Single-stage versus variable-speed air conditioning dehumidification performance

After an exciting summer packed with three blower motor failures in three 6-year-old Trane single-speed air conditioning systems, the transformation of our house into a showcase for variable-speed communicating Trane/American Standard equipment is complete.

For background, see the folllowing:

- ChatGPT is almost as bad at home maintenance as I am

- Heroes of Technical Support: American Standard/Trane HVAC

The most humid part of our house was the upstairs. This contains two big bedrooms served by a 3-ton A/C for a calculated Manual J demand of 2.1 tons. Relative humidity was 58-62 percent with a TEM6 variable-speed air handler and a single-stage condenser.

Step 1 was replacing the condenser with a variable-speed “communicating” condenser that sends digital information back to the air handler over a two-conductor cable. Trane says that this new condenser is a match for the 6-year-old TEM6 so long as an adapter relay panel is installed. What they don’t say is that the result is a brain-dead system in which the air handler always runs at the same blower speed regardless of what the compressor speed is. Compared to the 6-year-old single-stage A/C, there was no reduction in humidity from this arrangement.

Step 2 was replacing the (working perfect with a new blower) TEM6 air handler with a top-of-the-line TAM9 air handler. Humidity immediately plummeted to a reasonable 51 percent on a wet hot Florida day with hours of rain, an 87-degree high, and humidity as high as 95 percent.

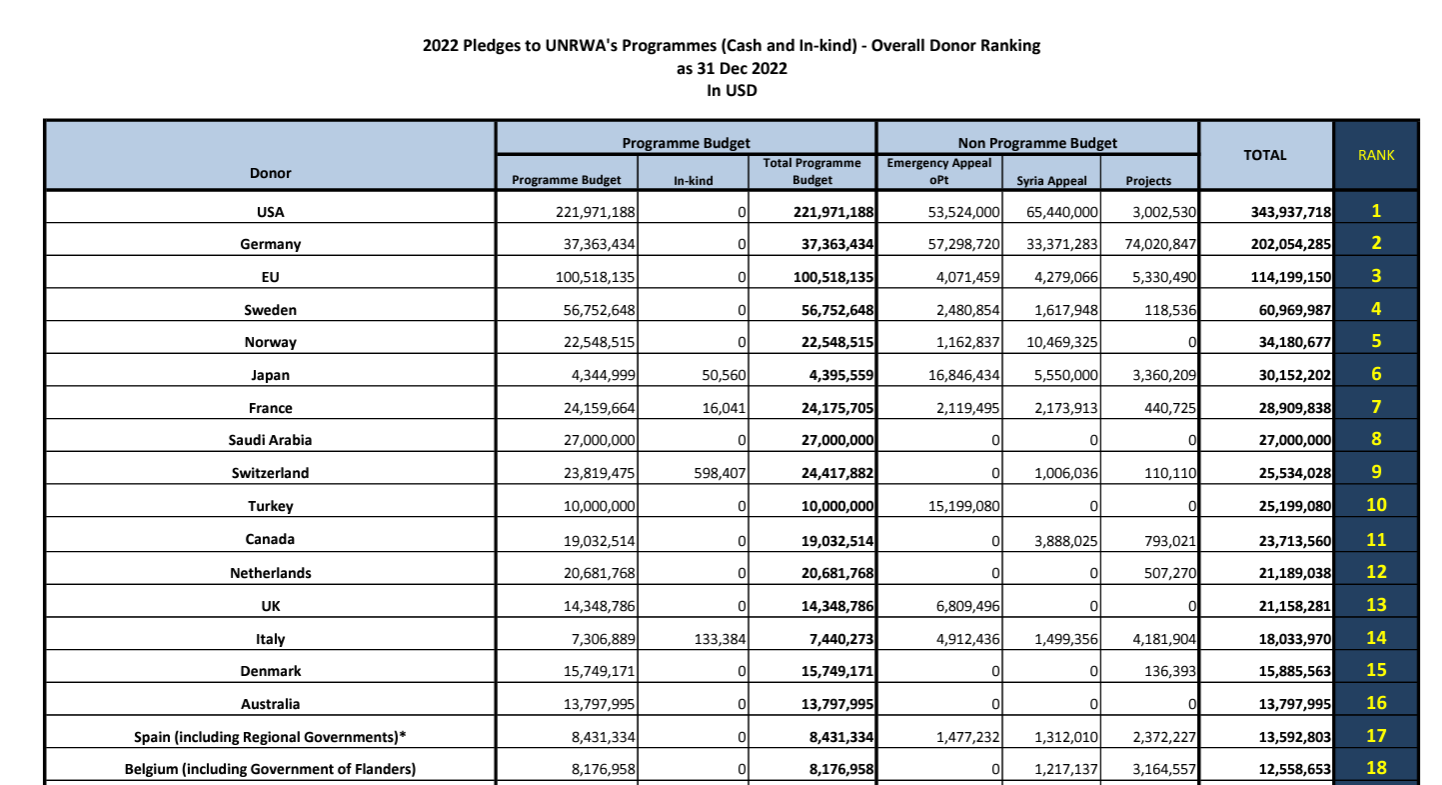

What does #Science say about this result? “Dehumidification performance of a variable speed heat pump and a single speed heat pump with and without dehumidification capabilities in a warm and humid climate” (Kone and Fumo 2020; Energy Reports):

the variable speed mode was able to maintain relative humidity between 50% to 52% on summer days. In the single-speed with enhanced dehumidification, a slightly less effective humidity control was achieved on summer days with the mode keeping the relative humidity between 53% to 55%. In the normal cooling mode, which resembles a conventional system, the humidity levels were controlled between 55% to 60%. In the shoulder season, the variable speed and enhanced dehumidification modes maintained the relative humidity between 55% to 58% and 53% to 56% respectively. In the shoulder season, the normal cooling mode kept the indoor relative humidity near or above 60%.

In going from single-stage to variable-speed, #Science found a reduction in humidity from an average of 57.5% to 51% (middle of the ranges given), or 6.5%. My data, consistent from a Govee sensor set and a $300 Airthings monitor, was 8-10% reduction in the relative humidity reading. The ground floor of the house still feels and measures less humid (40-50% depending on the location), but walking upstairs no longer feels like entering a steam room.

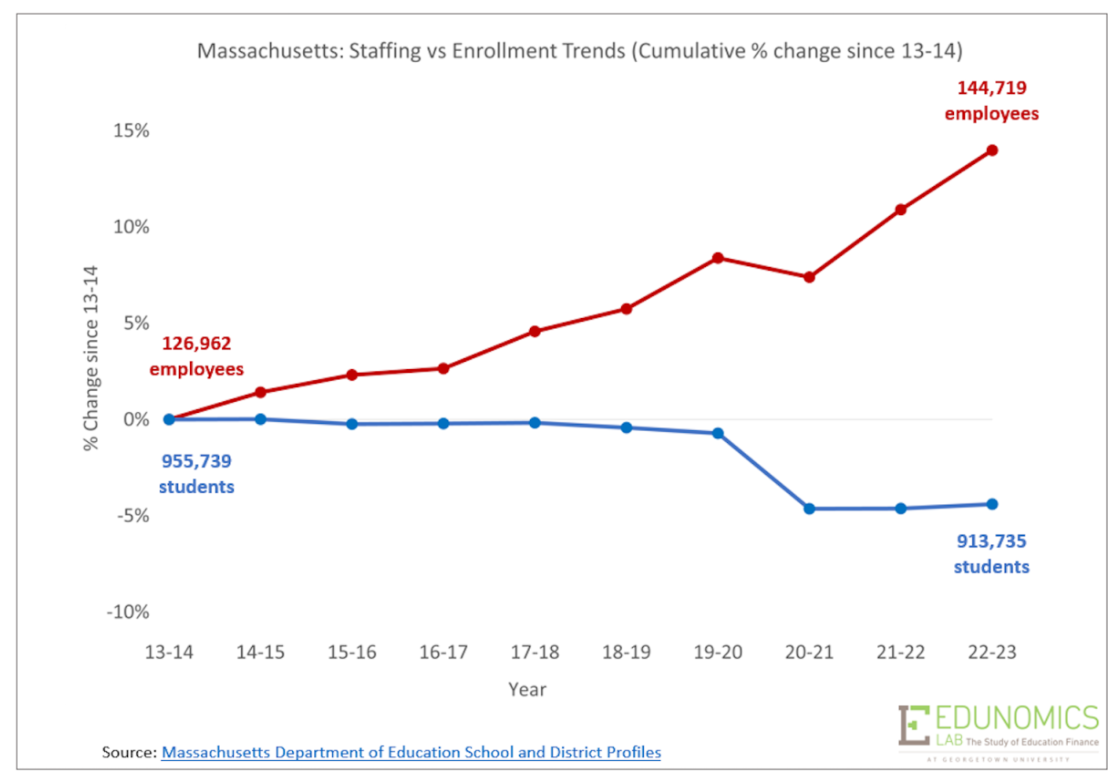

It’s tough to find objective data from anywhere else. Carrier is the only company, I think, that offers any numbers:

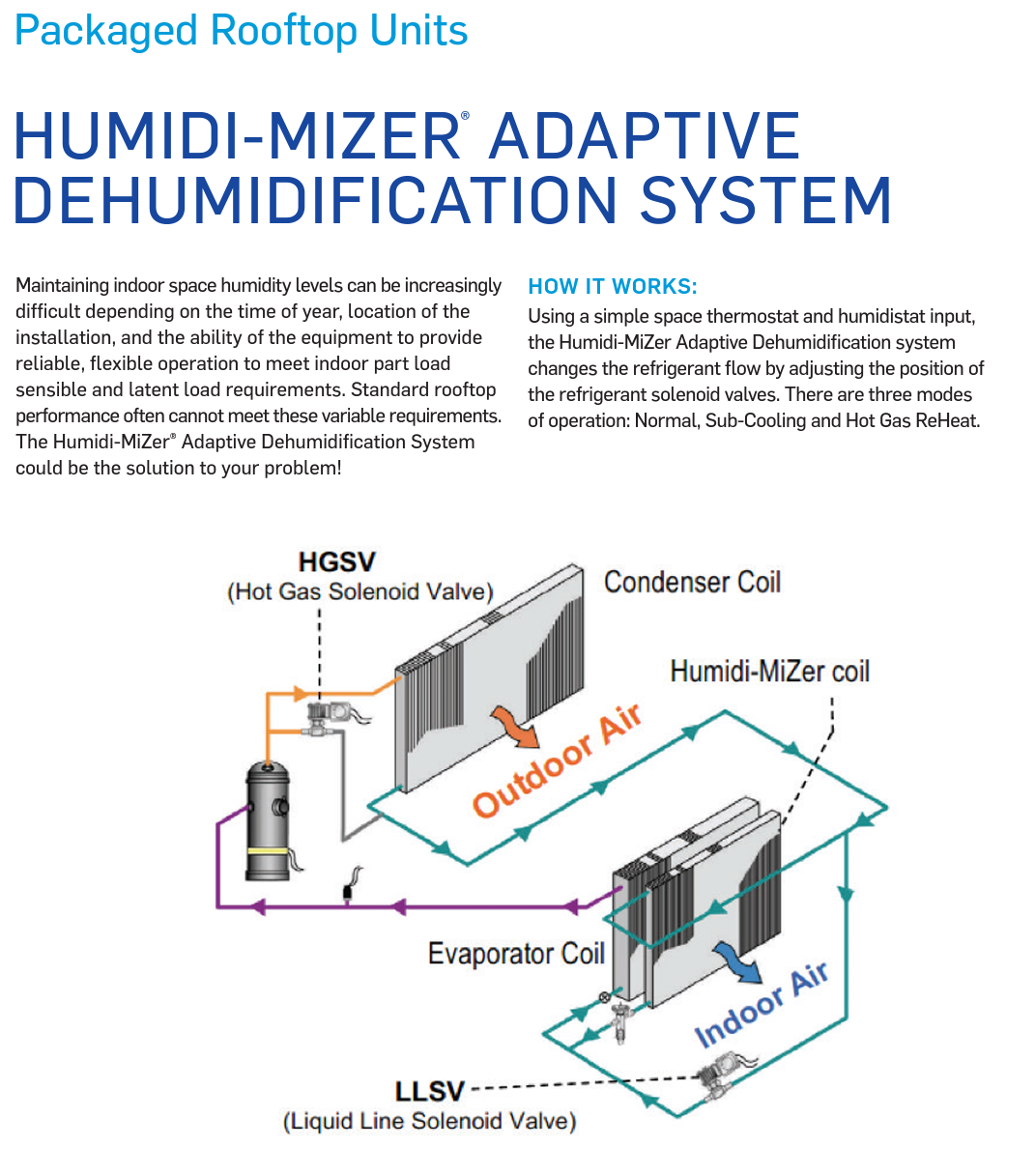

The Trane stuff has an emergency dehumidification capability in which it will run the heat strips as the same time as the A/C. Carrier also might have something like this (their commercial systems have a “reheat” mode that might do something similar, but using only the coil and not the resistive heat strips).

It is unclear from the Carrier page if they’re talking about using an extreme measure to dehumidify or just running the variable-speed in an optimized manner.

I’m also unclear what they mean by “400 percent more moisture” removed. If a single-stage system is removing 1 gallon of water, the variable-speed system removes 5 gallons when outside temp and thermostat temp are held constant? That doesn’t seem plausible. If it is hot and humid outside, the system has to remove a huge amount of water just to do its basic job (since cooling outside air will almost immediately result in 100% relative humidity and condensation).

If relative humidity is linear in the amount of water vapor, a properly sized single-stage system has already removed more than half the water that was originally present in the air (since cooling resulted in 100% relative humidity and the house ended up at 50% humidity). As great as Carrier may be (they’re headquartered only about two miles from our house here in Palm Beach County!), I don’t see how they can remove 5X the amount of water compared to a system that removes half of the water available.

(Why didn’t we get Carrier? We already had Trane gear and thought that we might be able to preserve at least some of it (we weren’t). Also, the Carrier dealer who came out to quote the project refused to deal with our house because of a splice where the wires exit the house near the condenser, claiming that their communication wouldn’t function properly.)

I can’t figure out why single-stage A/C continues to be the standard here in the U.S. Everyone in Asia has variable-speed equipment (all of the mini splits are variable-speed). Assuming a constant thermostat setting, a single-stage system is the correct size for only one outdoor temperature. Why wouldn’t people be willing to pay a little more for a system that can run at the correct speed for whatever temp Climate Change happens to dish out at any given hour on any given day? Is it that it is impossible to explain to consumers what a dumb idea single-stage A/C is? (Maybe it makes sense in Arizona, though, where there isn’t any humidity to begin with?)

Full post, including comments