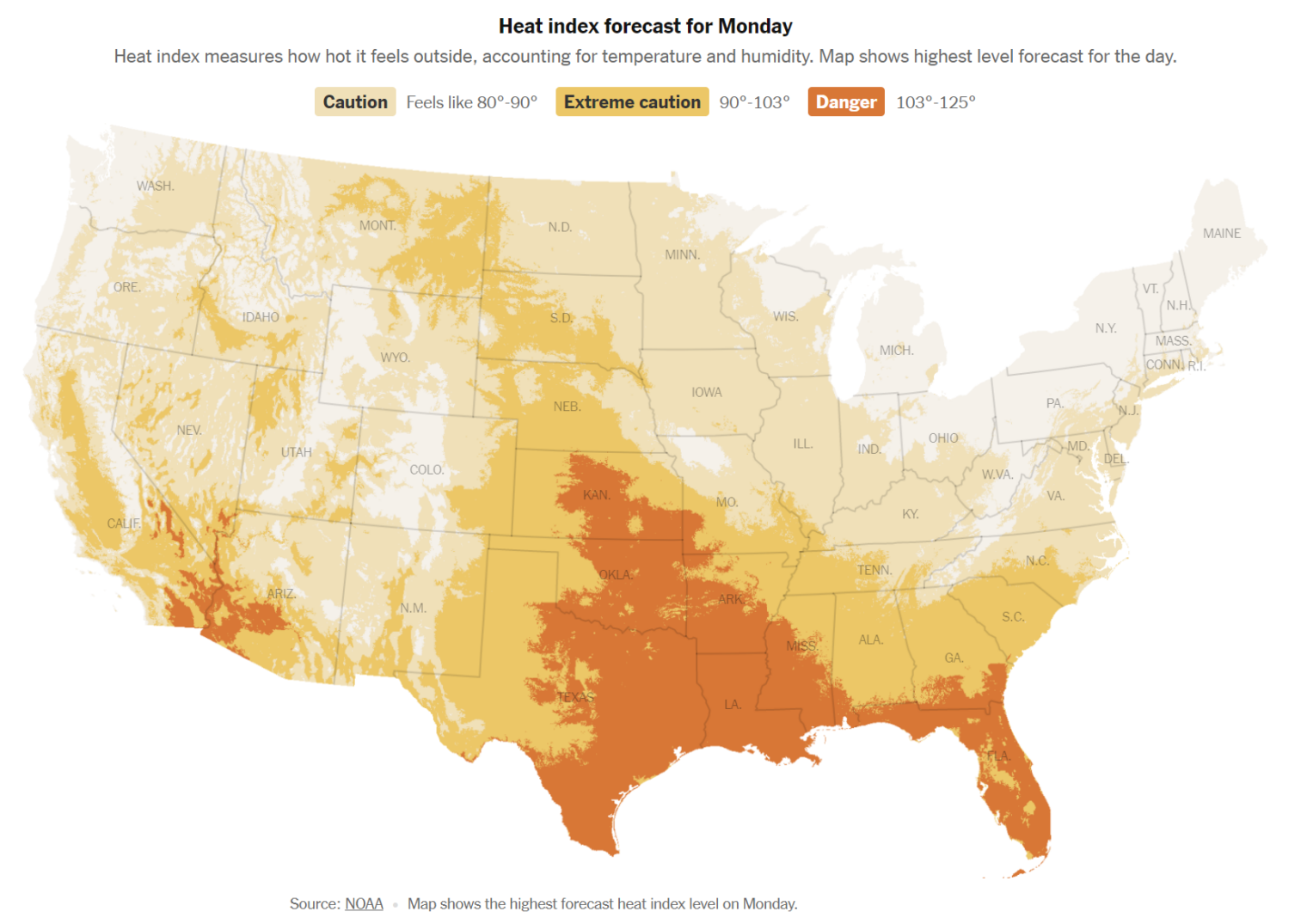

I’ve been trying to reengineer the air conditioning in our house to match the new(ish) reduced cooling load after a hurricane low-E glass window retrofit by the previous owner (see ChatGPT is almost as bad at home maintenance as I am). Before I downsized the system, however, I decided that I had better make sure that the theoretical Manual J calculations of an 8.5-ton demand were correct. The goal was to see what percentage of the time the 12-ton current system (divided into three condensers/air-handlers) was running on hot days (e.g., when the NYT says South Florida is facing EXTREME DANGER).

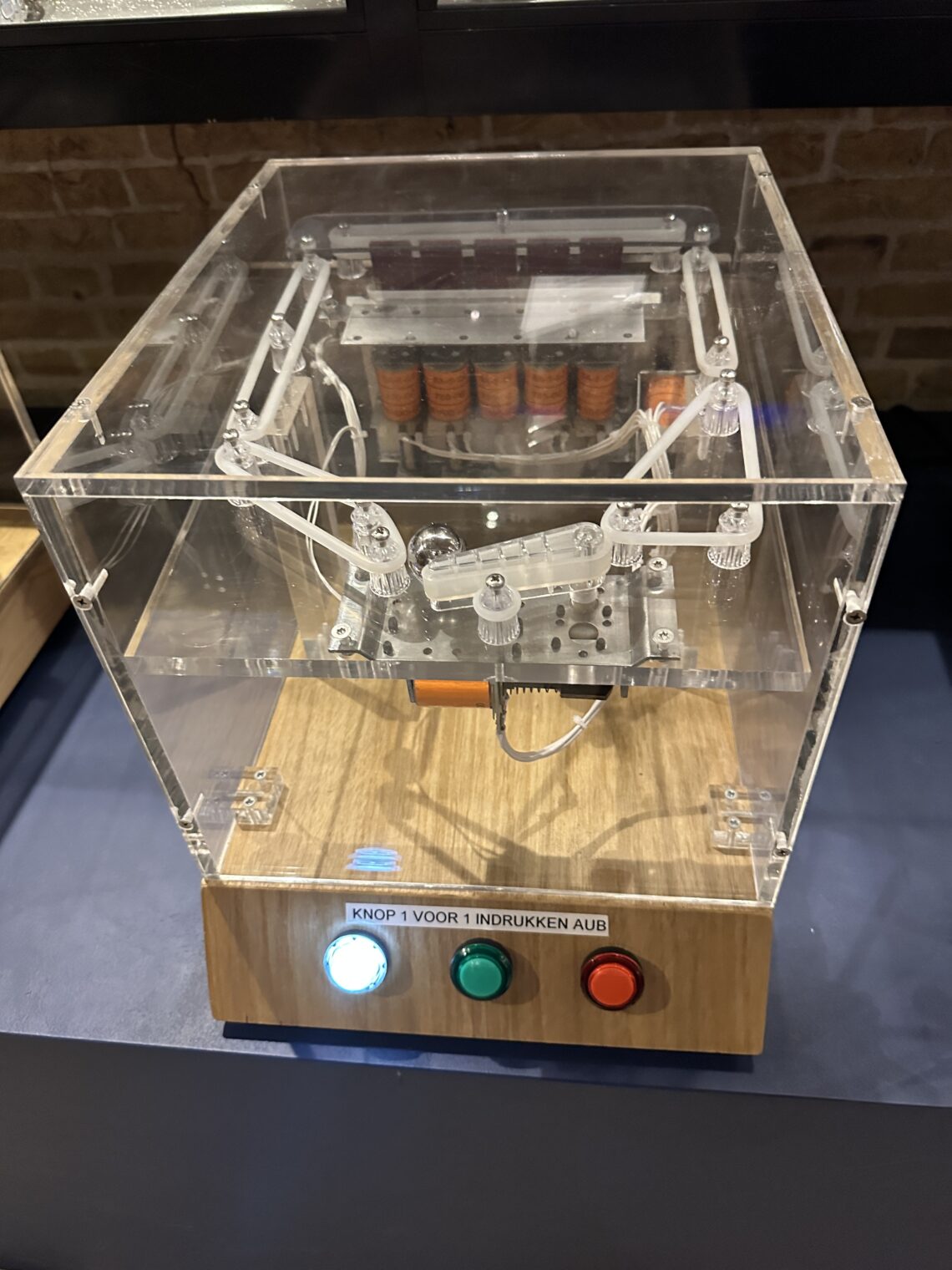

I decided to install an inductive current monitor in the circuit breaker panel that could watch all three air handler breakers, specifically the Emporia Vue 2. This is supposed to be easy to install oneself and I have a Ph.D. in Electrical Engineering… so I decided to hire an electrician to do it properly. It took him less than one hour and he never shut off power to the panel, as the instructions suggest.

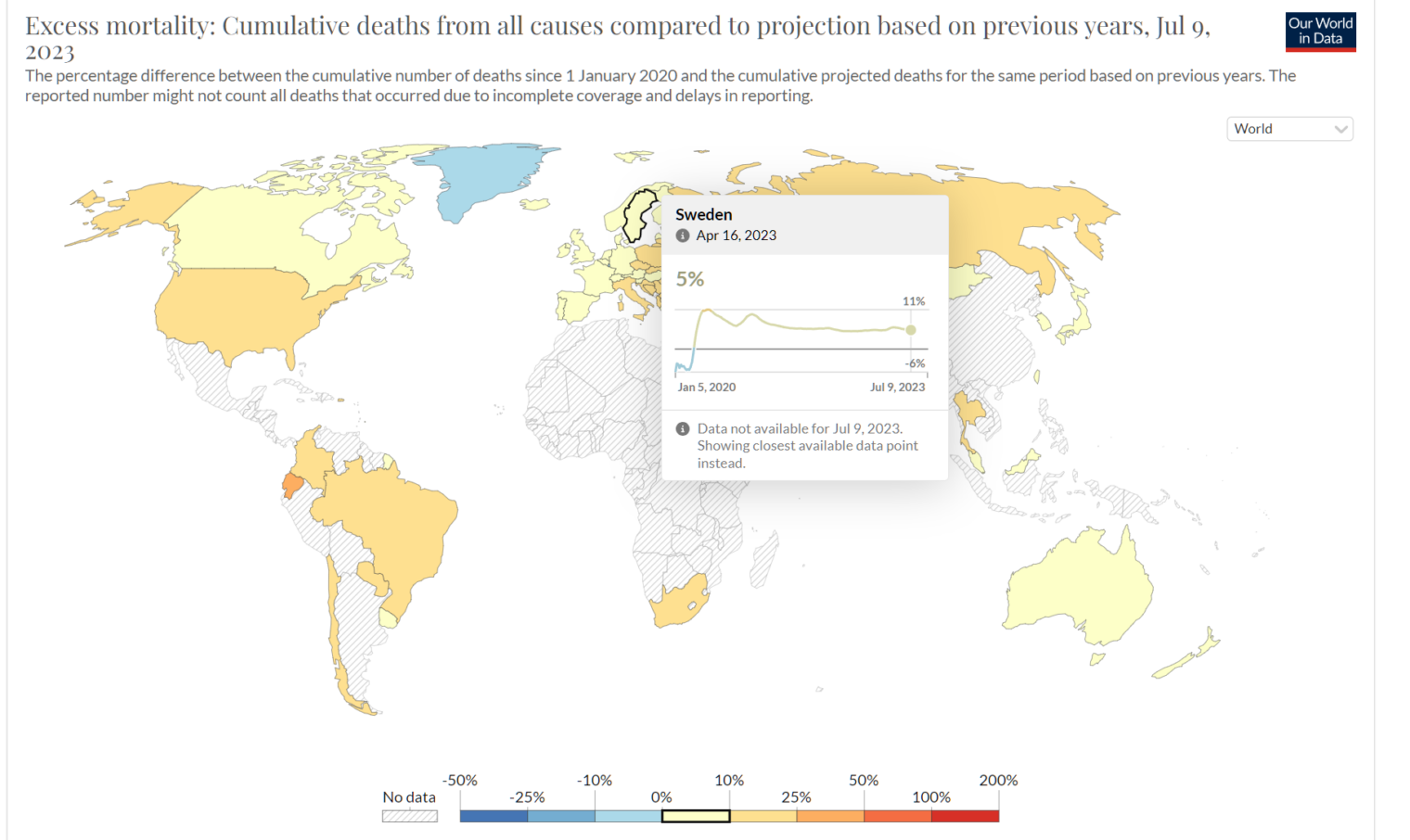

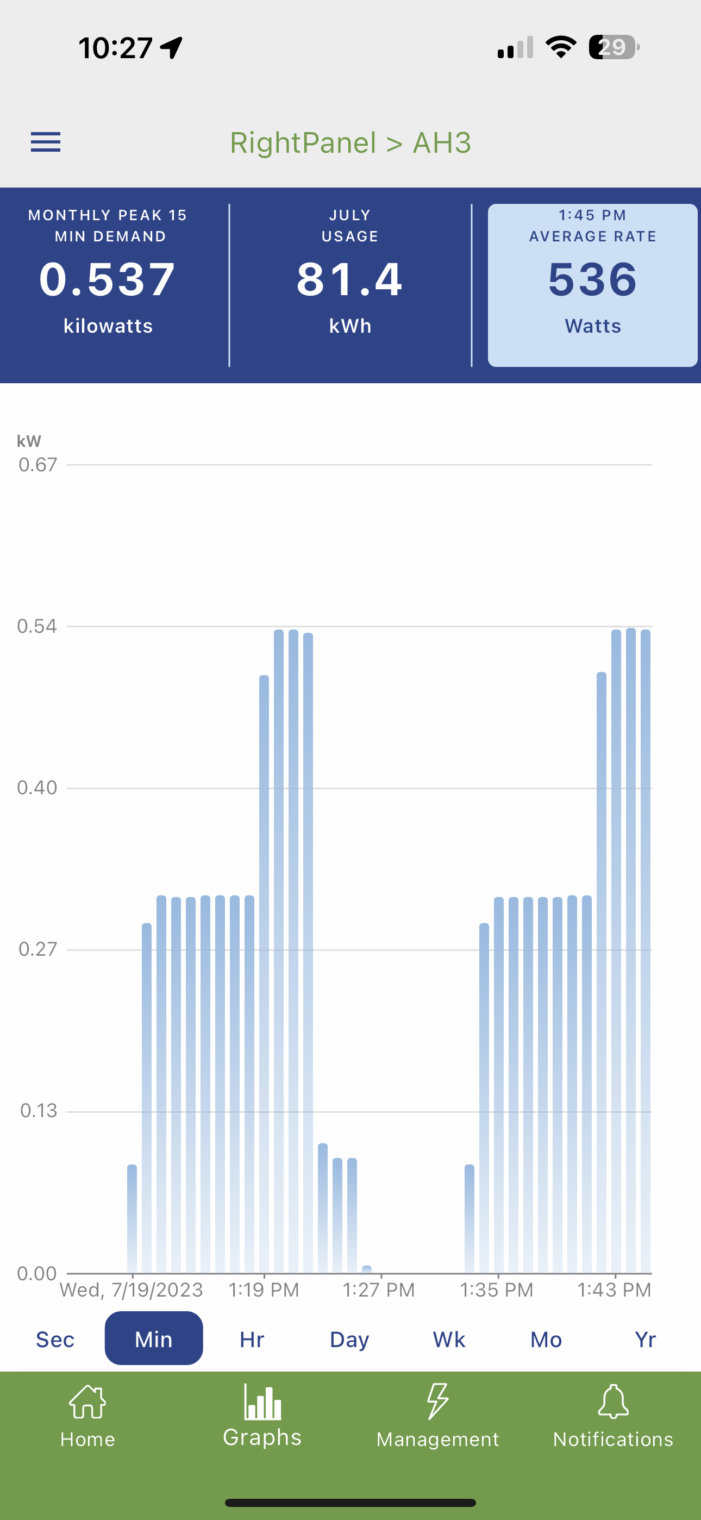

The software is reasonably good, but setup operations take longer to complete than you’d expect. Budget perhaps 30 minutes to get it all connected to WiFi and then to rename the ports. Here’s our Air Handler 3, a 3-ton system, on a day that was 125 degrees (NYT) or 91 degrees (Google/Apple). We can see that the variable-speed air handler (sadly, connected to a one-speed condenser) ramps up to about 500 watts and also that it is running most of the time (the calculated current demand for the upstairs was just 2.3 tons).

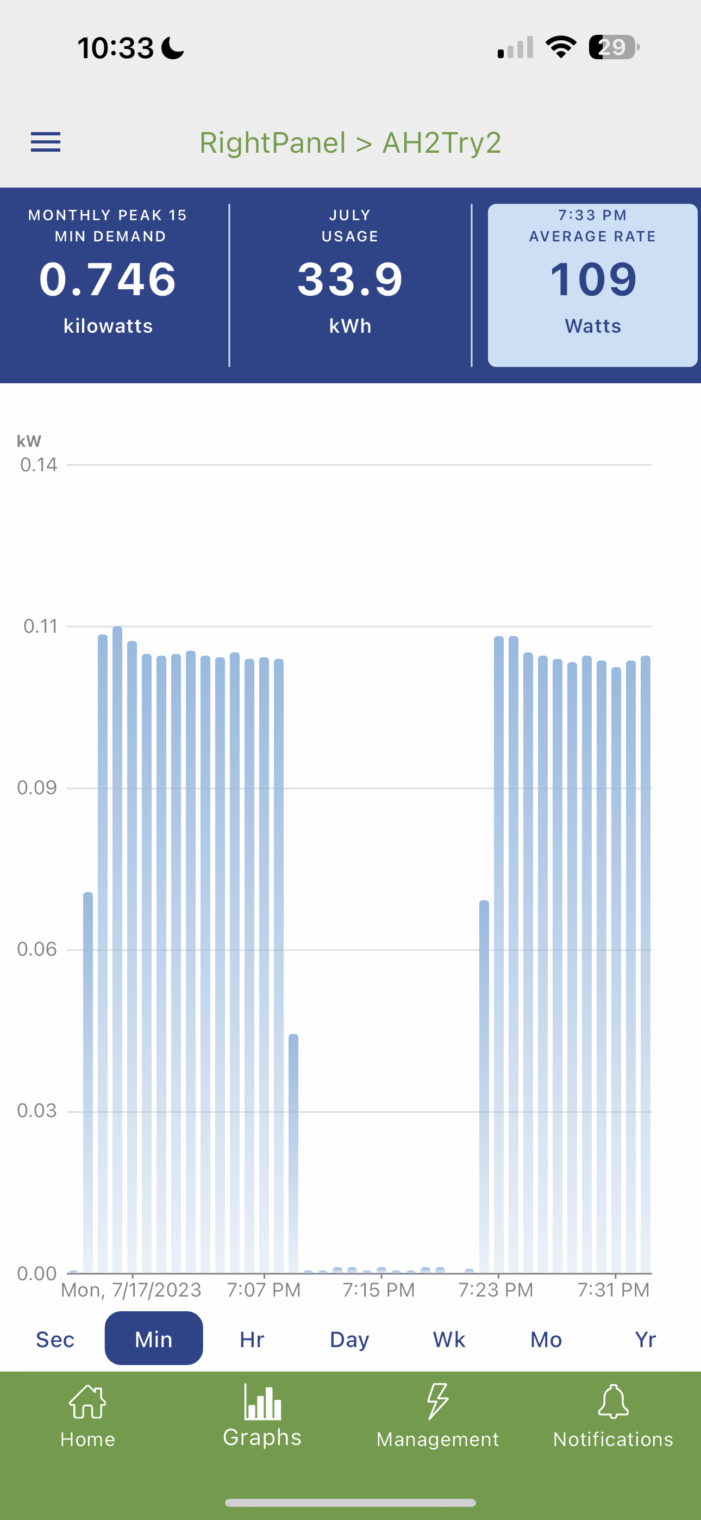

Here’s the a 5-ton air handler:

It’s drawing only 100 watts. Notice that I called it “AH2Try2” because I replaced the probe (myself!) and connected it to a different port because I assumed that the Emporia device was bad.

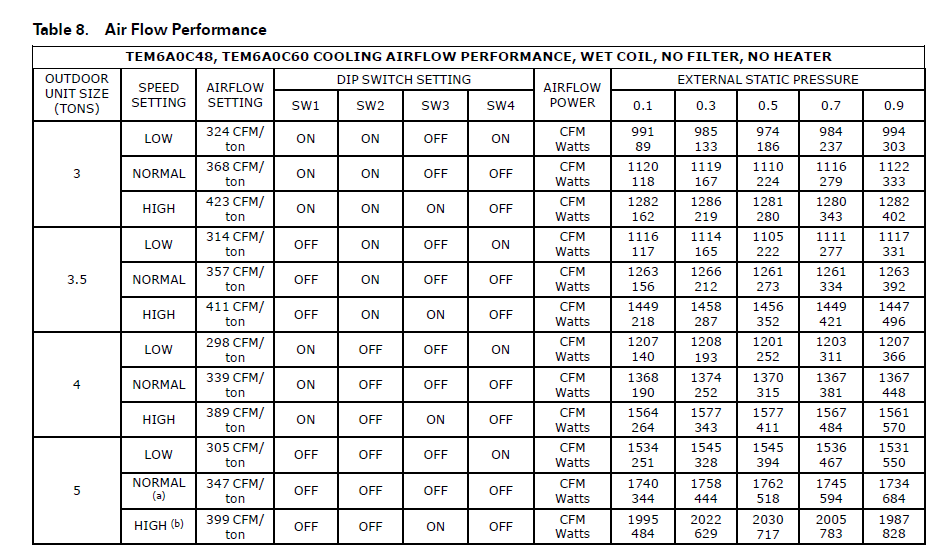

The installation guide for the Trane TEM6 air handler says that it should be drawing at least 500 watts:

I found that the unit was sweating on the outside and, opening it up, mildewing on the inside. The A/C contractor did the following:

- replaced the blower (covered under warranty by Trane)

- took the air handler apart and cleaned it

- pumped out the refrigerant and cut the evaporator coil out and brought it down to the side yard and cleaned it thoroughly

- cleaned out the air handler interior

- replaced the plenum

- replaced a failed UV sterilizer that had been in the old plenum with a REME HALO

With the new fan in place, power consumption went up to over 700 watts and the cabinet stopped sweating.

Given that air handlers are hard-wired, I don’t know of any other way to verify that they’re working properly. The regular A/C service guys don’t measure airflow carefully. And the power monitor is fun to have for investigating random appliance power consumption questions. Our 20-year-old last-legs KitchenAid refrigerator is consuming only 75 watts, for example.

What if you don’t want to spend $250-ish, including an electrician’s time? You can spend $thousands to replace your whole breaker panel and/or all of the breakers with “WiFi breakers”. Span will sell you a panel for $4,500 (plus the breakers?). Can you guess where this new company is located?

Eaton, which has been making panels for about 100 years, sells individual WiFi breakers that can report consumption and also be reset remotely. These seem to cost about $250 each, but if you already have an Eaton panel the installation could be cheap and simple.

Leviton makes a comprehensive system, but it will require replacing your panel(s). The panels themselves from Leviton seem to be cheap (less than $200). Once that’s done, an individual breaker can be as cheap as $54. Our electrician put this system in his own house and likes it.

Speaking of breakers, how long do they last in your experience? Our panels have spent 20 years in a hot/humid garage and the Cutler Hammer breakers inside don’t seem to be happy about it. Especially if a big one trips or is toggled it will tend to require replacement.

Full post, including comments