Why can’t supervisors and replacement workers unload container ships during the longshoremen’s strike?

When the typical business is hit by a strike it is able to continue operating at a reduced capacity via the use of supervisors and/or replacement workers (airlines are an exception due to FAA regulations; see “Unions and Airlines”). Why are Atlantic and Gulf Coast U.S. ports completely shut down by the International Longshoremen’s Association strike for a 77 percent wage increase to compensate them for the inflation that the Biden-Harris administration says does not exist (CBS; 77 percent is pretty close to the rise in the cost of buying a house during the Biden-Harris years, considering the increase in price and the increase in mortgage rates).

The port operators have offered a 50 percent wage increase to compensate workers for non-existent inflation and the strike relates to the 77 v. 50 number.

Today’s question is why ports are shut down. Managers aren’t part of a union. Why can’t the management/supervisory staff at the ports operate the cranes and unload container ships at a reduced rate compared to if a full staff were available? Continued operations at a reduced capacity is what happened after Ronald Reagan fired America’s striking unionized air traffic controllers (state-sponsored NPR).

Historically, American employers had the right to hire permanent replacement workers for striking union workers, though the Biden-Harris administration is trying to eliminate that right (source (2023)):

The law of the land for the last 60 years has permitted employers to permanently replace employees engaged in an economic strike, providing employers with the right to hire workers to continue business operations in response to a union’s use of its most potent economic weapon. In its decision in Hot Shoppes, Inc., 146 NLRB 802 (1964),the Board held that employers may lawfully hire permanent replacements and that this action is not inherently destructive of the right to strike under the National Labor Relations Act (“Act”), making the employer’s motive for hiring the replacements immaterial. Accordingly, an employer does not need to prove it had a business necessity when hiring permanent replacements or that the employer’s ability to continue operations during a strike required the hiring of the replacements. Rather, the GC has the burden of proving the employer violated the Act by permanently replacing strikers because of an “independent unlawful purpose.”

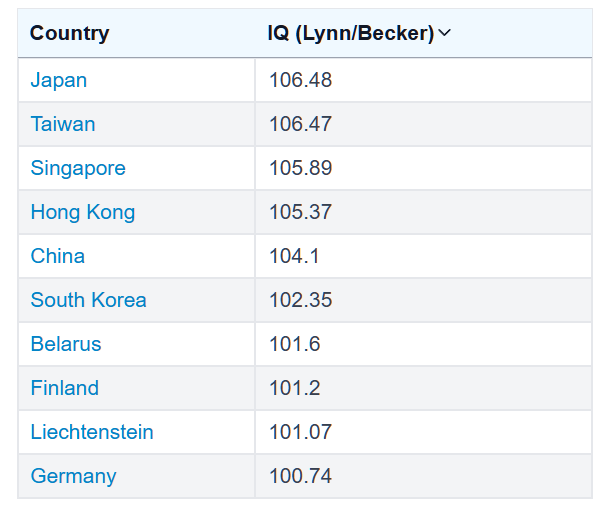

Even if Biden-Harris makes it illegal for the ports to hire permanent replacements, why can’t the ports operate with temporary replacements? The container cranes are highly automated, which has, in fact, been a big motivation for fighting between unions and management (the “workers” aren’t actually required for the “work” because robots do a better job at running the cranes).

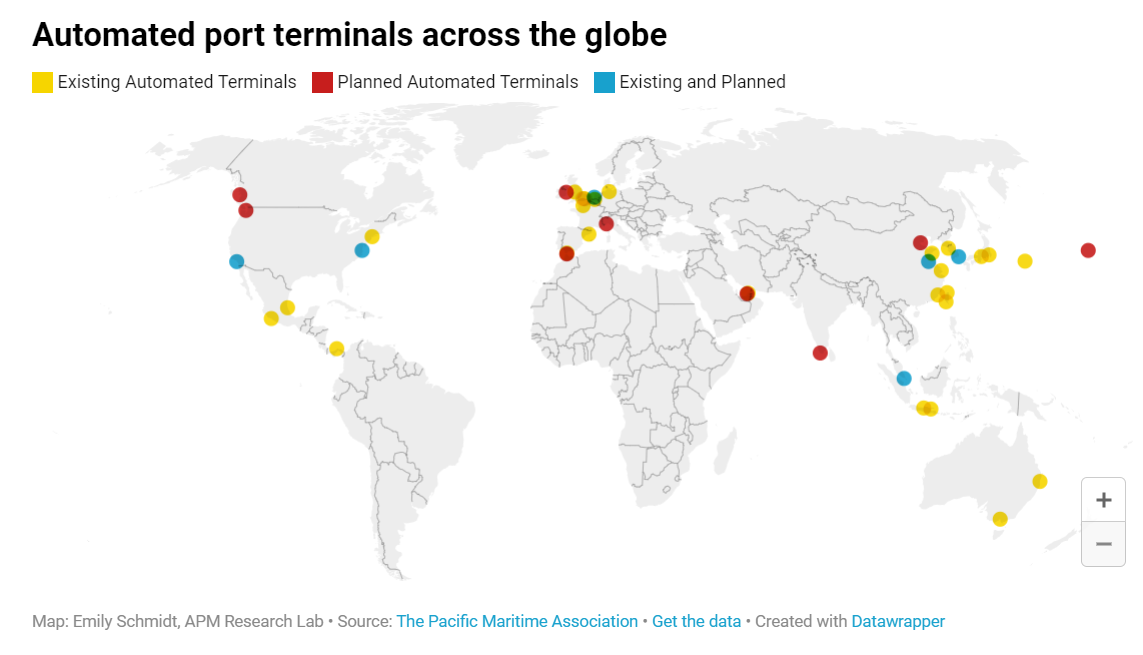

It looks like ports are mostly automated in other parts of the world, e.g., China, Europe, and Central America (source):

But the U.S. does have some ports that you’d think could be operated by managers. From the same article:

Currently, only four out of 360 commercial ports in the U.S. have at least semi-automated terminals: Los Angeles, Long Beach, New York & New Jersey and Virginia.

Why wouldn’t NY/NJ and Virginia be up and running with managers staring at the monitors while the computers do all the real work?

Full post, including comments