After a long hiatus due to my laziness and the author being a resident, here’s an addition to Medical School 2020… It’s the fall of 2019. SARS-CoV-2 is just beginning to build mindshare in Asia. Our hero is looking for a job…

Three months off for interviews, each of which is progressively less exciting.

There are three classes of surgery programs: academic, community, and hybrid. Academic programs typically require at least two years of research in addition to the 5 PGY (post graduate) years. Our hospital’s residents warn that academic programs struggle to deliver case volumes for training. Residents may participate in complex robotic whipples, but won’t learn bread and butter procedures. The best opportunities are grabbed by fellows, who don’t exist in community programs. Many academic programs ship residents off to satellite community hospitals with higher case volumes that enable better training for going into general practice.

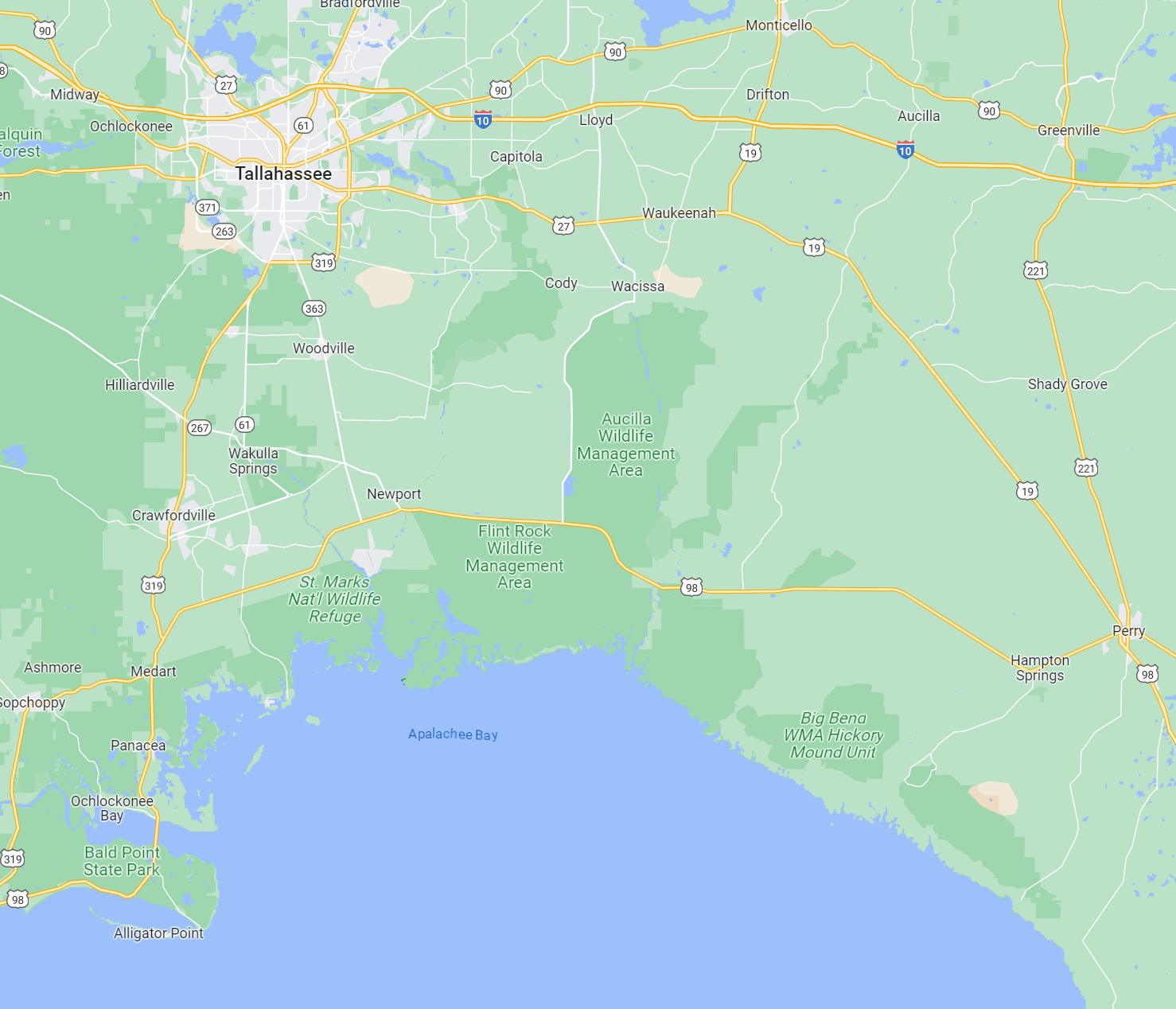

My first interview is at a community program in a comfortable suburb of a Northeast city. After checking into the Best Western, I walk around the main street for an hour before I head back to change into business casual attire for the evening reception at a local bar. Three other likely applicants are waiting in the lobby for the 6:30 pm shuttle.

An applicant from a Southwestern DO school explains that he doesn’t know much about the program or the area. “Beggars can’t be choosers. I’m just happy to get an interview.” An applicant from a prestigious medical school is less grateful. “I don’t expect to go to a place like this,” she says, “I’m using it for practice.”

Several residents and their families are enjoying beer and finger food. A couple of attendings, including the program director, are chatting with applicants about hobbies. At 8:00 pm, the attendings leave to allow the residents to speak more candidly. “One important factor that I wish I had considered in applying for surgery residency is the level of trauma exposure,” explains a PGY4 (rising chief). “We are not a level 1 trauma center. We stabilize traumas en route to the main city trauma center. We get our sexy GSWs [gun shot wounds] in our fourth year rotation at the trauma center.” There are advantages: “You don’t get as many trauma cases, but you don’t have to spend half of your time being an amateur social worker.”

I wake up at 5:00 am for an early morning walk to the hospital for 6:00 am remarks over catered Chick-fil-A. The program director, a soft-spoken, humble 60-year-old MIS (minimally invasive surgery) surgeon, introduces himself and describes the unique opportunities at the program. One that appealed to me is the chief service. “We are proud to still offer a chief service. Three months of the year you will rotate on the chief service where you run the ship. You interview patients in clinic, and schedule them for surgery. You do the surgery. You manage their complications. You see them at their post-op visit. We also teach you about the intricacies of billing. There is an attending available for any issues, but this is your service.” He added, “This used to be commonplace at surgery residencies but has fallen out due to insurance issues and case volumes. The administration and I are confident enough in our residents to continue this opportunity.”

(What is not stressed is that the chief duties are mostly restricted to Medicaid patients. Care of the privately insured is overseen by more senior physicians.)

We had four 30-minute interviews with selected faculty. I interview with a young vascular surgeon who moved here because the cost of housing near her NYC fellowship was beyond her means. Most of my interview with the chair focused on his love of poker. I tried to steer our conversion back to medicine by alluding to the similarities between surgical decisions and the risk analysis with poker. “If you come here, we’ll have to invite you to our poker nights.” In my interview with the program director I ask him what he is most proud of. “I am proud that I would let any graduate of this program operate on my family.”

After the morning interviews, we have a Panera-catered lunch with residents popping in and out between cases. One interviewee is from a Seattle-based medical school, “My home residency program ships their 4th year out to Chicago for 2 months,” she said over our Panera-catered lunch. “They get 10 GSWs a day and hit their numbers in a few weeks.” The program director provides some concluding remarks. “I know this is early on in the interview process. Each of you is qualified and has an exciting surgical career ahead of you. Most of you will not come here, and that is okay. We would love to have you.” He continues, “I would like to leave you with two final thoughts: First, take a deep breath, you will match. Every applicant we interview is competitive and will match. Second, get excited. You have chosen an amazing path. You will play such an important role in the lives of others. The best surgeons are humble because they understand that we stand on the shoulders of giants whose achievements have allowed our patients to trust us. Honor this pact and safe travels.”

Those who don’t have to get on a plane immediately are invited on a 45-minute tour of the hospital, which is as close as an interviewee gets to patients or an operating room. I found these fascinating and always took the opportunity to join.

(Mostly because of a lack of interest in the geographical location, I did not rank this program highly in the Match and therefore I never learned how high they ranked me.)

Lanky Luke interviewed at a new Accreditation Council for Graduate Medical Education-accredited residency program started last year by a previously successful program director who had moved to a beachside hospital. The night before the interview the interns and residents got together at an upscale restaurant featuring an open bar. “The attendings were drunker than the interns! Everyone was hung over for the interview the next day, which thankfully didn’t start until 9:00 am.” Luke loved it. “Basically you just work with the attendings day in and out. The interns operate like crazy.” Our surgery chair, however, discouraged Luke from giving this program a high rank because it would be more difficult to get a job than if he went through a more established program.

Jane returns from boot camp and two back-to-back away rotations at military hospitals. After three months she has missed a lot of our class drama. I am also not up to date on the newest gossip. To mend this, we get lunch with Ambitious Al. Jane asks about Southern Steve. “Is he still with that ICU nurse?” Al laughs, “No, he’s been dating an M2, and they are getting engaged tonight.” He adds, “Y’all should come to the afterparty tonight!” Jane asks after our classmate who had suffered a stroke at age 10 and had some trouble with one hand and his gait (see Year 1, Week 31). Al responds, “He doesnt go here anymore.” (He dropped out during the third year.)

[Editor: If his stroke symptoms prove to be mentally debilitating he can serve as a U.S. Senator from Pennsylvania.]

A few residency programs ask for a supplemental application, typically a two-page application with four questions. Examples: How would you deal with conflict of opinion between providers in the care of your patients? How would you approach one of your fellow residents not carrying his or her share of the workload? Oregon Health & Science University: “We value diversity in its many forms and strive to create an inclusive community. Please let us know how you will both contribute to and learn from our community during your training at our program. (250 words or less)”. Perhaps due to my failure to minor in Intersectionality as an undergraduate, I was not selected for an interview by OHSU.

The main drama and stress of this period is trying to match in the same city as Jane. She’s restricted to military hospitals and I’m restricted by being a white male with an above-average, but not top-one-percent score on Step 1 and 2. Neither of us can write our own tickets.

The rest of the book: http://fifthchance.com/MedicalSchool2020

Full post, including comments