A Robinson R44 goes home to Boca Raton (from the Panhandle)

Day 4 of a Robinson R44’s life after release from the factory…

Due to low clouds, we didn’t rush to get out of Destin, Florida, a beach town developed with the same attention to aesthetics as Ocean City, Maryland.

I posted the above images to Facebook, which added a reminder from Science (TM):

It’s Monday morning, but there are quite a few planes parked (looking towards the beach and the area for smaller planes):

We saw beautiful fish and rays along the shoreline, as well as Truman Show location Seaside, Florida (a New Urbanism development that is less urban/practical than the MacArthur Foundation-planned development in which we live). It was a one-hour flight to Tallahassee where we were prepared to assist Ron DeSantis with advice, if requested.

The northwest coast of Florida has been mostly left in its natural condition, punctuated by occasional fishing towns or camps:

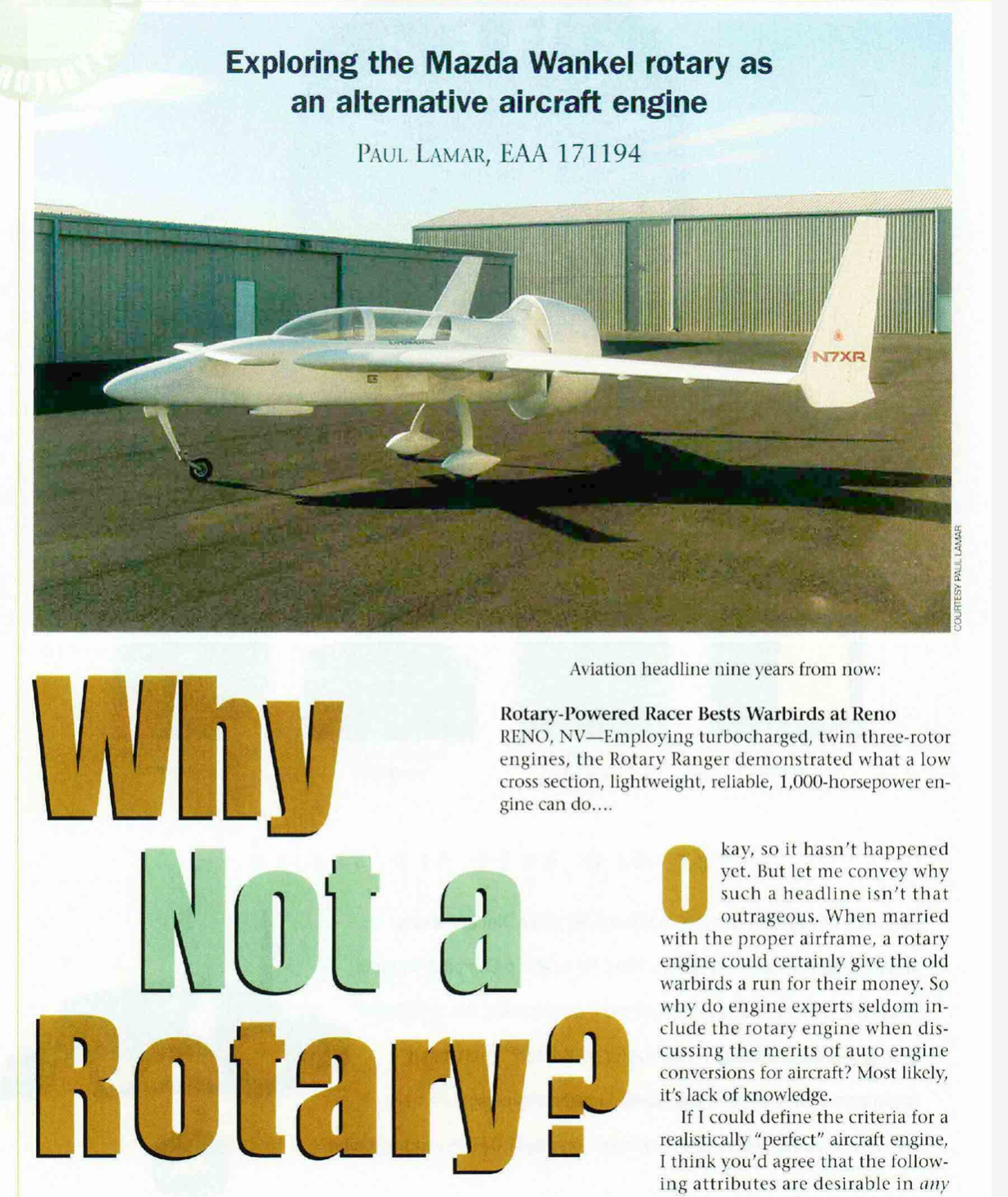

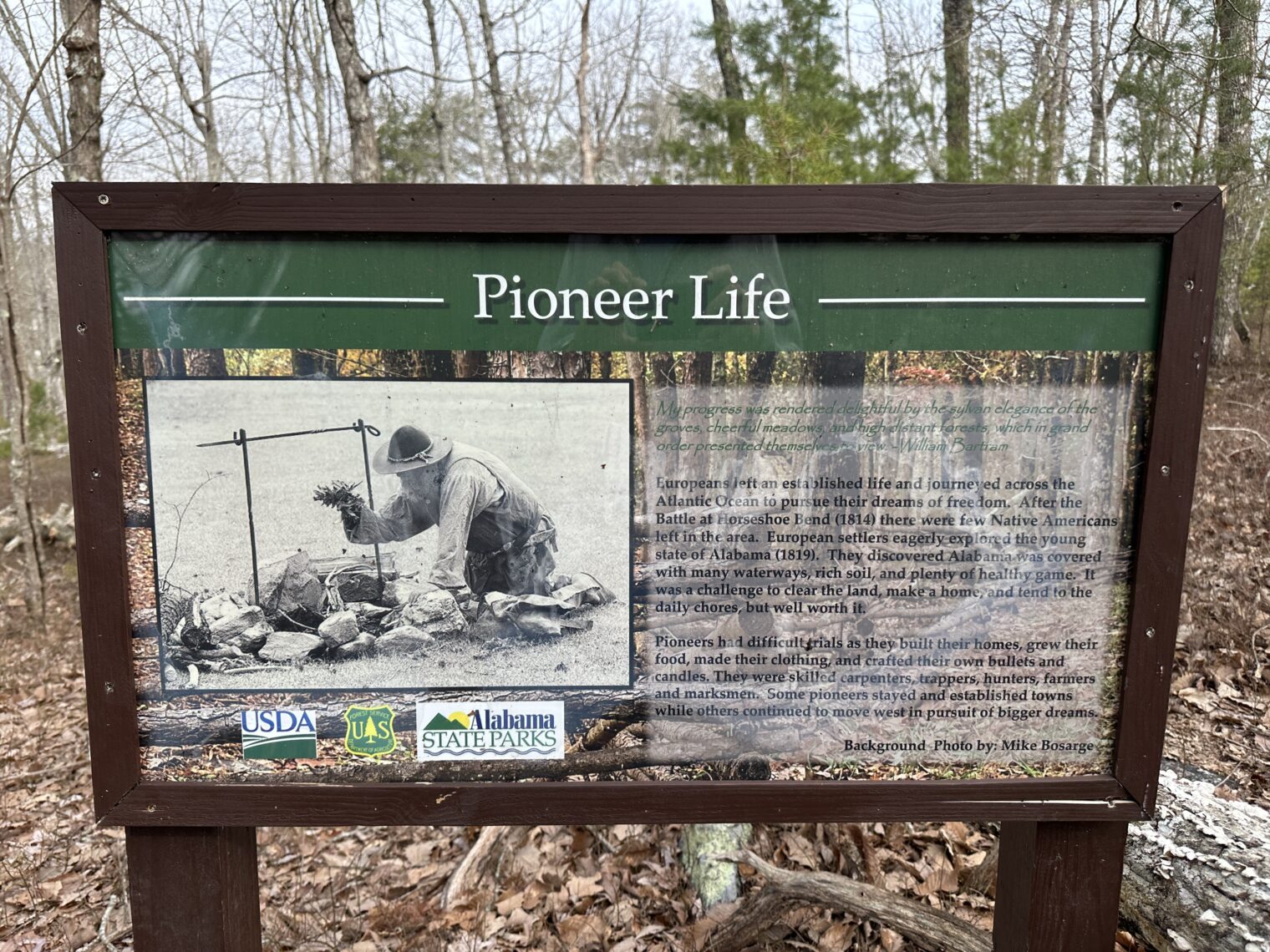

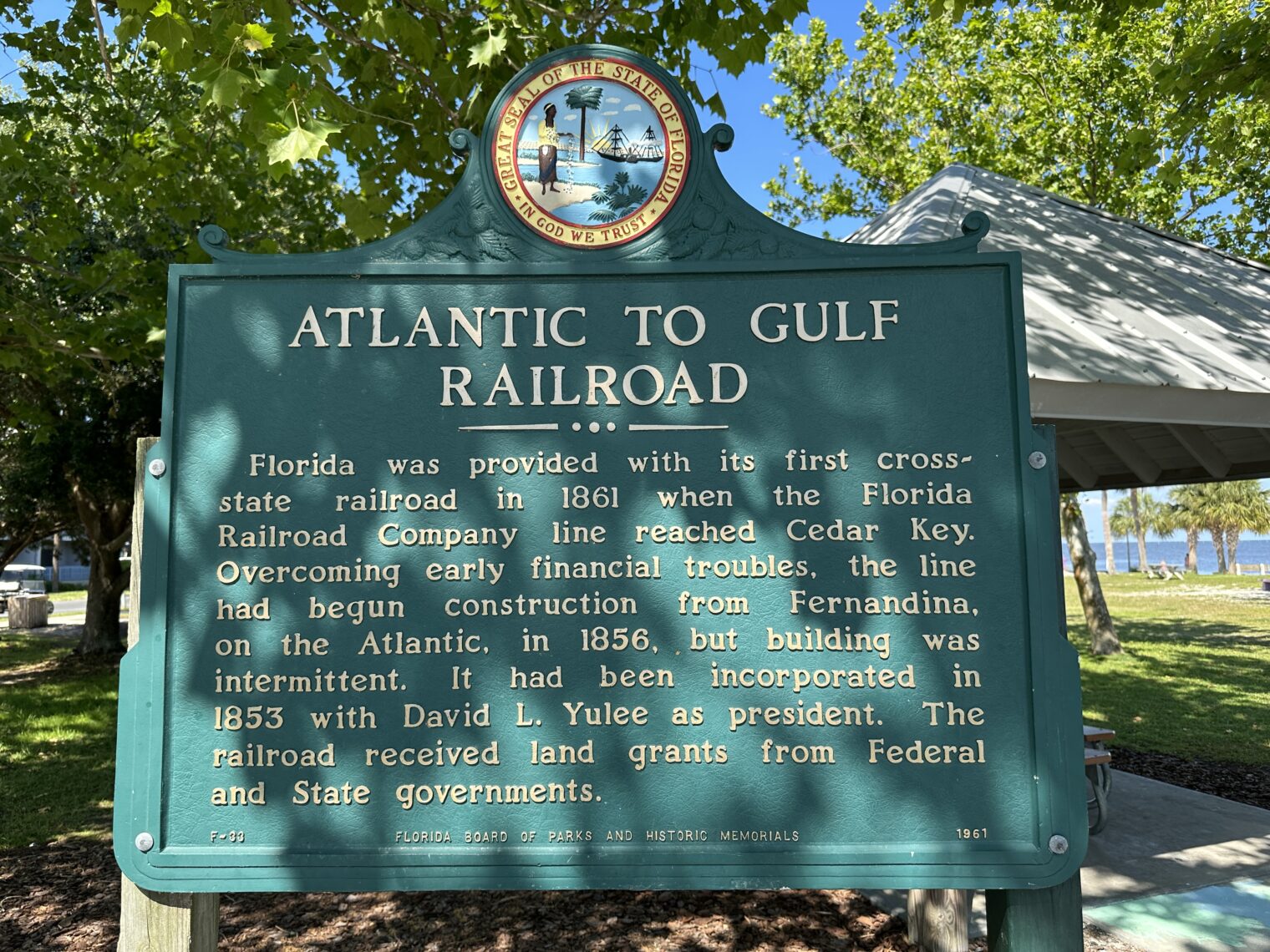

Cedar Key, Florida was once the terminus of a railroad from Florida’s northeast coast, but is now comparatively isolated from the essentials of human life (Walmart, hospitals, Home Depot, etc.). Here we are setting up for a heroic landing on the shortest public runway in Florida, 2300′ (and a displaced threshold!):

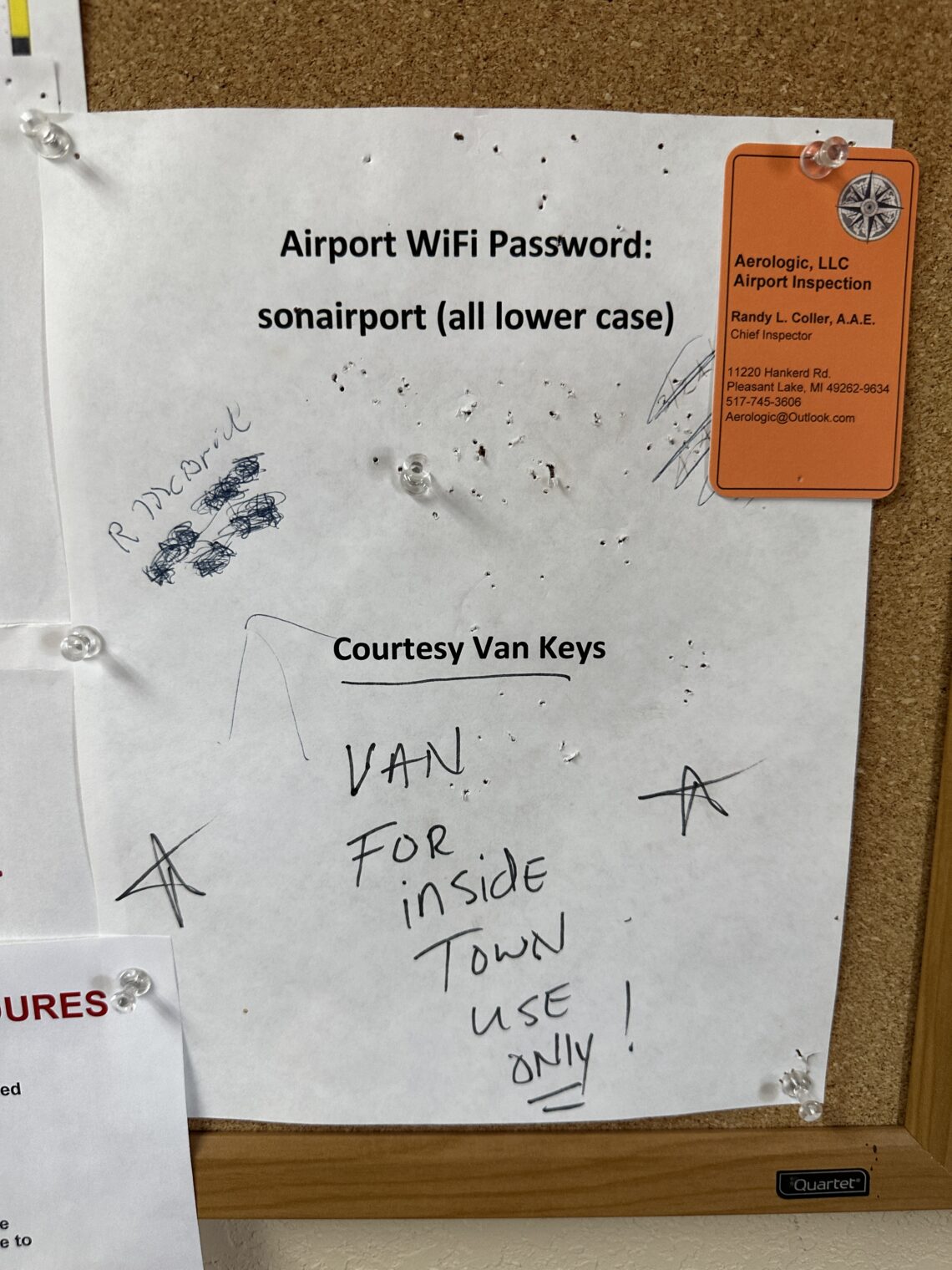

When you land at Cedar Key, you can take a golf cart that’s already at the airport into town and pay the Cedar Key Adventures folks for its use. Or you can call Judy at (352) 949-2127 and she’ll come fetch you in her minivan ($20 into town for two). Steamers is Judy’s favorite restaurant, so we ate local oysters (cooked, but still perhaps not wise to combine with flying?), shrimp, and salad there with a water view:

Whoever wins the Republican nomination for the 2024 Presidential election might not need to campaign here:

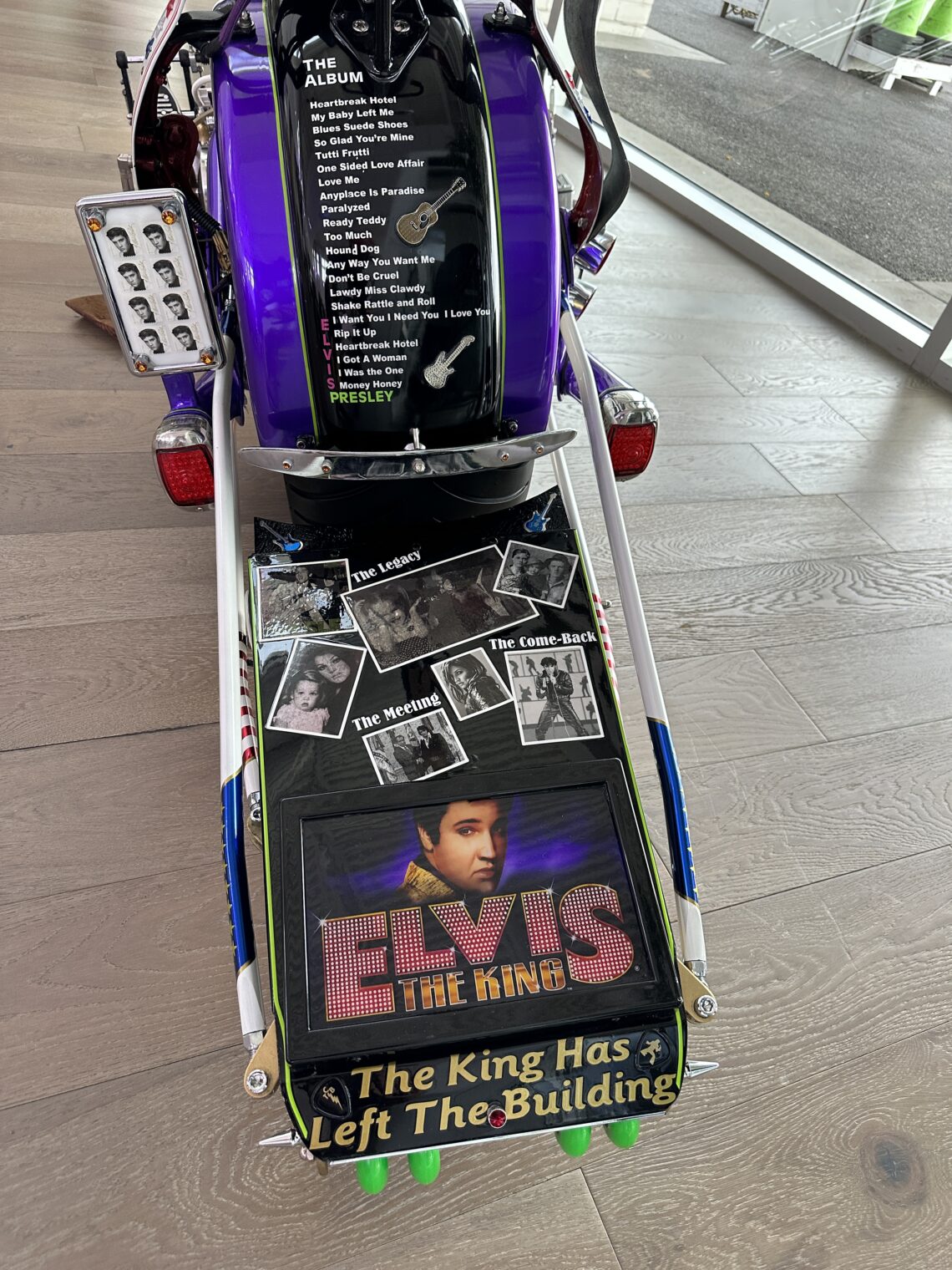

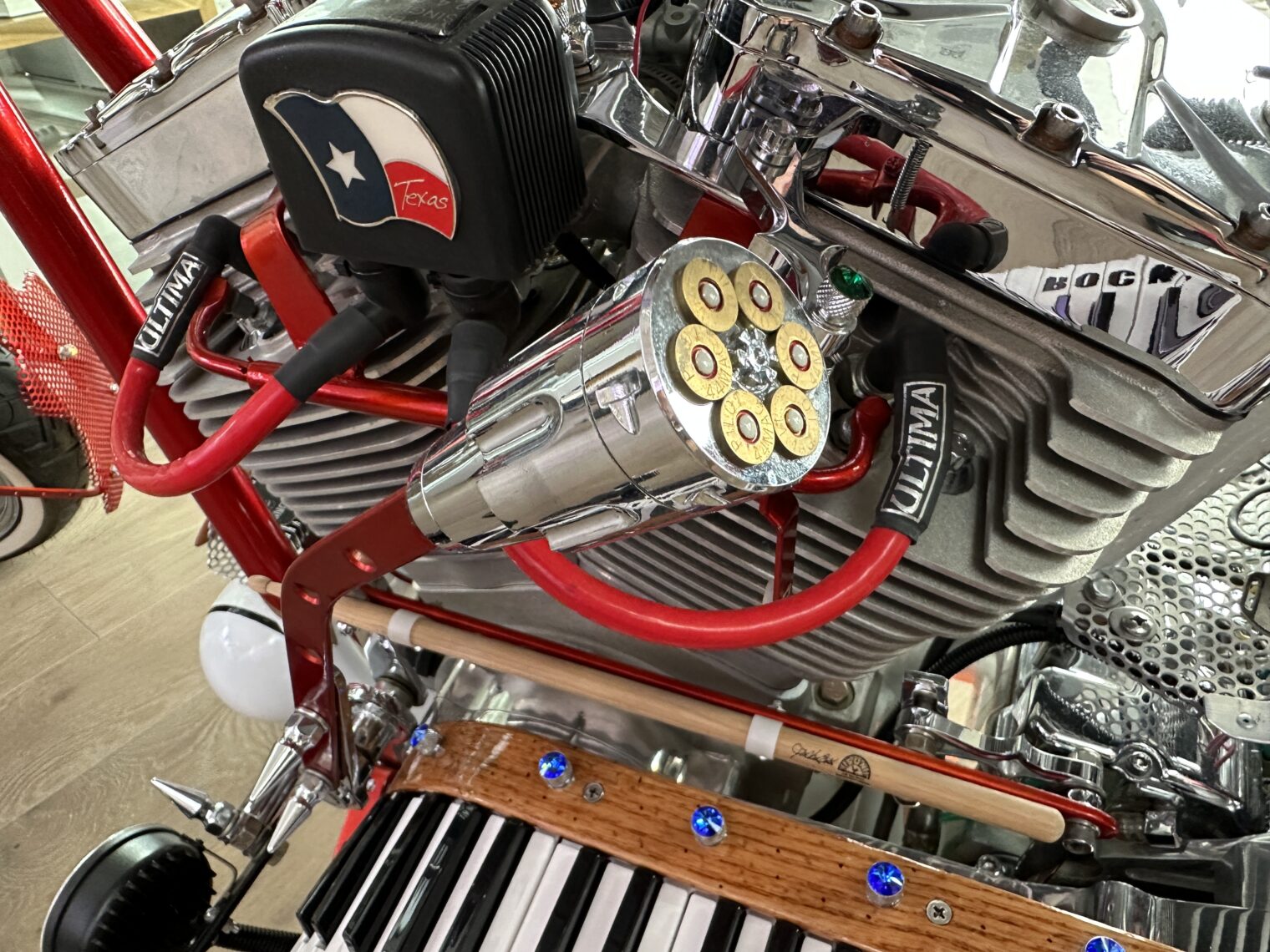

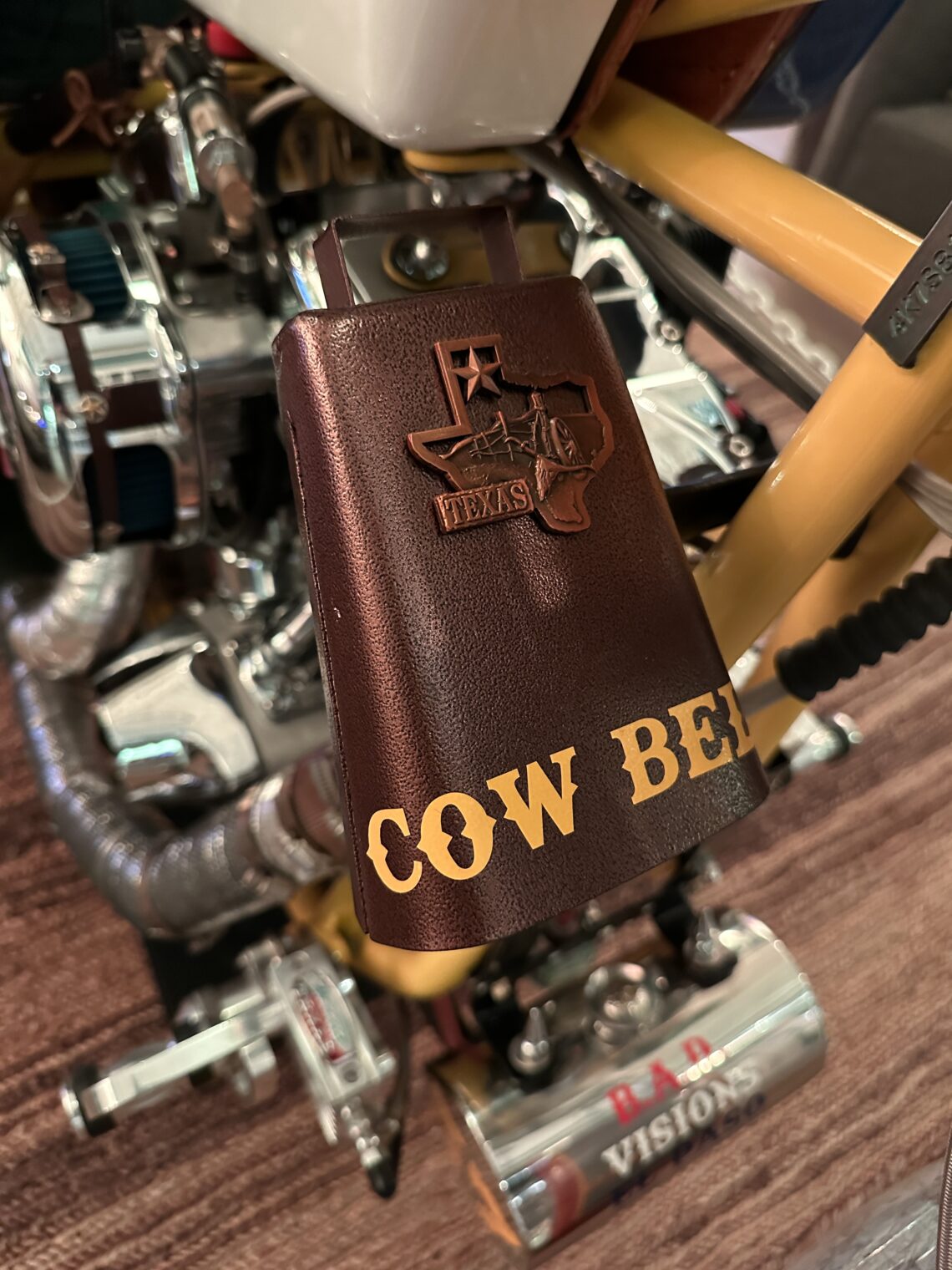

Some photos around town, including extreme golf cart decoration and what is plainly the best fishing enterprise:

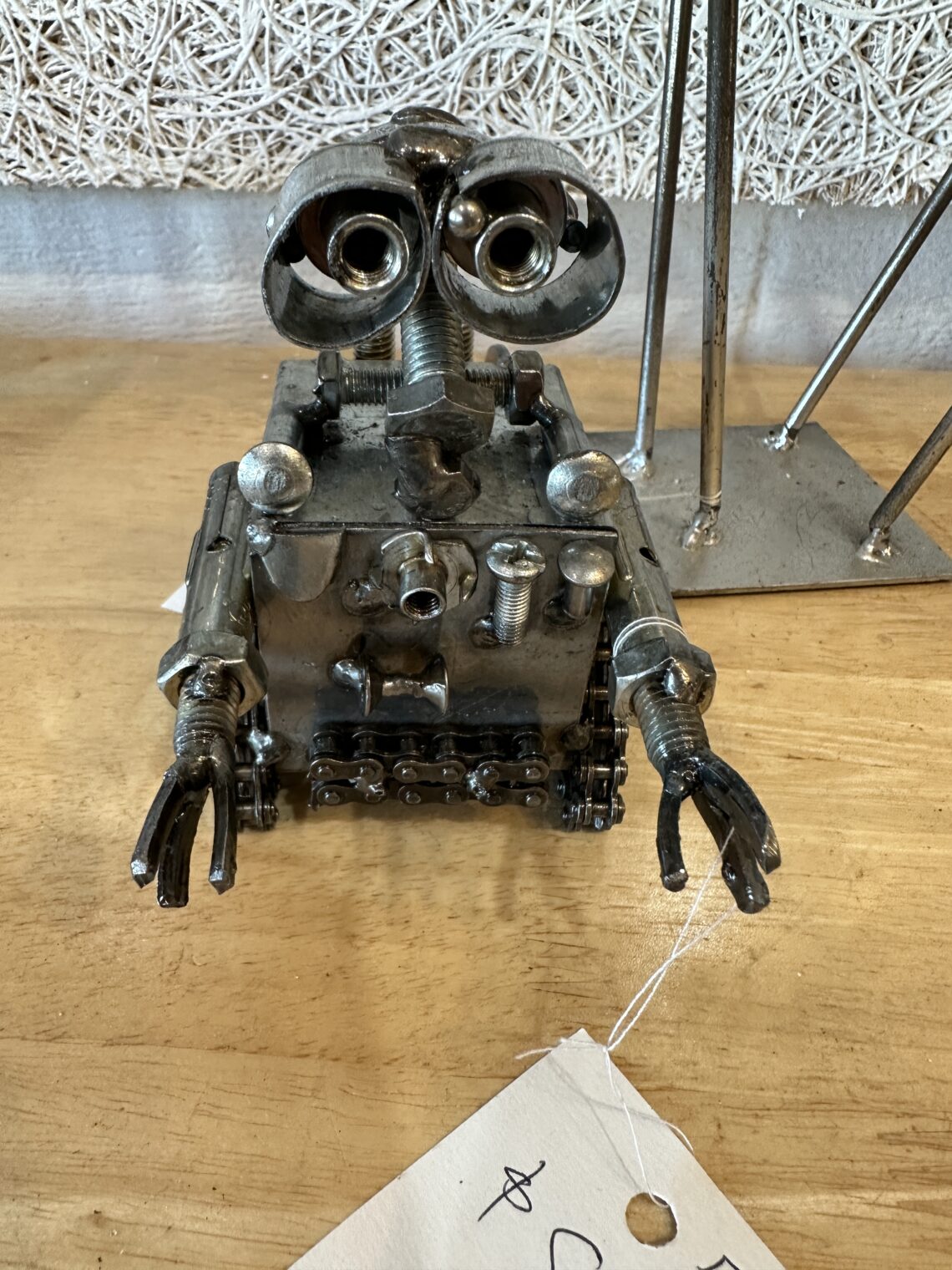

The gallery with the Wall-E sculpture also had some interesting artwork based on underlying nautical charts from Gayle Miller.

Back at the airport, a sign reminds pilots to think before departing in the dark:

A last look at the town…

We stopped for fuel at Lakeland, Florida, which has a great year-old restaurant: Waco Kitchen (from Waco Aircraft). Then it was over Florida’s Massif Central

and around Lake Okeechobee

before landing at Boca Raton.

It was about 33 hours of rotor-spinning time. We suffered from two squawks, unlike the previous flight that ended squawk-free. Robinson has a fancy new “cyclic guard” designed to keep folks in the front left seat from knocking into the central cyclic inadvertently. There is a somewhat complex mechanism to allow this to come down so that the seat can be flipped up to reveal the luggage compartment. The hardware came apart. We also had seepage from the tail rotor transmission sight glass window seal.

Final thoughts: Thank God we had air conditioning!

Full post, including comments