Indoor, Outdoor, and Bearded Maskers in the Boston Area

Photos from August 21, 2023, Allston, Massachusetts (adjacent to Boston University):

My favorite, of course, is the surgical mask over full beard as a means of blocking out an aerosol virus. However, the most confusing are the outdoor maskers. The risk of being in a crowded city is so high that they need a mask when outdoors… yet they won’t move away from the crowded city. I guess the masked supermarket shoppers are also tough to explain. Why don’t they stay safe at home and let the Latinx essential delivery workers incur the risk of gathering groceries? (See The social justice of coronashutdowns)

I visited a friend in Brookline who warned his elderly mother to stay away from me because I was insufficiently cautious about the possibility of a SARS-CoV-2 infection (I had arrived from an oceanfront estate in Maine with about 3,000 square feet of space per person). A few minutes later, he decided that it would be too onerous to cook pasta at home, safe from COVID-19, on the high-end induction cooktop. So we then all went out to a cramped neighborhood Italian restaurant in which the elderly mom was within breathing distance of about 30 local humans (presumably not Covid heretics, however).

Both the mom, a Manhattan resident, and the grandkids spontaneously offered the opinion that Florida schools were terrible, partly due to the fact that reading was banned in Florida. Said grandkids had been removed from the Brookline, Maskachusetts public schools (one of the highest-rated districts in the state) due to being bored and the school system not having any gifted program. So they were paying private school tuition ($55,000+/year per student) on top of state income tax (banned by the FL constitution), state estate tax (also banned by the FL constitution, unless it can be credited toward federal), and property tax at a similar rate to what a typical FL county charges. I pointed out that Florida state law required every public school district to offer gifted education beginning in 2nd grade and that, if necessary, there was also the Big Hammer in which Florida high school kids can take online or in-person courses for free at any state-run college or university (and taxpayers have to buy them the textbooks as well!). Finally, the larger counties run magnet schools for those who are artistically or academically inclined (one of Miami’s is the #4-ranked public high school in the U.S.).

Related:

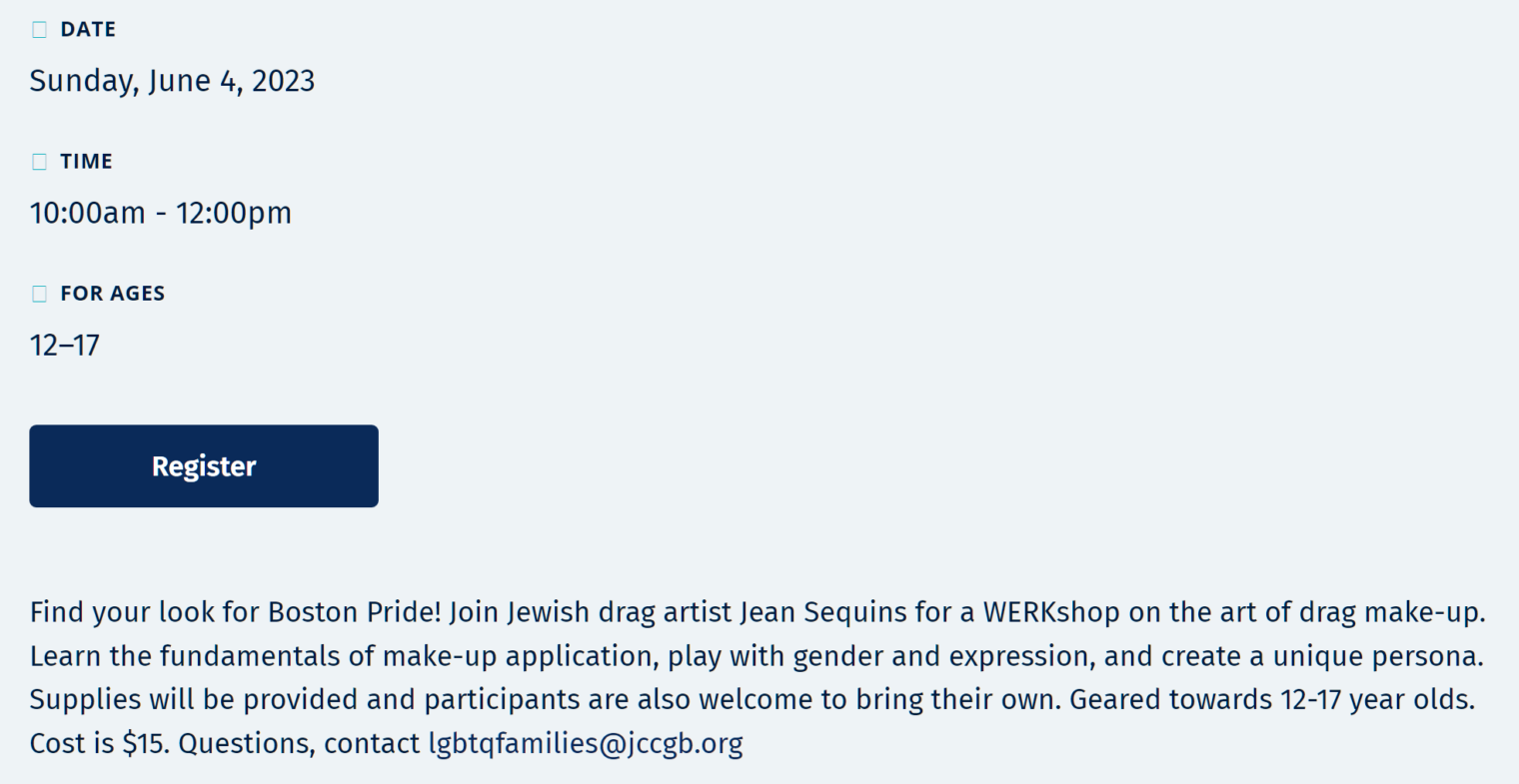

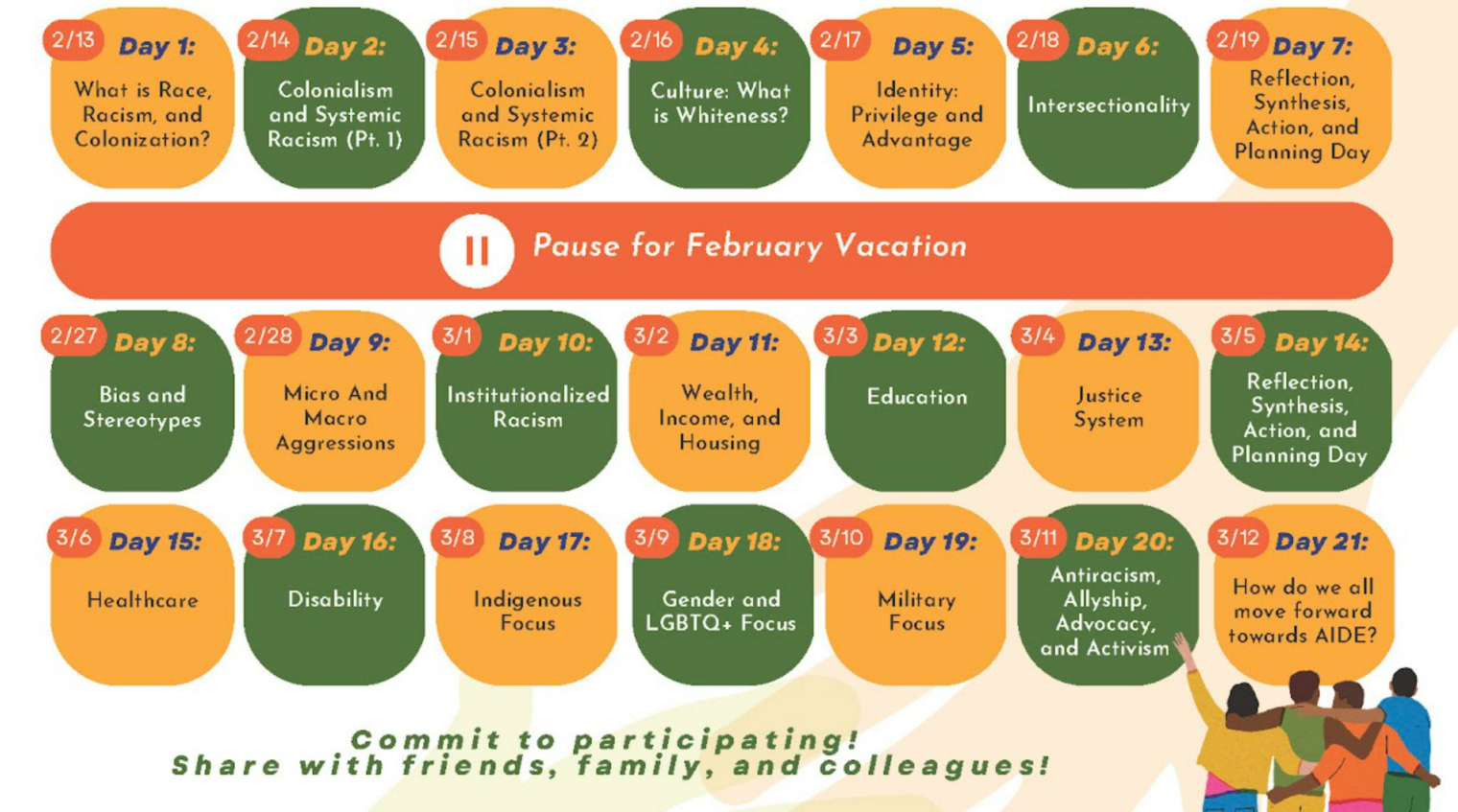

- Brookline’s Office of Diversity, Inclusion and Community Relations (what they spend tax dollars on instead of gifted education)

- the high school’s quest to hire teachers with a different skin color from what currently prevails

- the white privilege curriculum at Brookline High School (2018 edition)

- “It may be time to break out the masks against Covid, some experts say” (CNN, August 23, 2023)