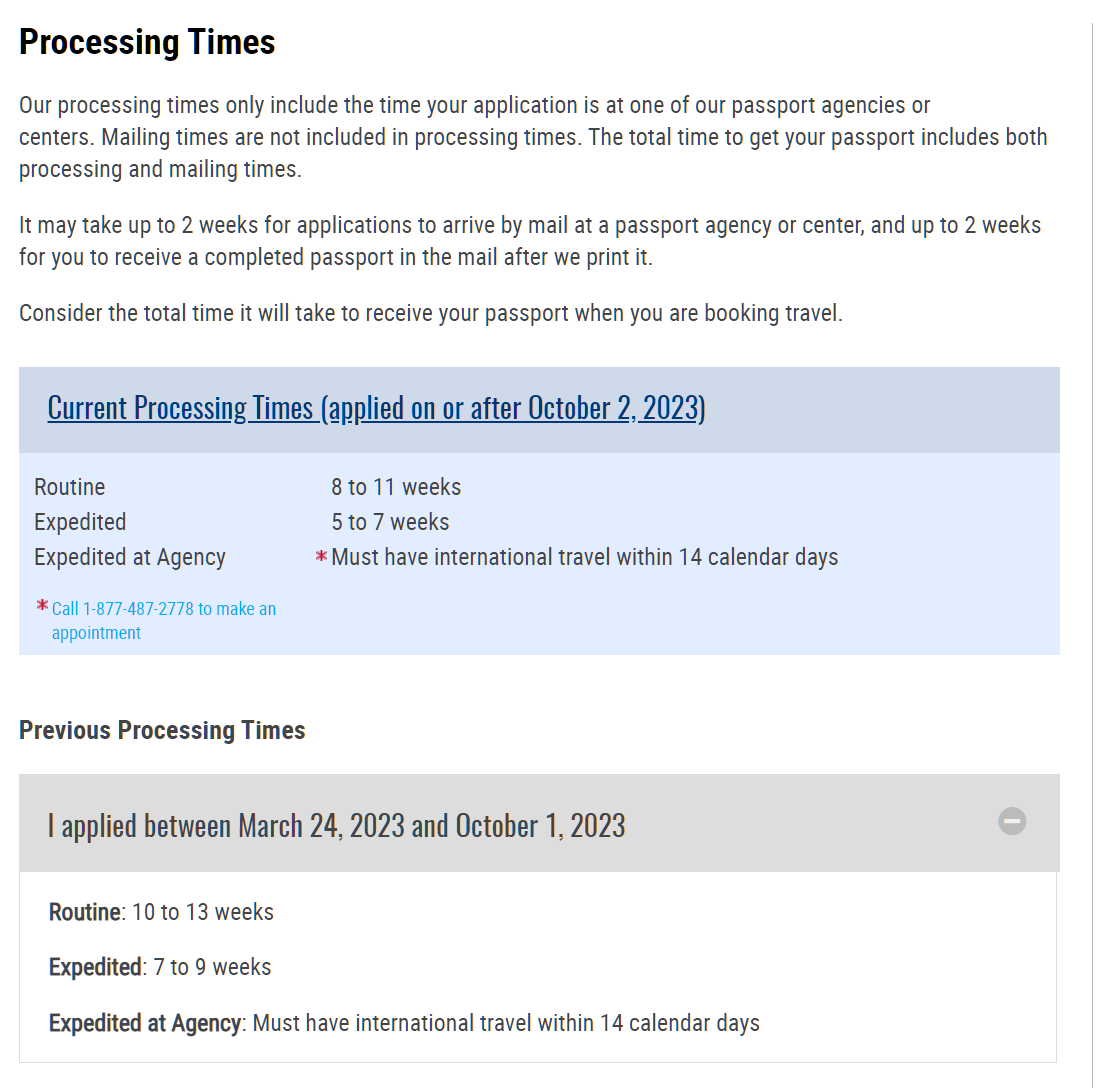

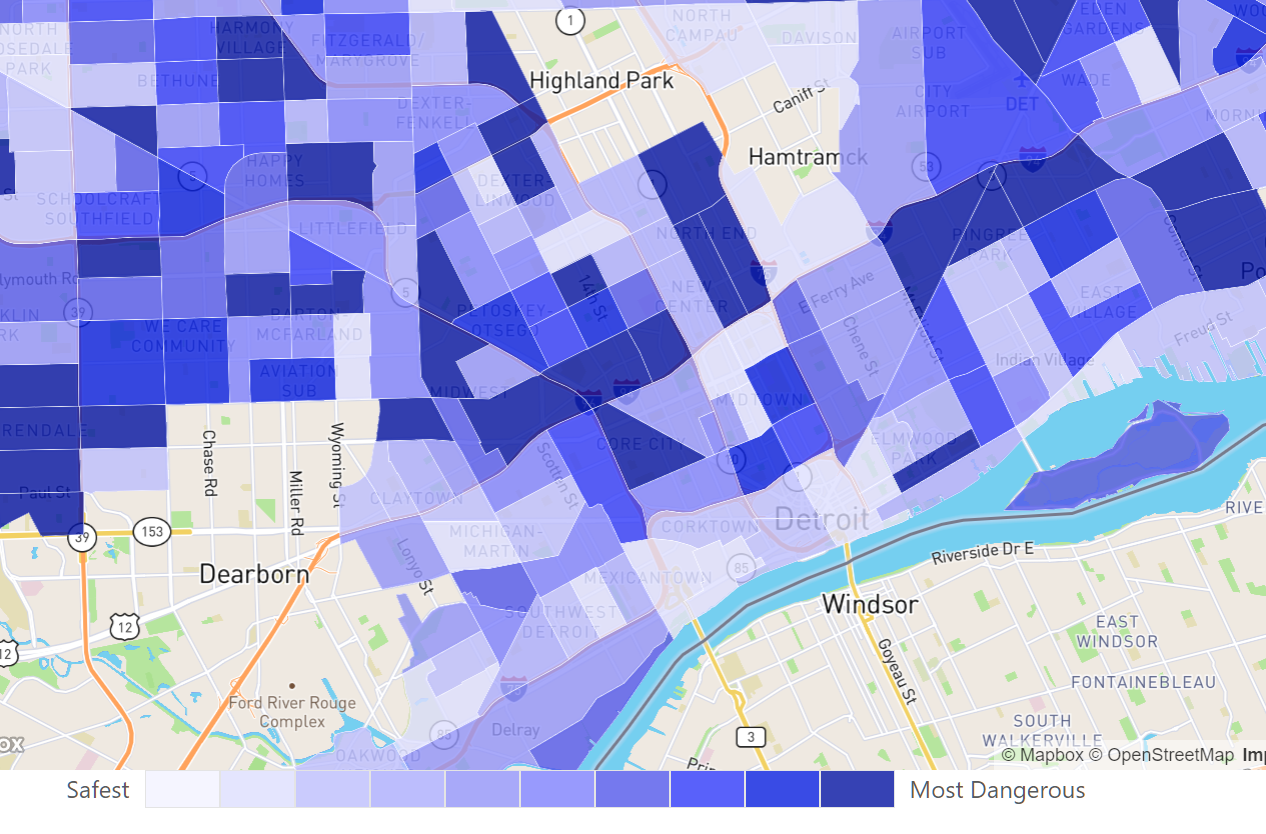

What would it look like in Detroit, Michigan, rated #1 in “Total Crime Index”? Referring to the map below, the neighborhoods in the darkest color (?!?) would be walled off as a reasonable public health measure. Residents could leave their houses only during certain daylight hours and only for purposes deemed essential, such as buying marijuana. (See this March 23, 2020 article: “Michigan marijuana shops may remain open during the COVID-19 coronavirus stay-at-home order issued Monday by Gov. Gretchen Whitmer”) There would be checkpoints at a few points in the wall where people could be screened for guns and drugs on the way in or out (in those situations where the governor was permitting residents to go in or out).

Is there any flaw in the above reasoning? Separately, if you haven’t seen District B13, I recommend it!

Related (loosely):

Full post, including comments