Modelo vs. Bud Light and the Reno Air Races

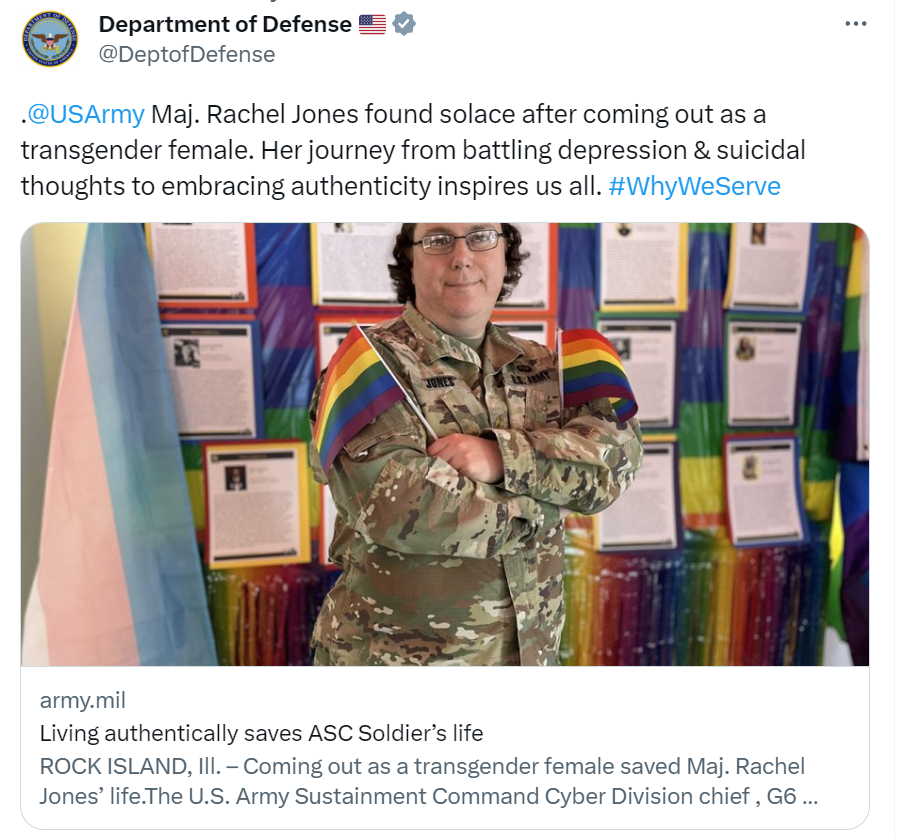

Modelo is America’s #1 selling beer (NBC). Meanwhile, at the other end of the rainbow, “Bud Light sales still down 30% six months after Dylan Mulvaney disaster, drinkers ‘lost forever’: expert” (NY Post).

What is Modelo sponsoring? Check these photos from Oshkosh 2023 of the Lockheed T-33 that they sponsor in airshows:

Note that this can be considered a “trans sponsorship” because the aircraft was assigned “fighter” at birth in 1944, but switched to identifying as “trainer” in 1948. In other words, a trans sponsorship need not hurt a beer brand so long as aerobatics and Jet A are involved.

Tranheuser-Busch was a significant sponsor of airshow performers decades ago. They famously had a BD-5J, just like James Bond (before James Bond spent most of his time in gay bars). Back issues of aviation magazines also show more conventional piston aerobatic planes whose sole sponsor was Bud Light.

Could Bud Light be revived with sponsorship? Let’s consider the example of Saudi Arabia, whose laws and values are not necessarily shared by everyone worldwide. Nonetheless, everyone cheers the soccer and golf teams and events that they sponsor.

If Bud Light wants to reclaim market share, should Tranheuser-Busch bring its checkbook to airshows? Due to residential encroachment driven by population growth (one of the many benefits of expanding our population to 450+ million via low-skill immigration?), the Reno Air Races (which start today) need a new home, which was challenging to find. Consider a typical American who welcomed lockdowns, school closures, forced masking of 2-year-olds, and coerced vaccination. He/she/ze/they meekly cowered in place for a year or two and now you expect him/her/zir/them to accept the risk of a 75-year-old P-51 flying nearby at 550 mph? Air racing requires infrastructure in the middle of nowhere and, in direct contradiction, proximity to a major population center with commercial airline service.

For 2024 at least, the plan is to race just outside of Las Vegas in Pahrump. This will cost a lot of money to set up and Tranheuser-Busch could supply it in exchange for the races being renamed the “Bud Light Not Trans At All Air Races”. Since the CEO won’t abandon his/her/zir/their passion for promoting Rainbow Flagism, one stipulation could be that all competitors be painted in the following scheme:

Rainbow yet not Rainbow?

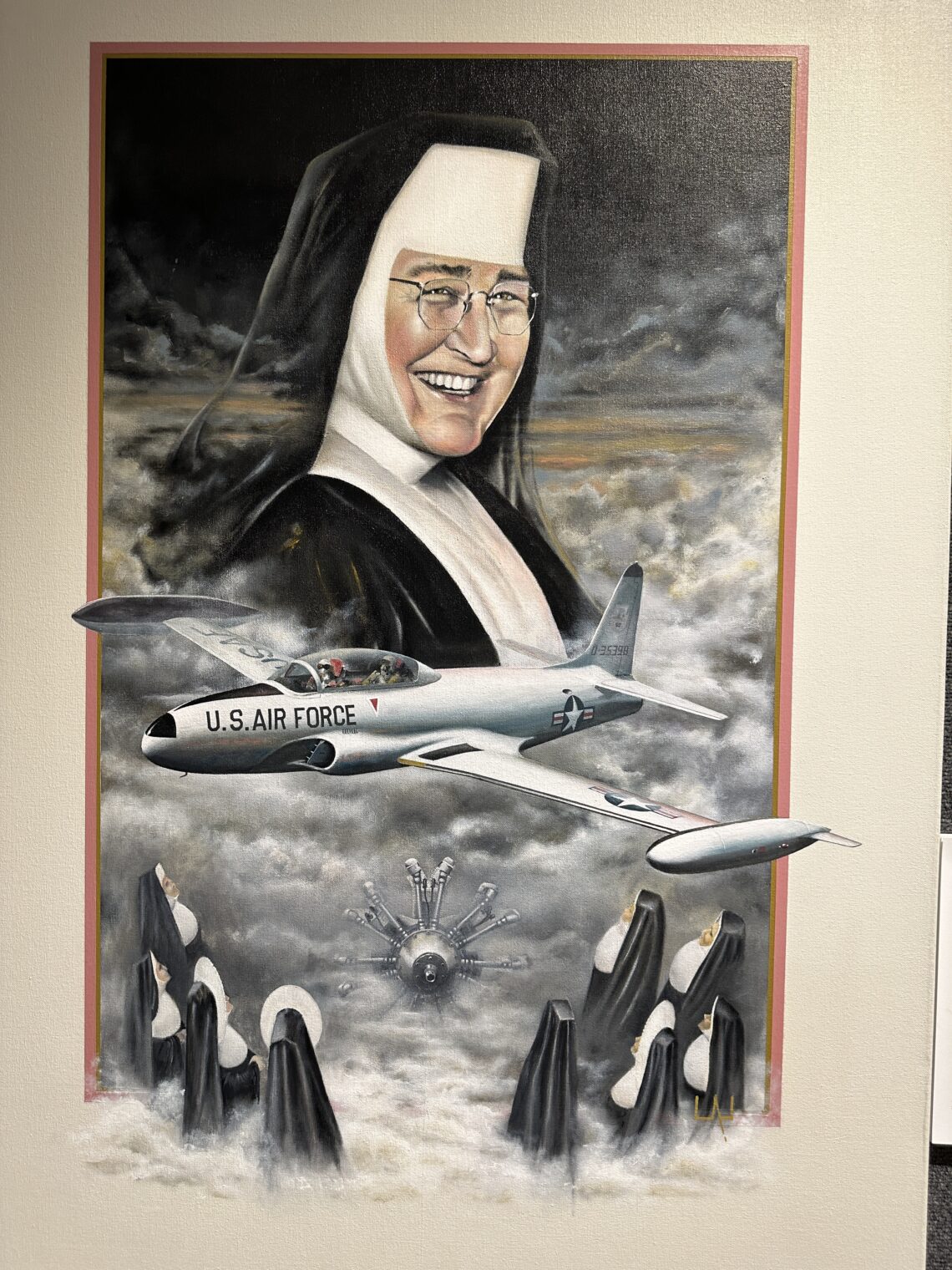

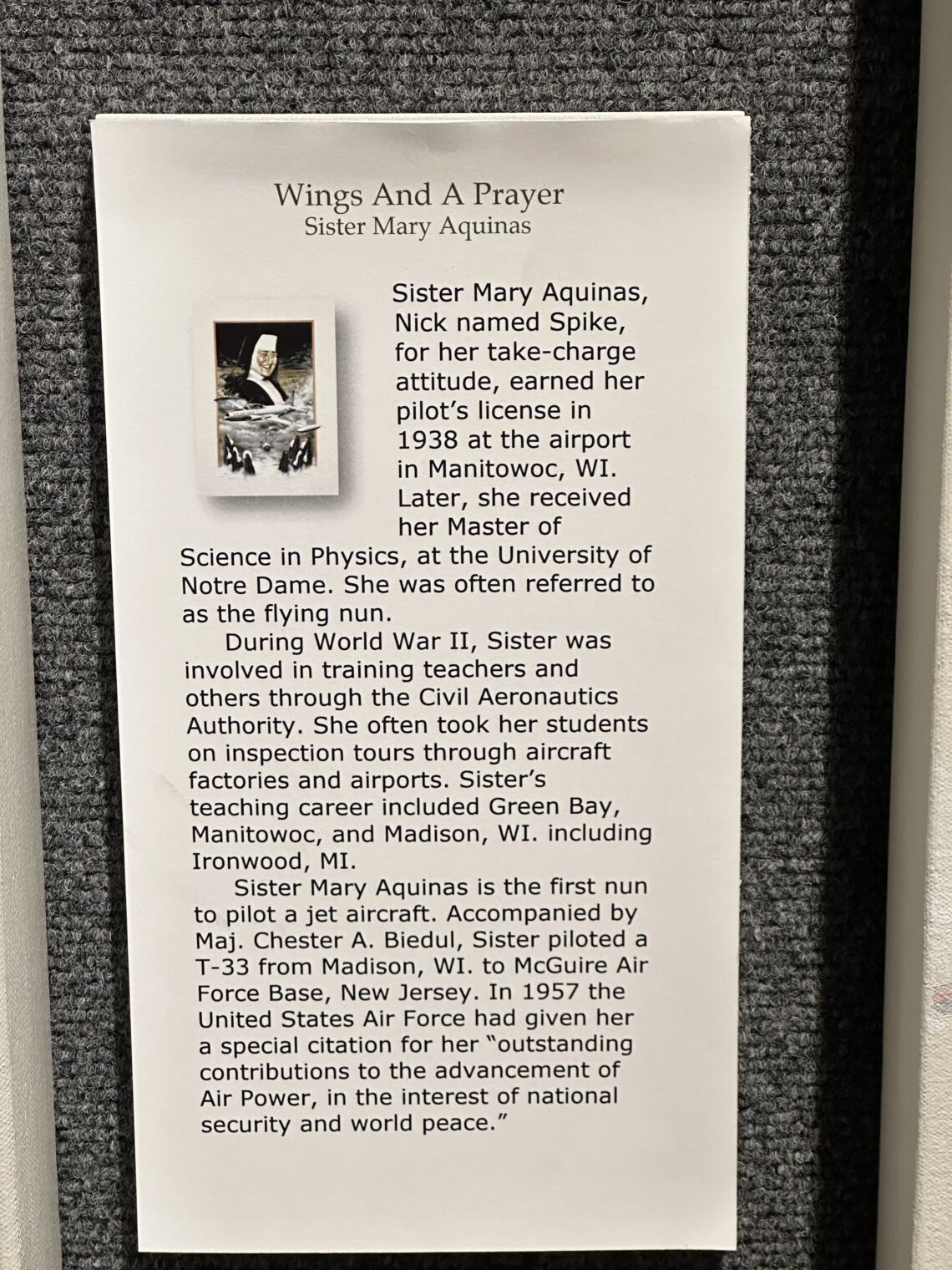

Speaking of the T-33, here are a couple of photos from the EAA Museum commemorating a nun-piloted flight from Wisconsin to New Jersey:

Related:

Full post, including comments