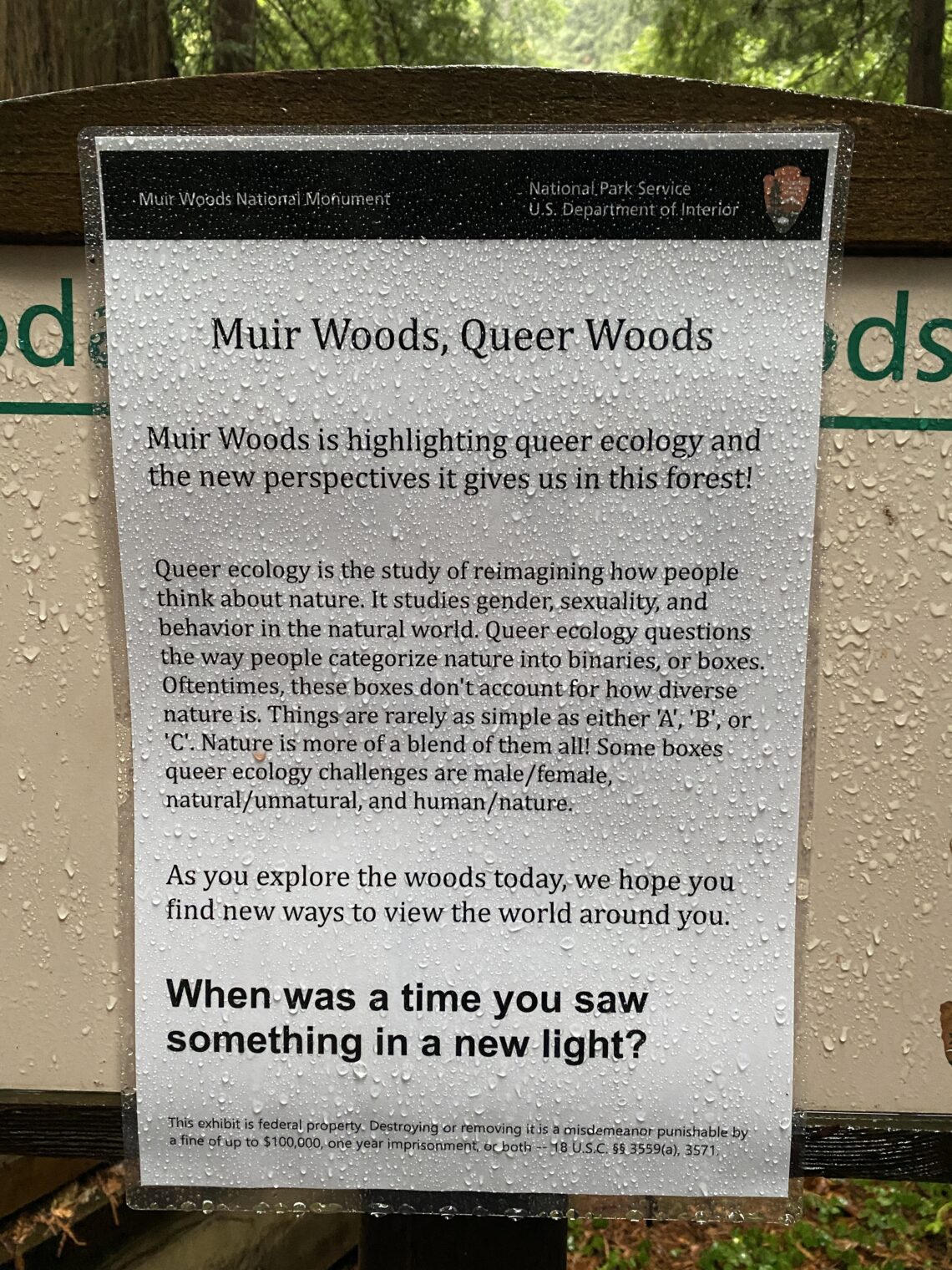

Dedicated to diversity and regulated/supervised by a San Francisco Fed that was dedicated to diversity (see also “San Francisco Fed elevates a gay woman — its vice president — to the top job” (LA Times, 2018)), Silicon Valley Bank is being described as a casualty of its own wokeness. A friend who used to run a multi-$billion investment fund sent me this article by an economist, which attributes the need for an FDIC bailout… to the existence of the FDIC. Some excerpts:

The wrong way to think about moral hazard

Deposit insurance gives bank executive an incentive to take socially excessive risks. In some cases the risks won’t pay off. But that doesn’t mean executives don’t have an incentive to take excessive risks.

Things didn’t pan out for SVB. But that doesn’t mean their executives made an unwise gamble. It’s very possible that SVB’s strategy had a very high expected payoff, and they were simply hit by bad luck (rising interest rates.) Of course from a social perspective their decisions may have been bad, but not necessarily from a private perspective. “Heads I win, tails part of my losses are borne by taxpayers”. Of course I’d take more risk with those odds.

… back in the 1920s people cared a great deal about bank safety. Banks knew this, and managed their balance sheets far more conservatively than do modern banks. That’s why big city banks used to look like massive Greek temples; they had to convince depositors that they had the capital to survive hard times. The vast majority of big banks survived the Great Depression. US GDP in 1929 was about $100 billion and deposit losses during the Great Depression were $1.3 billion. Today, a 50% fall in NGDP (as in 1929-33) would wipe out almost our entire banking system. Modern bankers are far more reckless “despite” regulation. The negative effects of deposit insurance are far more important than the positive effects of regulation.

How do we get to Yglesias’s utopia [of more big banks]? Abolish deposit insurance (he wouldn’t agree). You’ll see a massive shift of deposits toward the larger, more diversified banks, making our system resemble the Canadian system.

FDR opposed deposit insurance, as he (correctly) feared it would create moral hazard. Unfortunately, Congress refused to listen to his good advice.

“FDIC fees are not a tax on the public.” Yes, they are.

“We aren’t bailing out bank executives”. No, we are not bailing out SVB executives, but we are (implicitly) bailing out their competitors.

I disagree with that last statement. The executives at SVB got to keep all of their big earnings from the big years that they had due to their aggressive risk-taking. Mary C. Daly gets to keep her $500,000+/year (including benefits) SF Fed compensation from incompetently supervising SVB. When things fell apart, none of these people had to pay anything back to the FDIC. It is the chumps with low-interest accounts at conservative banks who are left to pay.

Separately, I’m shocked that McKinsey wasn’t involved somehow in SVB! How can there be a group of elites robbing the peasants without McKinsey’s assistance? At least one of the usual suspects was there… “How Goldman’s Plan to Shore Up Silicon Valley Bank Crumbled” (WSJ):

Silicon Valley Bank executives went to Goldman Sachs Group Inc. in late February looking for advice: They needed to raise money but weren’t exactly sure how to do it.

Soaring interest rates had taken a heavy toll on the bank. Deposits and the value of the bank’s bond portfolio had fallen sharply. Moody’s Investors Service was preparing for a downgrade. The bank had to reset its finances to avoid a funding squeeze that would badly dent profits.

While few could have predicted the market’s violent reaction to the SVB disclosures, Goldman’s plan for the bank had a fatal flaw. It underestimated the danger that a deluge of bad news could spark a crisis of confidence, a development that can quickly fell a bank.

Goldman is the go-to adviser to the rich and the powerful. It arranges mergers, helps companies raise money and devises creative solutions to sticky situations of the financial variety—a talent that has made the firm billions.

Yet, for SVB, Goldman’s gold-plated advice came at the steepest possible cost. SVB collapsed at warp speed in the second-largest bank failure in U.S. history, setting off a trans-Atlantic banking crisis that regulators are working furiously to contain.

How big was the failure compared to the investments that are needed to build things with silicon? SVB’s pre-coronapanic/free-money-shower value was about $13 billion. A single Samsung fab is on track to cost 25 billion Bidies: “Samsung’s new Texas chip plant cost rises above $25 billion” (Reuters). The bump due to inflation in this one factory, according to the Reuters article, is in the same neighborhood as the SVB market cap, at least in nominal dollars.

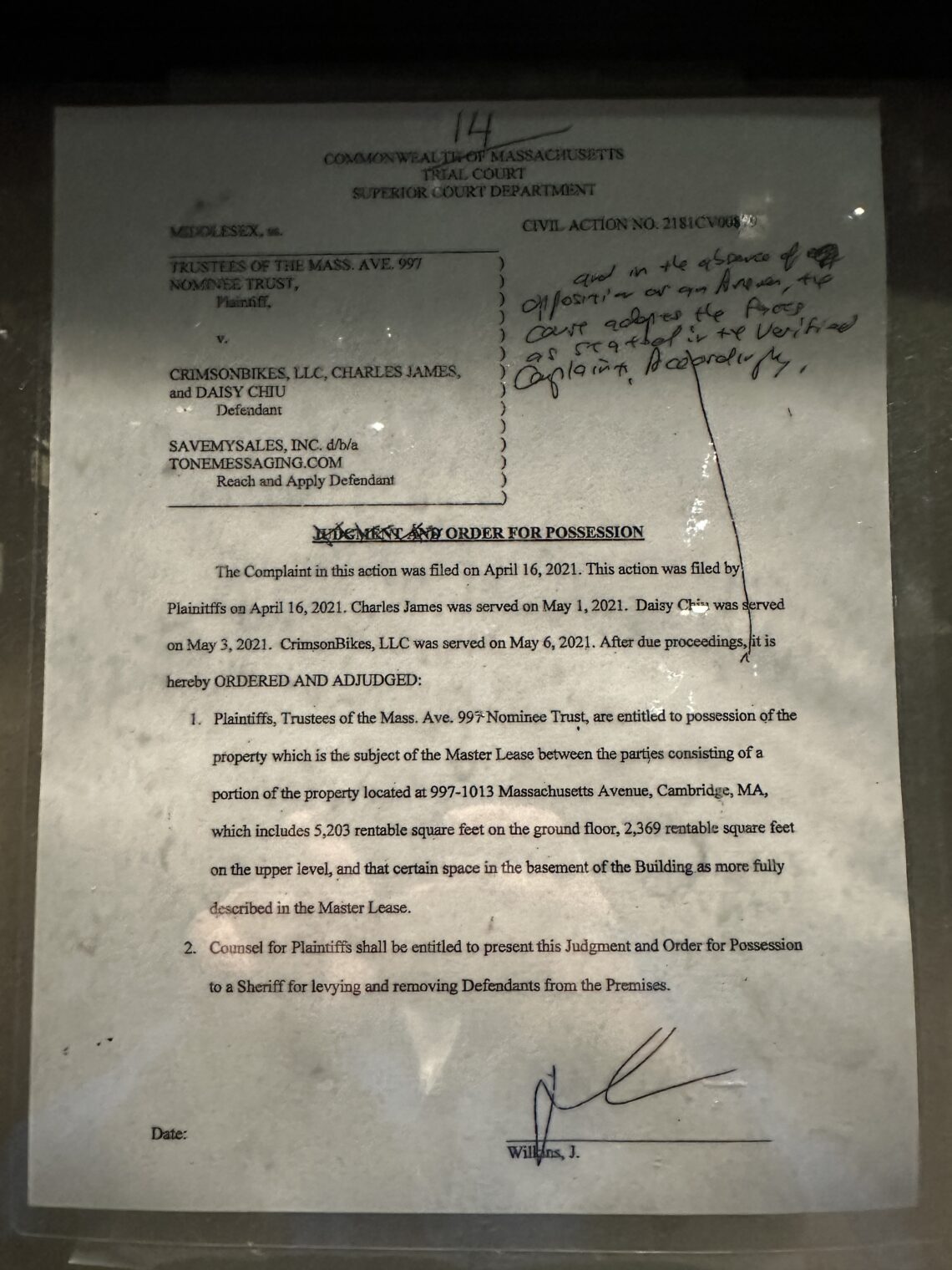

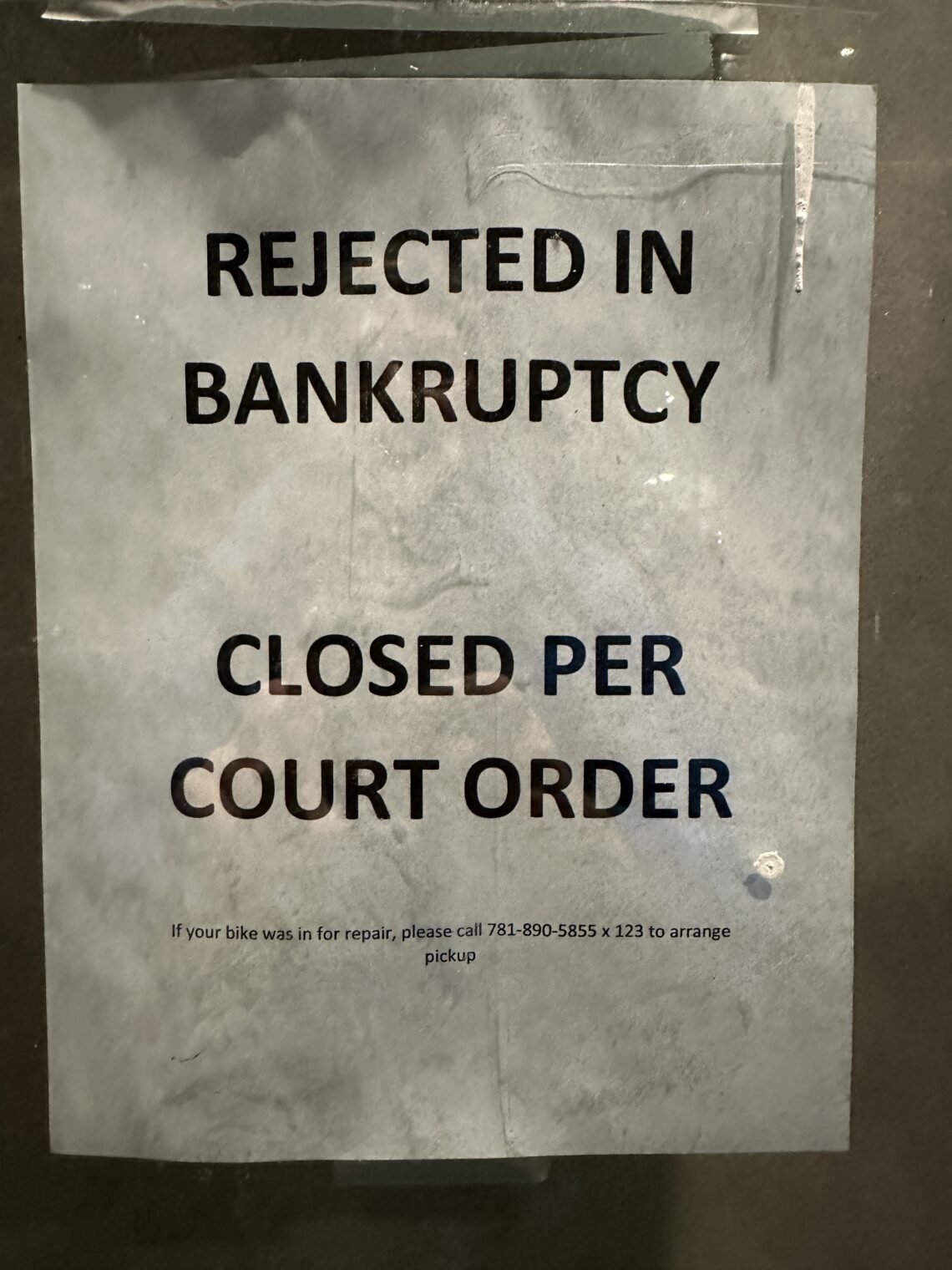

We’re not hearing much about Signature Bank’s failure. For 8 years up to and including its seizure by the FDIC, Barney Frank was on the board: “Barney Frank defends role at Signature Bank: ‘I need to make money’” (FT):

FT says that Barney Frank made about $2 million by serving on the board of failed bank. None of that will be clawed back by the FDIC…

Full post, including comments