In light of this weekend’s failure and seizure of First Republic Bank, I thought it might be nice if the FDIC employees who are working over the weekend, at modest rates of pay, got a thank-you note from the regulators and supervisors at the San Francisco Fed who enabled the Silicon Valley Bank and First Republic failures. (The regional Feds are not technically part of the government and they pay employees vastly more than actual federal government agencies, such as the FDIC, do.)

My prompt to ChatGPT:

My name is Mary C. Daly and I earn over $400,000 per year working at the San Francisco Federal Reserve Bank. I’ve been busy tackling the diversity crisis at the Federal Reserve and also in the wider economics profession. Consequently, Silicon Valley Bank and First Republic Bank both failed on my watch. Please draft a thank-you note from me to the hard-working employees at the Federal Deposit Insurance Corporation for all the clean-up work that they do after banks that I supervise fail. Work in that I hope they enjoy that GS-based salaries and ask if they want me to buy them a Starbucks gift card with my higher-than-Joe-Biden’s salary paycheck.

The response, not in quote style:

Subject: Gratitude and Appreciation from Mary C. Daly

Dear FDIC Team,

I hope this message finds you well. My name is Mary C. Daly, and I am currently working at the San Francisco Federal Reserve Bank. I wanted to take a moment to express my sincere gratitude and appreciation for the outstanding work that each and every one of you does at the Federal Deposit Insurance Corporation.

I understand that, in recent times, both Silicon Valley Bank and First Republic Bank experienced difficulties that ultimately led to their failure. As the events unfolded, it became apparent just how crucial the FDIC’s role is in providing stability and confidence in the financial system. I am truly grateful for the diligence, professionalism, and expertise you demonstrated during the clean-up process, and I acknowledge that your hard work has been indispensable in mitigating the impact of these unfortunate events.

As someone who has been focusing on addressing the diversity crisis within the Federal Reserve and the wider economics profession, I am keenly aware of the challenges and demands associated with our roles. I hope you find satisfaction and pride in the vital work you carry out, as well as in the GS-based salaries you earn, which are well-deserved.

I would also like to extend a lighthearted offer: if you ever find yourselves in need of a little pick-me-up, please let me know, and I would be more than happy to send a Starbucks gift card your way. It would be a small token of appreciation for your continued efforts in ensuring the stability of our financial system.

Once again, thank you for the important work that you do. Your dedication and commitment to upholding the integrity of our financial institutions do not go unnoticed. Wishing you all continued success in your endeavors.

Warm regards,

Mary C. Daly

How about a thank-you for the folks who will pay for all of this? The prompt:

Please write an additional thank-you note that will go out to all Americans who are customers at banks outside of California, thanking them for accepting low interest rates and poor customer service on their deposits so that their boring banks could pay big fees into the FDIC fund that will bail out the banks that I was supervising.

The output:

Subject: A Heartfelt Thank You to Bank Customers Nationwide

Dear Fellow Americans,

As a representative of the San Francisco Federal Reserve Bank, I would like to extend my deepest gratitude to all of you who bank with institutions outside of California. Your continued support and patronage of these banks have contributed greatly to the stability and resilience of our financial system.

I understand that many of you have been accepting lower interest rates and, at times, less-than-ideal customer service in order to support your local banks. Your willingness to make these sacrifices has enabled these institutions to contribute to the FDIC fund, which in turn has played a critical role in safeguarding our financial system during times of crisis.

The recent challenges faced by Silicon Valley Bank and First Republic Bank have highlighted the importance of the FDIC fund in maintaining confidence and stability within our banking sector. Your ongoing support has been instrumental in ensuring that the necessary resources are available to assist banks in need, thereby minimizing the impact on both the industry and the wider economy.

I want to thank each and every one of you for your understanding and commitment to the greater good. It is through your collective efforts that we can continue to build a stronger, more resilient financial system that benefits all Americans.

In recognition of your contributions, I encourage you to voice your expectations and demand better service and competitive rates from your financial institutions. Your feedback and active engagement will drive improvement within the industry, ultimately leading to a more prosperous and stable financial future for us all.

Once again, thank you for your unwavering support and dedication to the financial wellbeing of our nation.

With warm regards,

Mary C. Daly

San Francisco Federal Reserve Bank

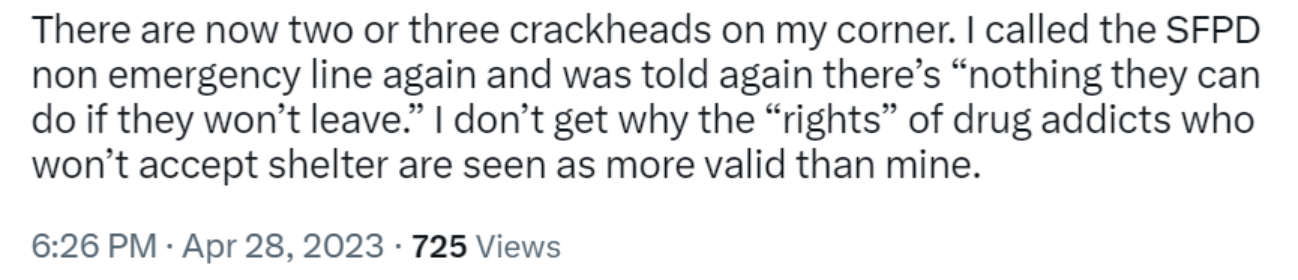

Meanwhile, a tweet from a San Francisco resident:

(I admonished her that the CDC-preferred term is not “crackheads” but rather “Persons who use crack”)

Full post, including comments