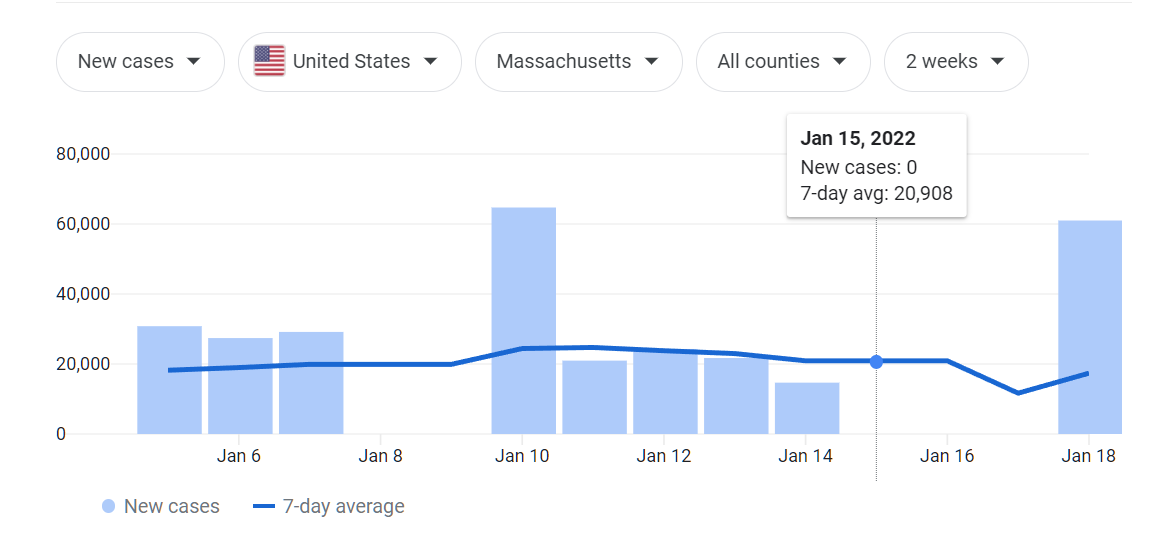

With deaths from COVID-19 only about as bad as in January 2021 (when few were vaccinated), in both the U.S. as a whole and Maskachusetts alone, declarations of “Mission Accomplished” are becoming common, with associated rollbacks of orders to check vaccine papers and orders for the subjects to wear masks.

How do people who have clung to their cloth masks as security blankets react during the Twilight of the Coronagods?

“Massachusetts Mask and Vax Mandates: A (Temporarily Accurate) Guide” (Boston Magazine, 2/16/2022):

Whether you’re required to wear a face mask depends on where you are. When you see it on a map, it’s striking just how much variety there is when it comes to policies town-by-town and city-by-city. Boston still requires them for all public indoor spaces, as do neighbors Cambridge, Somerville, Newton, and Brookline. Some places, like Medford, Malden, and Melrose, require masks only in municipal buildings.

As you certainly know by now, Boston opted to make vaccine checks mandatory at indoor venues like restaurants and gyms in January. Brookline did the same thing. (Interestingly, Brookline’s vax mandate applies to restaurants’ outdoor patios, while Boston’s does not). Other cities and towns considered following in Boston’s footsteps—among them Arlington, Cambridge, and Somerville—but didn’t, although lots and lots of business owners have enacted their own vaccine rules.

Meanwhile, Boston is nearing the next stage of its vaccine mandate policy—per the city’s B Together plan, kids 12 and older will need to be fully vaccinated to enter those places, too, beginning February 15. Kids ages 5-11 will need to have at least one dose by March 1, and two doses by May 1.

Even though lots of states have been dropping their school mask mandates, the CDC thinks it’s too soon to take that step, and is sticking with its guidance that kids stay masked in schools.

From the linked-to article:

“As small business operators we have a civic duty to take care of the health and safety of our guests and employees alike,” Tracy Chang told Eater in July 2021. Chang is the chef and owner of Pagu in Cambridge’s Central Square. “The past year has taught us just how vulnerable are the lives of essential hospitality workers, just how broken the existing hospitality industry is when it comes to wages, benefits, and welfare,” Chang continued. “We now have an opportunity to rebuild the industry to be a better, stronger one, starting one restaurant at a time. The least we can do is pay people more, check for proof of full vaccination, take temperatures at the door, and require masks indoors when not eating/drinking.” [later in the article it notes that Mx. Chang also requires government-issued photo ID, which is definitely not a racist policy]

If he/she/ze/they really wants to #StopTheSpread, why not close his/her/zir/their restaurant permanently? People eating at home won’t generate as many infections or breed as many mutations as people eating in restaurants.

Club Passim (47 Palmer St., Cambridge): All staff, performers, and customers are required to show proof of vaccination (the card or the photo) upon entering the club; ticket purchases will be refunded for those who cannot or will not show proof. Non-performers must wear masks indoors unless actively eating or drinking. Passim continues to offer livestream performances and online classes.

Again, if you’re concerned about COVID-19, why assemble COVID-19-spreading people to hear music when everyone has the capability of streaming audio and video at home?

How about those schools? February 17 email from a suburban district is presumably typical:

The Lincoln Board of Health met on Wednesday evening, February 16th to discuss the February 28, 2022 expiration of the Department of Elementary and Secondary Education school mask mandate. While they agreed that our positive case numbers have dropped to low levels, concerns were raised about the possibility of an increase in cases after the February vacation week. They would like to see that our low number of cases are sustained over the next few weeks. In addition, Board of Health member Dr. Kanner shared that state level data is still at rates higher than it was in August when the BOH instituted the Town and school mask mandate.

The Board of Health voted to hold off on a decision until March 9, 2022 when they will reconvene to review the COVID data for the schools, Town and state and consider rescinding the town mask mandate.

The School Committee met this morning and received an update on the outcomes of the Lincoln Board of Health meeting. The Committee voted to re-visit the decision regarding maintaining the mask mandate or moving to less masking in the schools at it’s upcoming School Committee meeting on March 10th.

From “Brookline Indoor Mask Mandate and Vaccination Requirement at Businesses to Remain in Effect Until Further Notice”:

Interim Health Commissioner Patrick Maloney announces that the Town of Brookline’s mask mandate and proof of vaccination requirement continues to remain in effect though the need for these requirements will be reassessed next month. [i.e., in March 2022]

Proof of vaccination will continue to be required for patrons at all: … [restaurants, gyms, theaters, museums, etc.]

Additionally, masks continue to be required in all public indoor spaces in Brookline.

(Most of the above is actually illegal in Florida, of course, which refuses to follow Science. The legislature, for example, passed a law that forbids public schools to order children to wear masks.)

Full post, including comments